Representative Bill Seitz owned Duke Energy and Spectra Energy stocks while he led efforts to rollback Ohio’s renewable energy and energy efficiency standards during his previous stint in the Ohio Senate.

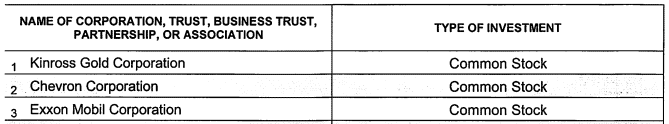

Rep. Louis Blessing III similarly owned ExxonMobil and Chevron stocks in 2015, when he served alongside Seitz on the controversial Energy Mandates Study Committee that recommended a two-year freeze on the clean energy standards be extended indefinitely.

Blessing is now the primary sponsor of the latest bill – HB 114 – to target those same standards. Seitz is a co-sponsor of Blessing’s bill and currently serves as the chair of the Ohio Public Utilities Committee, where the bill is up for its third hearing today, March 29.

Do Rep. Blessing and Rep. Seitz still own these fossil fuel and utility company stocks?

That remains an open question since state legislators do not have to report income from their current investments until the following year. Financial disclosure statements covering 2016 are not due until May 15, 2017.

Blessing and Seitz reported their earlier investments to the Joint Legislative Ethics Committee on financial disclosure statements that are publicly available online.

Annual financial disclosure statements that Blessing submitted for 2011-2015 are currently available online, as are the statements Seitz submitted in 1999-2015.

A financial interest in rolling back Ohio’s clean energy standards

Blessing did not report any investments in Chevron and ExxonMobil until 2015, which suggests that he obtained these stocks during the same year that he served with Seitz on the Energy Mandates Study Committee. Chevron and ExxonMobil have natural gas operations in Ohio. Experts have noted that the Buckeye State’s rush to replace retired coal-fired power plants with natural gas comes with myriad risks that could be mitigated by investing more – not less – in renewable energy and energy efficiency. ExxonMobil lobbied on last year’s bill to extend a two-year freeze on Ohio’s renewable energy and energy efficiency standards.

A selection from Rep. Blessing’s 2015 Financial Disclosure Statement

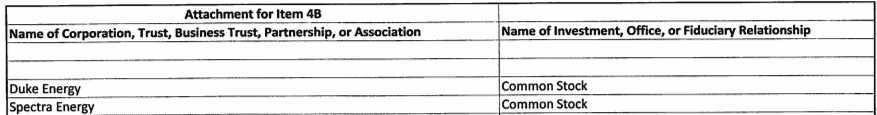

Seitz disclosed income from investments in Cinergy Corp., which later merged with Duke Energy, as far back as 1999. He reported income from investments in Duke Energy and Spectra Energy for every year from 2007 to 2015. During that time, Seitz served as chair of the Ohio Senate Public Utilities Committee, and pushed bill after bill after bill after bill to weaken the state’s renewable energy and energy efficiency policies. Ultimately, thanks to one of Seitz’s earlier bills, Ohio’s clean energy standards were frozen for two years after 2014, and only went back into effect this year after Republican Governor John Kasich vetoed a bill to extend the freeze.

A snapshot from then Senator Seitz’s 2015 Financial Disclosure statement.

Emails obtained via public records requests submitted by the Energy and Policy Institute have previously documented Seitz’s behind the scenes relationship with lobbyists from Duke Energy in 2014 and 2015. Spectra Energy (which was recently acquired by Enbridge) owns several natural gas pipelines in the Buckeye State.

A secret hiding in plain sight

No one has reported on Seitz’s or Blessing’s ownership of these energy stocks before. Duke Energy, ExxonMobil, and Spectra Energy – these are utility and fossil fuel companies that employ lobbyists and dole out campaign cash in Ohio, some of which has gone to Representatives Blessing and Seitz.

Similar information has made headlines in other states. For example, the Concord Monitor recently reported on state Senator Jeb Bradley’s voluntary disclosure that he owned stock in Spectra Energy. Bradley serves as vice chairman of the New Hampshire Senate Energy and Natural Resources Committee, where he is pushing legislation that could benefit Spectra Energy.

The question now is, “Are state representatives in Ohio who are backing HB 114 currently invested in fossil fuel and utility companies that could potentially benefit from this latest political attack on renewable energy and energy efficiency?”

[…] disclosure forms filed by Seitz show he has owned stock in Duke Energy for years. In a quarterly disclosure filed in March of this year, Duke Energy reported a $5 million […]