David Pomerantz and EPI Senior Fellow Nancy LaPlaca co-authored this piece.

While most electric utilities are sprinting away from coal and toward less expensive and cleaner generating options, Southern Company’s subsidiary Gulf Power wants to make its customers in Florida pay for double the coal it burns for them now.

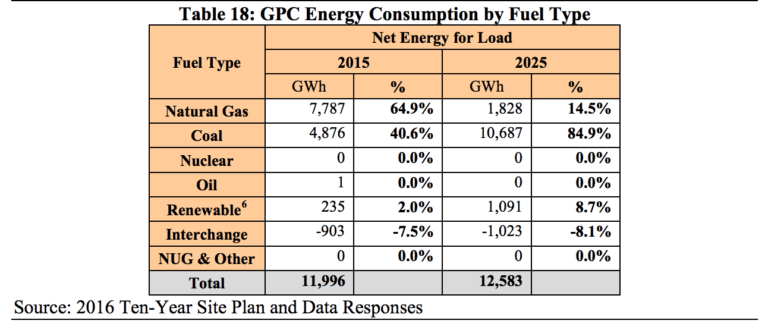

By 2025, the electricity that Gulf sells to its customers in the Florida Panhandle would be powered by 85% coal, up from 41% today, according to filings in Florida’s 2016 Ten-Year Site Plans.

Gulf Power aims to charge its customers for twice as much coal by 2025.

This will not be a good deal for customers. For utilities that need more power generation, renewable energy and natural gas are cheaper options than coal, and that’s not counting the fact that burning coal causes climate change and creates pollution that leads to asthma and heart disease – all of which are reasons that virtually all other utilities are abandoning the resource.

So why is Gulf swimming upstream toward coal? The Southern Company subsidiary is trying to saddle its customers with the output from a coal plant that it has for years sold to others via bilateral contracts. But those contracts have now expired, and if Gulf can’t find other buyers – which it almost certainly cannot – it would have to sell the power into the open market, where it would likely take a bath and contribute to the risk of stranding the asset entirely.

Gulf Power is trying to stick its customers with coal they don’t need

Gulf Power is a 25% owner of Unit 3 of Plant Scherer, one of the dirtiest coal plants in the U.S, and the utility is seeking $19.4 million from its 450,000 customers for that interest in the power plant. The behemoth Plant Scherer, located in Georgia, has ranked first in global warming emissions, third in toxic mercury emissions, and fourth in coal combustion waste. Plant Scherer has also been investigated for drinking water contamination from the plant’s huge coal ash dumps.

The other 75% of Unit 3 is owned by Georgia Power, Southern Company’s subsidiary operating in Georgia. Gulf had sold its share of the coal unit to other parties in three contracts until now. Two of those contracts ended in 2015 and 2016, and the third ends in 2019.

Not surprisingly, given that coal is facing an extreme sellers’ market, Gulf could not find new buyers for that power, according to the Sierra Club in a recent hearing. Thus, Gulf is trying to pawn off a polluting, out-of-market resource to its customers even though they have no need for the electricity. Their only hope at avoiding the raw deal is if the Florida Public Service Commission (PSC) rejects Gulf’s proposal.

In a letter Sierra Club staff attorney Diana Csank sent to the Florida PSC, Gulf Power “failed to show any need for the Scherer coal-burning generation.” The letter also highlighted that fact that Gulf Power even admitted that its “customers did not need the Scherer coal-burning generation over the past 29 years and Gulf Power did not — and perhaps cannot — specify the date when new demand will materialize.”

The math backs up the Sierra Club’s case. As the Florida PSC noted, “over the last 10 years, [Gulf Power’s] customer base has increased by 7.8 percent, while retail sales have declined by 3.0 percent” (p 67). In other words, even while the utility gains customers, it’s selling less electricity, because the economy is getting more efficient.

Data further suggests there is plenty of efficiency gains left to be made. A 2007 study by energy efficiency experts found that Florida could reduce its electricity consumption by 30-34%. Currently, Florida’s overall energy efficiency is at a paltry 0.88% of retail electricity sales.

To the extent Gulf does need to buy new generating resources, it could meet any gaps by purchasing renewable energy from third parties, which are likely cheaper than the Scherer investment.

Gulf Power aims for fixed charges that hurt low-income customers, solar, energy efficiency

Along with this stunning proposal, Gulf Power is asking its 450,000 customers for a rate increase of $107 million, and an 11% return on equity. Gulf wants to increase customers’ fixed monthly charge from $18 to $48, an increase of 155%. Fixed charges are highly regressive: they tend to increase bills for low energy users, and decrease bills for high energy users, which means they are felt the hardest by the poorest customers. The charges make rooftop solar less valuable, which is why utilities who are antagonistic to rooftop solar are pursuing them around the country, and they also reduce the value of energy efficiency, since they rob customers of a chance to reduce that large fixed portion of their bill by consuming less electricity. Gulf Power already has the highest fixed monthly charge in Florida.

Gulf Power’s requests echo the behavior of Southern Company’s other subsidiaries, one of which has also shown a reckless reliance on coal at its own customers’ expense: Southern’s subsidiary in Mississippi, Mississippi Power, built the Kemper coal plant, which ran billions of dollars over budget, with ratepayers stuck with much of the bill.

Gulf Power’s requests, if allowed, will only harm Gulf Power’s customers and the climate, and the Florida PSC should reject them.