Arizona Regulators Blunt Solar Progress

Arizona has been called ‘the Saudi Arabia of solar.’

But the state’s relationship with solar has been rocky in recent years. Despite the fact that Arizona currently ranks third in the U.S. in total installed solar PV (2,170 MW), the state is falling further and further behind front-runner California (13,793 MW).

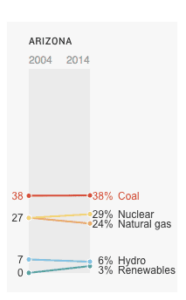

The sunniest state in the U.S. has also kept the proportion of coal it burns for electricity flat at ~38%. In other words, while virtually every other state has reduced the amount of electricity from coal since 2004, Arizona’s portion of coal-fired electricity (MWhs) has stayed flat from 2004 to 2014 – and its coal capacity (MWs) even increased since Arizona utilities purchased coal plants from California utilities that were required to cancel contracts for coal-fired power. Arizona utilities purchase over $2 billion per year worth of coal and natural gas, mostly from Colorado (coal) and Texas (natural gas). Rather than send billions out of state for fossil fuel, the money could be invested in local, clean energy jobs and manufacturing.

The U.S. Energy Information Administration (EIA) reports that in 2014, solar contributed less than 3% to Arizona’s net electricity generation.

A Brief History of Arizona’s Renewable Energy Standard

Arizona’s solar push was initially driven by its Renewable Energy Standard and Tariff, or REST, approved in 2006 by an all-Republican Arizona Corporation Commission (ACC). Although the REST at 15% clean energy by 2025 is fairly low relative to other states, it was an early adopter in a very conservative state, and helped create a steadily growing solar market.

Arizona’s Solar Slowdown Started in 2013

New Jersey provides a decent benchmark for Arizona’s volatile solar market over the years. The two states have been close solar competitors since the early days. In 2008, New Jersey installed over twice as much solar (70 MW to Arizona’s 25 MW). New Jersey, which has remained a solar leader despite its lack of Arizona’s desert sun, beat Arizona again for its yearly total in 2011 (313 MW to Arizona’s 273 MW).

By 2012, Arizona was gaining thanks to the REST and its excellent solar resource, and it beat New Jersey as its solar capacity leaped to 700 MW. But trouble was brewing as the 2012 election resulted in the ousting of two pro-solar incumbents at the Arizona Corporation Commission, the public utility board that governs many of the state’s electric and gas utilities.

In 2013, the solar market shrank, and solar developers cried foul as commercial incentives were cut to nothing. A knock-down fight over the addition of a fee for solar customers resulted in a $5 per month addition. That was less than the utilities asked for, but markets that should have been thriving were getting choked.

While the solar market in AZ has continued to grow since 2013, its rate of growth has slowed down dramatically. In 2015 Arizona added only 258 MW of solar, less than half the amount it had installed in 2012. For the first time ever, Arizona lost its overall 2nd place status to upstart North Carolina. Worse, in the first quarter of 2016, Arizona was in 8th place, behind New York, Massachusetts and New Jersey. The Saudi Arabia of solar is getting hammered by California, and newcomers like Massachusetts are catching up quickly.

What went wrong?

The Arizona Corporation Commission Shifts to Anti-Solar

Over the course of two elections — 2008 and 2010 — the Arizona Corporation Commission (ACC) dramatically changed its position on clean energy. The original five Republicans who passed the REST in 2007 were replaced in 2010 by a group with little love for solar. Remarkably, the ACC voted repeatedly to favor trash-burning over solar, despite the fact that it cost twice as much, with operating costs ten times higher.

In 2013, Commissioner Gary Pierce tried and failed to reduce the REST. Also in 2013, Arizona effectively killed its small but growing commercial market by getting rid of Performance Based Incentives or PBIs, which were paid to solar developers in the commercial (but not residential) market. In Arizona’s early solar years, PBIs were used widely, but as solar costs fell, Up Front Incentives or UFIs, which are a lump-sum based on the solar capacity, were used more.

When the ACC gutted PBI requirements from APS and Tucson Electric Power by $38.3 million, the commercial solar sector dropped dramatically, and never really recovered. Thus, even though other rate structures could have been used to continue the growth of the commercial solar market in Arizona, they were never implemented. (Rate structures would have included allowing aggregated and virtual net metering, community solar, and allowing third party solar for commercial, for-profit entities.)

It was a bad day for solar, and a harbinger of the future.

In 2014, Commissioners Brenda Burns and Gary Pierce tried to add a $50 to $100 per month charge to APS solar customers, but the outcry was swift and loud, and the amendment failed. (Former Commissioner Brenda Burns, elected to the ACC in 2010, served on the board of the American Legislative Exchange Council (ALEC) for nine years, and served as Board President in 1999.)

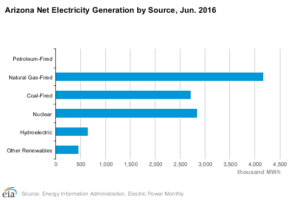

Arizona’s Electricity Mix June 2016: A Pittance of Solar, Lots of Coal, Natural Gas and Nuclear

Arizona’s electricity mix for June 2016 shows that coal- and natural gas- fired electricity dwarfed solar. Even hydropower in Arizona beat solar, despite power generation from Hoover Dam being down 30% as Lake Mead’s water level has plummeted over the past decade. EIA’s Electric Power Monthly for June 2016 shows that the most MWhs consumed in Arizona were from natural gas, with nuclear 2nd, and coal close behind.

Arizona’s solar slowdown has predictably weighed heavily on the state’s solar job growth.. At the end of 2015, the top ten solar states had about 146,000 jobs. California accounted for half (75,600), while Arizona had 6,922. At 15,094, Massachusetts had far more solar jobs than Arizona, and New York at 8,250 jobs and New Jersey at 7,071 beat Arizona as well.

So while APS wants to charge ratepayers an additional $3.6 billion over 3 years (an 8% per year increase for residential ratepayers), and the state as a whole sends at least $2 billion per year out of state to purchase coal and natural gas for electricity, the sun’s power is being completely underutilized.