Florida Power & Light (FPL) and Gulf Power are using customer money to subsidize the Edison Electric Institute (EEI), the very same group that is spearheading the electric utility industry’s misleading attacks on so-called “subsidies” for rooftop solar.

The Palm Beach Post previously reported on FPL’s proposal to continue charging customers more than $2 million per year to subsidize EEI. Gulf Power is now also seeking to have its customers continue to subsidize EEI to the tune of more than a quarter of a million dollars per year. The funding was disclosed in documents filed by FPL and Gulf Power as part of separate rate increase requests that are now before the Florida Public Service Commission (PSC).

Monopoly utilities in Florida use customer money to subsidize the Edison Electric Institute’s attacks on rooftop solar.

EEI’s attacks on rooftop solar incentives are at odds with public opinion in Florida

Nearly 80 percent of likely Sunshine State voters agree that Floridians who go solar should be allowed to sell the extra electricity they generate and do not use to utilities or other customers, according to a survey from earlier this year by the Saint Leo University Polling Institute. Net metering incentives offer one way to do that in Florida and 40 other states, but they have recently come under heavy fire from EEI and its industry funders.

In 2015, the Energy and Policy Institute and Washington Post exposed EEI’s profit-driven plan to stifle the growing competition electric utilities face from the rise of rooftop solar. Results of this plan can be seen today in state-by-state attempts to slash net metering incentives, institute controversial fixed charges that threaten to reduce the money utility customers can save by investing in solar or energy efficiency, and limit customers’ options for going solar.

Courts and regulators have at times frowned upon attempts by utilities to use customer money to advance political agendas that their customers may not agree with, and which provide no proven customer benefits. Legal experts have cited one court order that found such charges can represent a form of “taxation without representation,” which customers can not avoid due to the monopolistic nature of the regulated utility sector.

EEI: A leading foe of solar “subsidies” that is subsidized by FPL & Gulf Power customers

While cost-benefit analyses routinely show that net metering generates net economic benefits for all utility customers, EEI alleges that these popular programs somehow shift certain costs onto non-solar customers. The “cost-shift” claim has even found its way onto the ballot in Florida, where the deceptively worded Amendment 1 purports to be both pro-solar and fighting “unfair subsidies,” but could ultimately open the door for utilities to target net metering or penalize customers who choose to go solar with new fees. FPL and Gulf Power have dumped millions of dollars into the effort to fool voters into passing Amendment 1.

Meanwhile, FPL customers are on tap to fork over more than $9.5 million to subsidize EEI for 2015-2018. Gulf Power customers handed over more than $250,000 to EEI in 2015, and also face over $270,000 in EEI subsidies in 2017, with more likely to be disclosed as the company’s current rate increase proposal moves forward. Earlier FPL and Gulf Power filings with the Florida PSC serve as a reminder that their customers have been subsidizing EEI for years, and that the annual cost of these subsidies is only rising.

EEI’s real motive for attacking rooftop solar is to prop up the profits of its investor-owned utility members. For example, a 2013 EEI report that warned that the emerging solar competition could create the wrong kind of Kodak moment for electric utilities, where a company fails to update its outdated business model and winds up in bankruptcy.

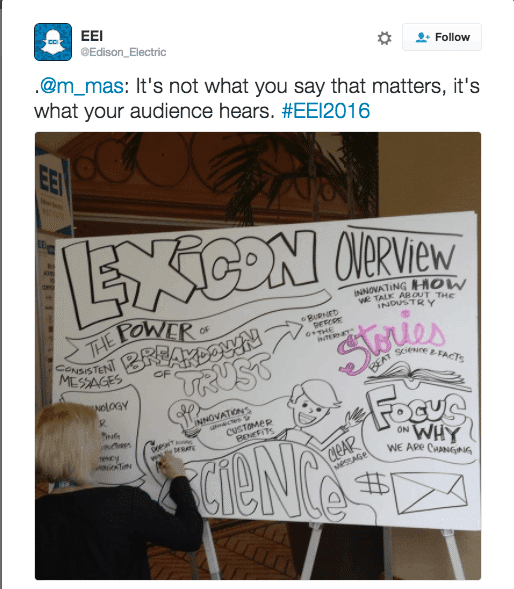

Polls show that Americans favor expanding solar more than any other source of electricity, and EEI’s campaign against rooftop solar has been greeted by controversy and public pushback. In response, EEI has launched a new public relations campaign – dubbed the “Lexicon Project” – to repair the industry’s tarnished image. The campaign will allow utilities to go back on the offensive on energy policy, according to Thomas Fanning, the current chairman of EEI. Fanning is also the CEO of Southern Company, the parent company of Gulf Power.

Rob Gould, vice president of marketing and communications for FPL, also helped to develop EEI’s latest Orwellian rebranding exercise. Through the Lexicon Project, EEI advises member utilities to replace positive terms like “rooftop solar” with new negative lingo, such as “private solar.”

“Stories beat science and facts.”

The image from this Edison Electric Institute Tweet sums up the rationale behind the group’s Lexicon Project.

Eric Silagy, the CEO of FPL, has used the “private solar” line and other terminology drawn straight from EEI’s Lexicon Project to defend the rollback of Florida’s solar rebate program and push for voter approval of the misleading Amendment 1.

One way that FPL is attempting to sell customers on its current proposal to raise their rates is by committing to “increase our use of solar power.” FPL is busy lauding its own plan to triple the electricity it generates for customers from “universal solar” – another term taken from EEI’s Lexicon Project that is doublespeak for utility-owned solar projects. However, further analysis shows that the amount of “universal solar” FPL generates per customers remains relatively paltry.

It’s another great example of what one political insider with ties to Gulf Power recently described as using “a little political jiu-jitsu” to “negate” the efforts of rooftop solar supporters in Florida in leaked audio that was obtained by the Energy and Policy Institute and Center for Media and Democracy. In reality, the best way to increase the amount of electricity that Florida obtains from the sun is to expand both rooftop solar systems owned or leased by utility customers, and large-scale solar projects owned and operated by utilities.

Lack of transparency on EEI subsidies puts FPL and Gulf Power customers at risk

FPL and Gulf Power customers will not find these largely hidden EEI subsidies listed on their monthly electricity bills. But some customers seem to sense that something is amiss.

“I implore you to look at providing customers in Florida a choice for their electrical energy, or at a minimum one who would be a more amenable partner for renewable energy sources,” one FPL customer told the PSC earlier this year during a public hearing on FPL’s latest proposal to raise rates. “Lastly, there should be a requirement that all expenditures have full transparency–no lobbying dollars or capital expenditures without complete disclosure.”

Unfortunately, FPL and Gulf Power are not being transparent about how EEI is using their customers’ money. This lack of transparency could serve as a loophole around decades of state and federal oversight aimed at protecting customers by ensuring that the costs of electric utilities’ political activities are primarily paid for by shareholders.

Back in the 1980’s, the National Association of State Utility Regulators (NARUC) investigated EEI’s gross misuse of money collected from customers of the nation’s electric utilities for lobbying and public relations. NARUC formed a “Committee on Utility Association Oversight” to provide rigorous oversight of any annual EEI dues to be paid by utility customers; the National Association of State Utility Consumer Advocates (NASUCA) soon endorsed that approach. NASUCA also ominously warned that “attempts are being made to dilute the effectiveness of the Committee’s efforts…”

“It is clear to us, based on a rather probing analysis of their expenditures, that the principal thrust of the Edison Electric Institute’s activities is that of attempting to influence the affairs of the federal government,” Michael Foley, then NARUC’s director of financial analysis, told the Washington Post in 1985. “The majority of the dues received from utilities are directed toward that goal.”

“That ratepayers do not fund utility political advocacy expenditures is a statute in most state codes,” Foley said at the time.

Internal documents and research from the Energy and Policy Institute confirm that little has changed since NARUC took that position 31 years ago; EEI today is organized to influence energy policy at the state, federal, and even international level.

Over time, strong calls for action gave way to a piecemeal system of federal and state rules that provided some additional consumer protections, but still generally allowed electric utilities to continue subsidizing varying – but often substantial – amounts of their EEI dues with money taken directly from customers.

In a 1997 decision, the Federal Energy Regulatory Commission (FERC) found that, “the entirety of Edison Electric Institute (EEI) dues cannot be included in an account that is fully recoverable from ratepayers.” As recently as 2006, FERC has cited that 1997 case, where it determined that a utility had misclassified the lobbying-portion of its EEI dues as “miscellaneous” expenses.

In the past, FPL has disclosed the lobbying portion of its EEI dues in its annual report to the FERC. But in its latest report to FERC, FPL did not disclose the lobbying portion of its EEI dues for 2015. Elsewhere, FPL has accounted for the only portion of its 2015 EEI dues that it has disclosed as “miscellaneous” and “executive” expenses.

For its part, the Florida PSC increased the lobbying-related portion of EEI dues that FPL and other utilities were barred from taking from customers from less than 2 percent in 1981 to one-third in 1984.

The PSC also prohibited FPL from charging customers for payments to EEI’s “Media Communications Program.” More recently, Tampa Electric disclosed to the PSC that it had removed “one-third of EEI dues consistent with past Commission policy” from its rates for 2012 and 2014, suggesting that some of Florida’s electric utilities want to at least appear to be following the PSC’s established rules voluntarily. Of course, Tampa Electric customers were still left to pay more than $450,000 in EEI subsidies for 2012, and over $510,000 in EEI handouts for 2014.

FPL is oddly citing those earlier Florida PSC decisions from the 1980’s in filings where the company claims to have only removed around 6 percent of its total annual industry association dues. These “dues” total around $20 million per year divvied up between nearly 50 entities, one of which is EEI. FPL also broadly claims the dues its customers will pay for include $0 for lobbying.

“The requirement is lobbying expenses must be charged below the line,” FPL’s chief accounting officer acknowledged during testimony earlier this year before the PSC. “It cannot be paid for by customers.”

However, FPL’s failure to more fully disclose the lobbying-portion of its industry association dues to the PSC on a case-by-case basis makes independent confirmation of these claims impossible. The cases FPL is citing suggests that the PSC should at a minimum deny one-third of $2+ million per year FPL wants to charge customers for its EEI dues, based on FPL’s failure to “adequately segregate” information about the lobbying-portion of its EEI dues. Arguably, the PSC should deny far more than that if it recognizes that customers should not have to pay for the full breadth of EEI programs that provide no proven customer benefit. For example, EEI’s new Lexicon Project sounds suspiciously similar to the old “Media Communications Program” that the PSC previously determined customers should not have to pay for.

Gulf Power similarly claims that no money for lobbying is included in the somewhat more modest subsidies its customers pay to several industry associations, including EEI. However, Gulf Power also fails to “adequately segregate” the lobbying portion of its EEI dues. As Gulf Power’s request to raise rates moves forward at the PSC, the company should also be required to fully disclose what exactly its customers are paying for when they subsidize EEI, or face losing out on recovering one-third or more of its EEI dues from its customers.

FPL and Gulf Power customers likely pay part of the bill for EEI’s lobbying

Mark Douglas, an investigative journalist based in the Tampa area, has pointed out that the shareholder money utilities are supposed to use to pay for their political activities actually comes from profits that must be approved by the PSC. Those profits are drawn from utilities’ revenue streams, which ultimately rely largely on money taken from the pockets of utility customers.

In other words, most of those shareholder dollars that FPL and Gulf Power should be using to fund EEI’s political activities still came from the hands of customers.

Shareholders have serious questions too

Shareholders are not immune to the fact that controversial political actions can put a company’s public image at risk, and the current headlines out of Florida are a case in point for the investors of NextEra, FPL’s parent company. While some investor-owned utilities do publicly disclose the lobbying portion of their contributions to industry association on their websites, FPL and NextEra Energy do not. NextEra faced a near revolt at its annual meeting in Oklahoma this spring, where 42 percent of its shareholders voted in favor of full disclosure of the company’s political spending – including contributions made to industry associations for political purposes.

Southern Company does publicly disclose the lobbying-portion of its own payments to industry associations, including EEI. However, Southern Company still does not disclose this information for its subsidiary Gulf Power.

What are they hiding?

EEI often provides members with invoices that supposedly disclose what portion of their annual dues go toward “influencing legislation,” information all industry associations must have at the ready to avoid IRS penalties. In some states, such as West Virginia and Texas, electric utilities have provided the consumer advocates and public utility commissions who oversee their rates with invoices and accounting to support claims that they are not charging customers for EEI’s political activities.

Just last year in California, regulators rejected around 44 percent of the EEI dues that one utility sought to pass onto customers, after they determined that the costs of EEI’s political activities were not fully accounted for in the invoices and other information that the utility provided.

Some electric utilities may therefore have an incentive to withhold information about their EEI dues to prevent closer scrutiny.

FPL provides an illustrative example of how utilities shift their lobbying and litigation to EEI, where it can be more easily subsidized. In December of 2014, the PSC rejected FPL’s request to take more than $225,000 from customers to pay for lobbying to influence the Environmental Protection Agency’s then proposed Clean Water Rule. But in a Wall Street briefing earlier this year, EEI boasted about its success targeting the same EPA rule in 2015:

Last year, EEI and allied stakeholders engaged in congressional efforts to require EPA and the U.S. Army Corps of Engineers to withdraw, narrow, and re-propose the final WOTUS rule. Similar efforts are expected to continue this year. EEI is working with member companies in support of legal challenges to this rule. A federal appeals court has stayed implementation of the rule nationwide while challenges to the rule play out in a complicated series of court proceedings.

EEI provided FPL with a readymade loophole that allowed it to charge customers to pay for efforts to rollback the EPA’s Clean Water Rule, more commonly known as the Waters of the U.S. or WOTUS.

A closer look under the hood of EEI’s political machine could illuminate other activities that provide no clear benefits to utility customers, things that those customers should not have to pay for. For example, EEI hands out awards for customer service to members utilities like FPL, who then turn around and use these awards as evidence that they deserve to charge customers more money. All that utility-customer and shareholder cash has enriched EEI to the point that it can afford one of the nation’s highest paid industry association executives in its CEO Thomas Kuhn.

Another bite at the apple

A FERC approved settlement recently resulted in another utility company, AEP, having to refund $4.2 million to customers that was inappropriately spent on lobbying, public relations, and other expenses. While the settlement did not center on customer subsidization of EEI dues, it does represent a sort of David versus Goliath story; only in this case, it was Martha versus Goliath. A sole customer named Martha Peine took on one of the nation’s largest electric utilities and won. The case showed a willingness among the country’s top electricity industry regulators to forcefully revisit the issue of customers subsidizing political work, against their will, despite it having largely faded from the headlines in recent years.

Will the PSC and consumer watchdogs in Florida learn a lesson from this, and work to address concerns about the subsidization of EEI and other industry associations with utility customer money?

The PSC’s current ratemaking process for FPL is now nearing its conclusion, and unfortunately it appears as though FPL will get a free pass to continue charging customers more than $2 million per year to fund EEI, without them having any say over the matter. On top of that, FPL customers will also have to pay excessive amounts of money to a number of other overtly political industry associations involved in efforts to obstruct clean energy, including the Business Roundtable, Florida Chamber of Commerce, and U.S. Chamber of Commerce. The Energy and Policy Institute will explore customers’ subsidization of those organizations’ political influence in subsequent posts.

Gulf Power’s request to raise rates is still in its early stages before the PSC, and offers another opportunity to demand full disclosure of what customers are paying when their hard earned money is used to subsidize EEI.

[…] customers are coerced to finance corporate efforts to quash competing distributed solar energy, as documented by the Energy and Policy Institute and legally challenged by the Center for Biological Diversity […]

[…] included nearly $3 million to the Edison Electric Institute (EEI), a utility trade group that has played a key role in FPL’s attack on rooftop solar. The Florida PSC approved similar pass-throughs for trade association dues during FPL’s previous […]

[…] customers are coerced to finance corporate efforts to quash competing distributed solar energy, as documented by the Energy and Policy Institute and legally challenged by the Center for Biological Diversity […]