Kemper Scandal Unraveling Southern Company’s Credibility

May 1, 2017 update: Southern Company’s Mississippi Power reported to the SEC today that its Kemper IGCC power plant will be placed in service by the end of May 2017. The delay adds $38 million to the price tag of the power plant.

February 1, 2017 update: Southern Company’s Mississippi Power reported to the SEC on January 31, 2017 that its Kemper IGCC power plant will be placed in service in late February 2017. Mississippi Power projects that an additional $25 million will be expensed due to the inclusion of projected schedule costs through February 28, 2017. The utility company also told the SEC that “any extension of the in-service date beyond February 28, 2017 is currently estimated to result in additional base costs of approximately $25 million to $35 million per month.” Six months ago, President and CEO Tom Fanning told investors and analysts on the 2016 Q2 earning call that “both units A and B of the [Kemper] facility are expected to be fully integrated by the end of September.”

December 2, 2016 update: Southern Company’s Mississippi Power reported to the SEC that it now expects that the Kemper IGCC will be placed in service during January 2017. If this is the case, Mississippi Power will be required to repay approximately $250 million in tax benefits associated with bonus depreciation that is dependent upon placing the Kemper IGCC in service by December 31, 2016. Furthermore, the delay will result in additional base costs of approximately $25 million to $35 million.

November 7, 2016 update: Southern Company’s Mississippi Power delayed the scheduled in-service date of the Kemper facility to December 31, 2016. The announcement occurred on the 100th day from when President and CEO Tom Fanning told investors and analysts on the Q2 earning call (July 27) that Kemper would be in service by the end of September. The delay will cost Southern Company an additional $25 million. If the Kemper plant does not start commercial operation by the end of the year, Mississippi Power will have to return $250 million of tax breaks. The total cost of Kemper is quickly approaching $7 billion.

October 11, 2016 update: Southern Company’s Mississippi Power delayed the scheduled in-service date of the Kemper facility to November 30, from October 31. The delay will cost Southern Company an additional $33 million. Last month, President and CEO Tom Fanning said the public attacks of Kemper are “garbage.”

August 8, 2016 update: Southern Company’s Mississippi Power delayed the scheduled in-service date of the Kemper facility to October 31. This revision comes 12 days after President and CEO Tom Fanning told investors and analysts on the Q2 earning call that “both units A and B of the [Kemper] facility are expected to be fully integrated and in service by the end of September.” The delay will cost Southern Company an additional $43 million.

Southern Company has unveiled a new corporate brand. This comes a week after the monopoly utility was the center of a New York Times investigation revealing poor company management and potential fraud, according to a whistleblower and numerous previously undisclosed documents.

In the wake of acquiring the natural gas company, AGL Resources (now called Southern Company Gas), Southern Company President and CEO Tom Fanning said, “Today we are a leading national energy company that is better positioned to deliver real solutions for customers.”

However, the utility giant still is the focus of a Securities and Exchange Commission (SEC) investigation, ratepayers are suing the utility alleging fraud, and public officials are upset that the company had been funding climate denial up until last year. Furthermore, customer frustrations in Southern Company territories are bubbling up. These tensions have led some regulators to more critically examine Southern’s business strategy.

A corporate rebrand will not shield Southern Company from lawsuits, nor likely change the viewpoints of regulators or their customers anytime soon. The company’s mismanagement goes all the way to the executive suite. Indeed, Chairman, President, and CEO of Alabama Power Mark Crosswhite told employees a few years ago, “To be crystal clear, failures of culture are failures of leadership, and I recognize that the leadership team and I are accountable.”

Investigations, Lawsuits, Customer Frustrations

The Mississippi Power Kemper power plant endeavor is $4.5 billion over budget and years behind schedule. A “clean coal” power plant that was supposed to be a $2.2 billion project is now projected to cost at least $6.74 billion. The SEC is investigating the management and reporting of the Kemper project as it relates to estimated costs, internal controls over financial reporting, and schedules.

In March, the Occupational Safety and Health Administration (OSHA) made a preliminary determination that the company violated the Sarbanes-Oxley Act when firing whistleblower Brett Wingo who had alerted Southern Company officials of improper financial reporting. In a letter to Southern Company, an OSHA administrator said the company “has not offered credible evidence” that justified the dismissal of whistleblower Brett Wingo and the treatment of Wingo is a violation of the law.

Also in March, ratepayers filed a lawsuit alleging Mississippi Power violated accountability for “fraud and mismanagement, all the while fleecing the public in the interest of profits… Plaintiffs demand that Defendant Mississippi Power and not the ratepayers bear the responsibility and damages for years of runaway spending, unconscionable excess, incompetence, delay, and mismanagement.”

Additionally, another lawsuit was filed in June against Mississippi Power by Treetop Midstream Services, a Mississippi-based oil company. The oil company is suing Mississippi Power and Southern Company over the cost it incurred for building a $100 million pipeline and other damages. Treetop claims fraudulent misrepresentation, concealment, civil conspiracy and breach of contract by the utility companies. Treetop entered into a contract with Mississippi Power to purchase 30 percent of carbon dioxide captured at Kemper to then be used for enhanced oil recovery in Treetop’s oil fields. Treetop said in its lawsuit that Southern Company intentionally concealed construction delays and forced Treetop to unnecessarily spend nearly $100 million on its pipeline and other equipment, then terminated its agreement with Treetop.

In neighboring Georgia, Southern Company’s subsidiary, Georgia Power is doing little to enhance Southern’s image. Georgia Power’s expansion project of the Vogtle nuclear power plant was projected to cost $6.1 billion, but numerous delays and cost overruns have increased the projected cost by $3 billion. The estimated cost is now over $9.5 billion, and as of earlier this year, approximately $21 billion is the current total cost estimate for the entire Vogtle project. Georgia Power, like Mississippi Power and other utility companies, argued that if the utility was allowed to collect money from their ratepayers to finance the construction of the project, it will ultimately save their customers money in the long-run. But according to PSC expert witnesses, the project is so off-track that any of the purported benefits have been completely negated; roughly 4.5 percent of a 6 percent rate increase for Georgia Power ratepayers is for Vogtle.

The project also resulted in a lawsuit in which contractors Westinghouse and Chicago Bridge & Iron sued Georgia Power over who would pay the increased costs. Southern eventually settled for $350 million. Georgia Power still claims the power plant will deliver “long-term savings for customers.” And now, Georgia Power has asked for another $175 million from ratepayers to study the feasibility of yet another nuclear plant.

In Alabama, the elected commissioners have continued to grant Alabama Power the highest return on equity (ROE) in the country at 13.75% (some years it has been as high as 14.5%). The ROE is the only portion of the revenue requirement that a utility ultimately keeps as profit. As a result, Alabama Power customers are paying some of the highest electricity bills in the region. In 2015, WalletHub.com ranked Alabama the state as the 11th most expensive state for energy prices.

In Alabama, the elected commissioners have continued to grant Alabama Power the highest return on equity (ROE) in the country at 13.75% (some years it has been as high as 14.5%). The ROE is the only portion of the revenue requirement that a utility ultimately keeps as profit. As a result, Alabama Power customers are paying some of the highest electricity bills in the region. In 2015, WalletHub.com ranked Alabama the state as the 11th most expensive state for energy prices.

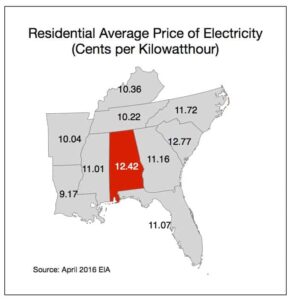

This year, Energy Information Administration (EIA) data shows that Alabama residential customers paid 12.42 cents/kWh for the month of April – higher than Arkansas, Florida, Georgia, Kentucky, Louisiana, Mississippi, North Carolina, and Tennessee. Only South Carolina residents pay more for electricity.

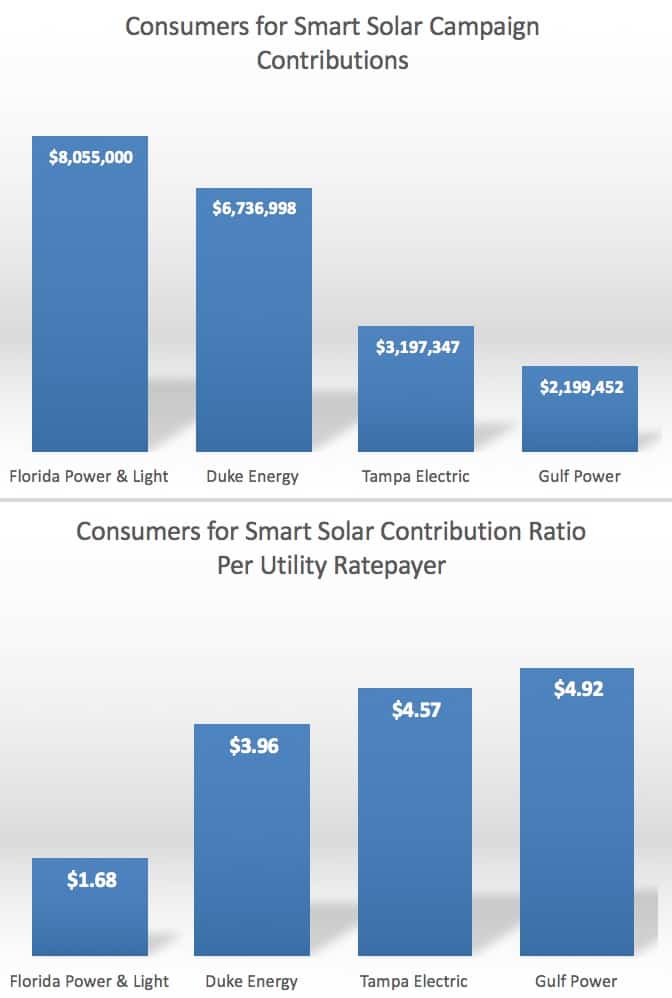

In Florida, Southern Company was involved through its subsidiary, Gulf Power, in misleading consumers over solar ballot amendments. Instead of voting on an amendment that would have allowed consumers to lease solar panels with limited upfront costs and sell the electricity to their neighbors, Floridians will face the Consumers for Smart Solar amendment. This amendment would preserve the status quo and continue to prevent homeowners or businesses from contracting with solar companies that can install solar for no upfront cost. Gulf Power is the top utility contributor per ratepayer for the Consumers for Smart Solar campaign.

In March, a 4-3 Florida Supreme Court ruling allowed the utility-backed initiative to go on the ballot, but dissenting members of the court including Justice Pariente understood that the ballot language was misleading:

“[T]his proposed constitutional amendment, supported by some of Florida’s major investor-owned electric utility companies, actually seeks to constitutionalize the status quo.

The ballot language is further defective for purporting to grant rights to solar energy consumers that are illusory; and failing, as required, to clearly and unambiguously set forth the chief purpose of the proposed amendment—to maintain the status quo favoring the very electric utilities who are the proponents of this amendment.

This ballot initiative is the proverbial “wolf in sheep’s clothing.”

(Since this blog was published, a Gulf Power-funded Florida think tank staffer essentially admitted that Consumers for Smart Solar’s Yes On 1 campaign was a well-designed ploy.)

Funding Climate Change Denial

On top of all the scandals and public frustrations over Southern Company emerging in Alabama, Georgia, Florida, and Mississippi, the utility company was also recently caught funding climate denier Willie Soon, an astrophysicist and climate change denier at the Harvard-Smithsonian Center for Astrophysics. The funding of Willie Soon has gone on since 2006, and reports from Inside Climate News show that in total, $409,000 has come from Southern Company Services over this time period.

The research Southern Company funded relates to articles in scientific journals that accuse the United Nations Intergovernmental Panel on Climate Change of overstating the negative environmental effects of carbon dioxide emissions and explains that the sun is the contributor to recent climate change. And according to Inside Climate News, “the documents reveal that Soon and Harvard-Smithsonian gave the coal utility company the right to review his scientific papers and make suggestions before they were published. Soon and Harvard-Smithsonian also pledged not to disclose Southern’s role as a funder without permission.”

In addition to Southern Company funding of Willie Soon, it was revealed that ExxonMobil was also funding the climate denier.

Relationship with Regulators Changing?

Southern Company and its subsidiaries depend on having relationships with the state commissioners and other state-level public officials to assist them with federal government funding and partnerships, and rate-case hearings. The favorable relationships also guide analysts on Wall Street with credit ratings. However, the winds are starting the change.

This past November, Democrat Cecil Brown won the Central District public service commission race in Mississippi. Brown replaced Republican Lynn Posey, who had been the commission’s strongest supporter of Kemper. Brown voted for the Baseload Act as a lawmaker, which allowed Mississippi Power to collect construction costs while building new power plants, and for a $1 billion bond bill to help pay for Kemper at a lower cost to ratepayers than through traditional power rates. However, Brown ran against Kemper and Mississippi Power. He pledged to “review” the Baseload Act and “ensure Mississippi families are protected from these outrageous costs.”

In Alabama, critics are beginning to wonder if the state commissioners are properly balancing the interests of consumers and shareholders. A 2013 report by David Schlissel and Anna Sommer find that there has not been a publicly contested rate increase case for Alabama Power since 1982 as a result of the commissioners eliminating the public hearings three decades ago because they were lengthy and expensive.

Last December, Michael Churchman, executive director of the Alabama Environmental Council, had an op-ed published in which he writes,

“The Alabama PSC has a uniquely closed and secretive process for a public regulatory body, voting on rate matters without a public hearing and releasing minimal information to the public it serves.

It’s misleading actions like those that make the public mistrust government agencies, especially when they’re supposed to be keeping an eye on utilities.”

Each of these issues proves that Southern Company is no longer a risk-free investment, and a corporate rebrand will not solve any of these problems nor ease their customers’ frustrations.