Pollution Payday: Analysis of executive compensation and incentives of the largest U.S. investor-owned utilities

Alliant Energy

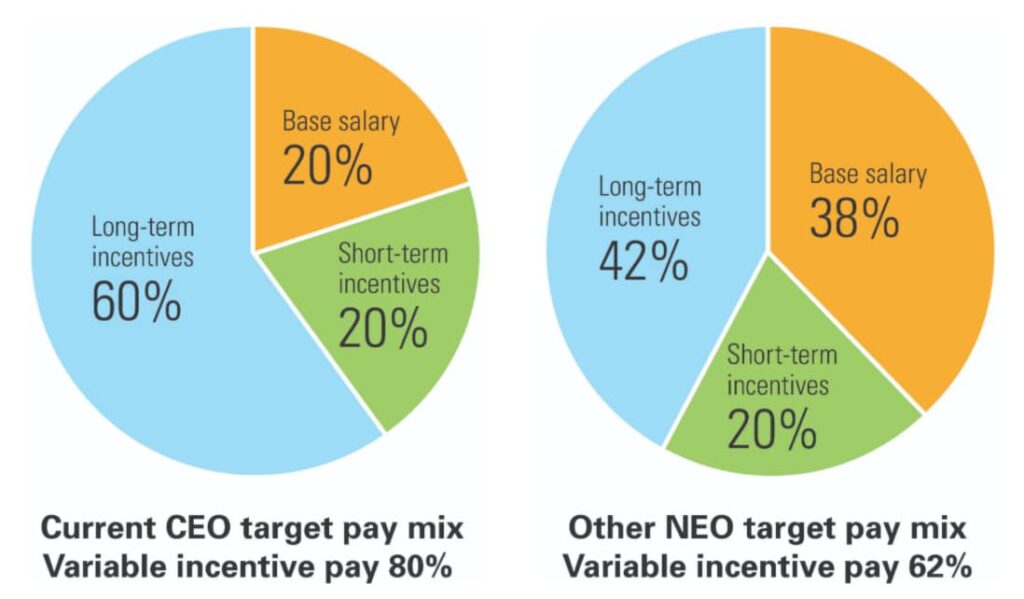

Alliant Energy, a Wisconsin-based utility holding company that operates Wisconsin Power and Light (WPL) and the Iowa utility Interstate Power and Light (IPL), provides its executives with a base salary, short-term compensation plan, and a long-term compensation plan.

The base salary provides fixed compensation that is subject to annual review and is weighted considerably less than the long-term incentive performance plan. In 2019, then-CEO Patricia Kampling’s base salary was increased by 5% to $1,060,000. After her retirement and the promotion of John O. Larsen to CEO, Alliant reduced the base CEO salary to $900,000.

Alliant’s short-term performance pay is an annual plan that provides executives with cash payments tied directly to achievement of certain goals established by the Board of Directors’ Compensation and Personnel Committee. The driving force behind the annual performance metric is Alliant’s consolidated earnings per share (EPS), which is weighted at 70% of the performance total. For 2019, the Board had established a target range of $2.10 to $2.33 EPS. Alliant reported a $2.31 EPS.

Alliant is one of the few utilities analyzed in this report that incentivizes a diverse workforce. However, the cash incentive pales in comparison to the EPS target. Of the performance total, 2.5% is given to the “people of color” metric and another 2.5% is given to the “women” target. Alliant’s executives failed to achieve the minimum threshold targets set by the Board for 2019.

The threshold was having people of color compose 5.1% of the workforce and women compose 25.9%. Alliant reported 5% and 25.8%, respectively.

Alliant does have a goal to provide net-zero carbon emission electricity to its customers by 2050; however, Alliant does not incentivize CO2 reductions in executive compensation. Alliant’s environmental metric, which incentivizes executives annually to executive the utility’s long-term goal of reducing emissions, is specifically for nitrogen oxides (NOx), sulfur oxides (SOx), and mercury, according to an Alliant spokesperson when asked by the Energy and Policy Institute. The spokesperson further stated that “Alliant determines the amount of emissions reduction we need that year to meet the long-term goal, which is then the target for the incentive plan.”

Alliant’s long-term incentives are strictly equity compensation “to align management interests with shareholder interest over a sustained period,” according to the company’s 2020 proxy statement. The Board incentivizes company management to achieve a 7% three-year compounded annual growth rate of net income. If executives achieve that threshold, they are awarded a 200% payout. The Board additionally wants Alliant to achieve greater shareholder return than its peers, measured by the Edison Electric Institute (EEI) Stock Index. If Alliant is in the 90th percentile or greater, executives again receive a 200% value payout. In 2019, Alliant’s three-year average performance exceeded the 7% compounded annual growth, which resulted in a 200% target award payout. This placed the utility in the 72nd percentile in the EEI Stock Index, which resulted in an additional 155% payout.

In addition to cash and stock awards, executives receive certain perquisites. Alliant’s perquisites include health physicals, reimbursement of financial planning expenses, disability insurance, the use of the corporate aircraft “in some instances,” and the ability to have a family member or members accompany the CEO on business trips. Alliant limits the CEO to up to 40 hours of personal use of corporate aircraft each year. In 2018 and 2019, then-CEO Patricia Kampling received $7,187 and $6,144 in perquisites for personal air travel by family members. The current CEO, John Larsen, received $27,287 for home security services in 2019.

| CEO compensation ranking among utilities studied, 2019 | 19/19 |

| Compensation ratio: CEO to median employee, 2019 | 56:1 |

| Percent change in CEO compensation, 2017-2019 | +16.6% ($1,084,670) |

| Maximum payout of performance-based shares as a percentage of target, 2019 | 200% |

| Is Alliant’s executive compensation structure aligned with decarbonization? | No. While Alliant has committed to providing net-zero carbon emission electricity by 2050 to customers, the Board does not incentivize CO2 reduction. The company’s environmental metric incentivizes reductions of NOx, SOx, and mercury. |

| Is there evidence from SEC filings that Alliant is using misleading financial metrics to determine executive compensation? | No. |

| What key perquisites or benefits do Alliant executives receive? | Executives receive an annual physical, home security services, reimbursements for financial planning services, charitable gift matching, personal use of the corporate aircraft, and a supplemental executive retirement plan. |