NextEra CEO Jim Robo envisions a renewable future, but his subsidiary FPL remains addicted to gas

Jim Robo, the CEO of NextEra Energy, made news last month during his company’s annual earnings call when he said, “By early in the next decade, as further cost declines are realized and module efficiencies continue to improve, we expect that without incentives, solar will be $0.03 to $0.04 per kilowatt hour product, below the variable costs required to operate an existing coal or nuclear generating facility of $0.035 to $0.05 per kilowatt hour.”

Robo went on to say, “We believe no other company has our expertise in all three products, wind, solar and battery storage, to leverage the combined technologies at the low cost we can achieve. In fact, we recently submitted a bid at a very competitive price for a combined wind, solar and battery storage product that is able to provide an around-the-clock, new firm, shaped product specifically designed to meet the customers’ needs.”

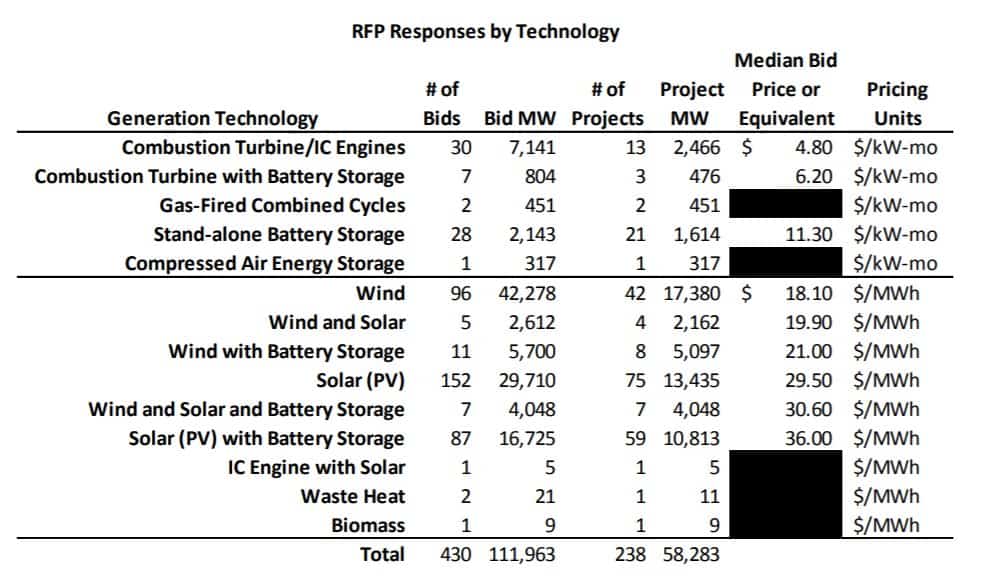

Robo was likely referring to recent bids announced by Xcel Energy in Colorado, a process in which NextEra participated. The median price of the solar-plus-storage bid of $36/MWh led GTM Research Senior Advisor Shayle Kann to tweet that the bid was the lowest price for solar plus storage that he had ever seen.

The renewable-plus-storage bids offered to Xcel may have hit unprecedented prices, but Robo has been consistent in his bullishness for storage. In 2015, Robo spoke at an analyst conference at Wolfe Research in New York and made a similar remark to his recent earnings call statement that also generated headlines. Robo said, “Post-2020, there may never be another [gas] peaker built in the United States — very likely you’ll be just building energy storage instead.”

Robo’s analysis that the cost of batteries and solar will be cheaper than gas peakers, and now even existing coal and nuclear by 2020, are in stark contrast to the activities of his own subsidiary – Florida Power & Light.

FPL, the largest subsidiary and crown jewel of the NextEra company, is nearing the end of a massive natural gas buildout in Florida that will burden Florida ratepayers for the next four to five decades. Sierra Club’s Diana Csank pressed FPL on this front during a 2016 rate case testimony. She stated,

customers are on the hook to pay billions more if the Commission does not prevail on FPL to stop growing its reliance on natural gas and finally to start adding, in earnest, clean, low-cost, low-risk alternatives instead: solar, wind, energy efficiency, and battery storage …

And at today’s prices, they are a bargain. Even FPL witnesses admit this. For instance, in their prefiled testimony on the company’s three new solar power plants. And NextEra, FPL’s affiliate, is the world’s leading solar and wind power developer, rapidly advancing battery storage projects and divesting from natural gas plants.

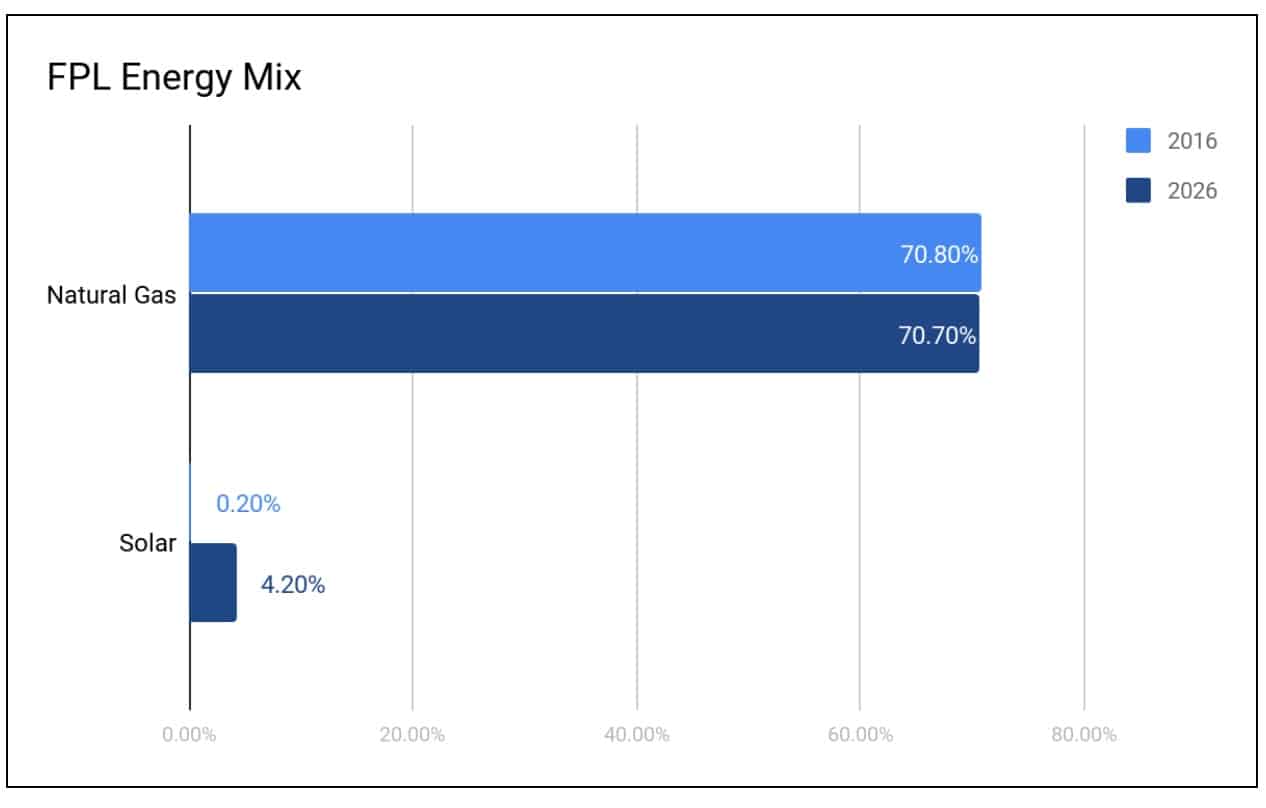

As Csank stated, FPL is clearly not working to accelerate solar and battery growth – even though it claims otherwise. The company’s Ten Year Power Plan Site Plan (2017-2026) reveals the utility’s focus.

FPL’s gas rush is almost completed, which means customers will miss out on a renewable energy future for decades to come

In recent years, FPL has built the following natural gas plants with more on the way:

- West County Energy Center Unit 1 and 2, service date of 2009, and Unit 3 service date of 2011, total 3,657 MW.

- Cape Canaveral, service date of 2013, total 1,210 MW.

- Riviera Beach, service date of 2014, total 1,212 MW.

- Port Everglades in Broward, service date of 2016, total 1,237 MW.

This gas buildout is reminiscent of FPL’s attempt in 2007 to add two coal units to its system. But FPL was unable to obtain approval from regulators for the units. If the utility did, the units would have been placed in service in 2013 and 2014 and remained operating for decades to come while costing FPL’s customers significantly more than today’s alternative sources, and emitting climate-warming pollution. At the time, FPL president Armando Olivera said, “We firmly believe this plant is the best solution FPL can pursue to maintain fuel diversity, ensure system reliability and mitigate price volatility for our customers.”

Today, FPL’s position on natural gas is similar to its 2007 belief in coal that history has proven to be colossally short-sighted. Last year, FPL spokeswoman Sarah Gatewood told the Miami Herald, “We believe that investing in natural gas reserves is a smart long-term investment that would help us continue to provide our customers with reliable electricity at low and stable prices.”

FPL’s Ten Year Power Plan Site Plan, which was presented to regulators last year, show at the end of 2016 the utility’s electrical generating facilities consists of: four nuclear units, four coal units, 16 oil/gas combined cycle units, four oil/gas steam units, four combustion gas turbines, nine simple cycle combustion turbines, and five solar photovoltaic facilities. Natural gas was by far the largest component of their generation mix.

In late 2017, FPL was given an exemption by the PSC from requesting proposals to build a nearly 1,200 MW gas unit at its Lauderdale site in Dana Beach, effectively stopping any analysis regarding potentially cheaper options such as those suggested by Robo. Csank told Southeast Energy News, “Skipping the RFP makes that evidence harder to develop, and hence, easier for FPL to slip another unscrutinized gas generation plant into its portfolio.” This is on top of the projected 1,748 MW Okeechobee gas plant that will be in service come 2019 after the PSC approved of its construction in 2016.

FPL customers dodged a bullet when regulators wisely denied the company’s request to go on a coal-building spree in 2007. It looks like they won’t be so lucky when it comes to FPL’s current gas building spree, and will be stuck with stranded costs for decades. Those customers would save a lot of money if FPL CEO Eric Silagy simply heeded the words of Robo, his boss.

UPDATE (March 19, 2018): According to PV-Magazine, NextEra placed a variety of historically low-priced bids for stand-alone battery storage. These bids further call into question an aggressive natural gas build-out by NextEra’s subsidiary Florida Power & Light.