Replacing coal with more coal: how Arizona Public Service’s Four Corners coal plant hurt customers, but earned investors profits

Arizona’s largest electric utility, Arizona Public Service, is back in front of regulators asking for its second rate increase in just over a year to collect $67 million more on an annual basis from its customers. In early September, Arizona Corporation Commissioners, the elected officials that regulates power companies in the state, heard testimony from APS and intervenors in a case regarding recently installed pollution control equipment at the Four Corners coal power plant. APS’s share of the total bill for the equipment and installation came to $400 million; the utility wants to have its customers pick up the tab. If the latest increase is approved, the plant will provide APS investors with not only a repayment of that expenditure, but also a tidy profit, while customers continue to foot the bill for an investment that environmentalists and consumer advocates warned would be unwise years ago. Those warnings have come true.

At a time when utilities around the country were beginning to ditch their coal plants for economic reasons, APS wanted to invest. The utility convinced regulators to allow it to purchase a California utility’s interest in a coal plant. It was a decision that David Schlissel, now the director of resource planning analysis for the Institute for Energy Economics and Financial Analysis (IEEFA), called “the only instance that I can recall where a utility is seeking to replace retired coal capacity with another aging coal facility.” Schlissel was testifying for the Sierra Club at the time, and is planning to release a report later this year about the power plant and its impact on customers’ bills.

Six years later, it has become clear that APS ignored the warnings about its uneconomic investment. The company made the decision knowing full well that investors would be able receive a profit. “Adding to rate base is a way for utilities to increase their profits. Buying the additional interest in Four Corners made no sense. It was uneconomical for ratepayers. Adding the pollution control equipment is also uneconomical,” Schlissel said in an interview with the Energy and Policy Institute (EPI). “Four Corners has had no benefit. It’s a very expensive plant that is just going to become more expensive.”

APS told regulators that natural gas was expensive and too volatile, so coal was needed

The purchase of Southern California Edison’s interest in the Four Corners plant was a result of lawmakers in California enacting legislation to limit global warming pollution from their electricity sector. After the enactment of Senate Bill 1368, California regulators at the Public Utilities Commission (PUC) ruled that Southern California Edison could not recover any money spent on the Four Corners plant from its customers if the investments would increase the life of the plant. The utility knew that it needed to invest in equipment at the plant to reduce nitrogen oxide emissions. Breathing air with high concentration of nitrogen oxide can lead to lung problems and can contribute to the development of asthma and other respiratory infections.

APS was carefully watching the proceeding in California, and since Arizona didn’t have a global warming law, APS could take more ownership in the coal plant and force its customers to pay for any investments at the plant. That would generate a profit for APS investors. Indeed, only months after Southern California Edison agreed to sell to APS, in February 2011 an executive for the Arizona utility told a Goldman Sachs analyst that if the acquisition closes in the fourth quarter of 2012, then investors would get recovery in 2013; and, “it would be a matter of getting into service the following year or sometime after that” to get the profit for the pollution control equipment. James Hatfield, Chief Financial Officer for APS, estimated that return to arrive sometime after 2013.

Immediately after the California PUC ruling, on November 8, 2010, Southern California Edison agreed to sell all of its 48% interest in units 4 and 5 of the Four Corners power plant to APS. The decision would make APS the majority owner of the two coal units that had opened in 1969 and 1970. Two weeks later, on November 22, APS opened a docket with the ACC to win their approval of the purchase. The docket lasted a year and a half, giving intervenors ample time to raise red flags about the project.

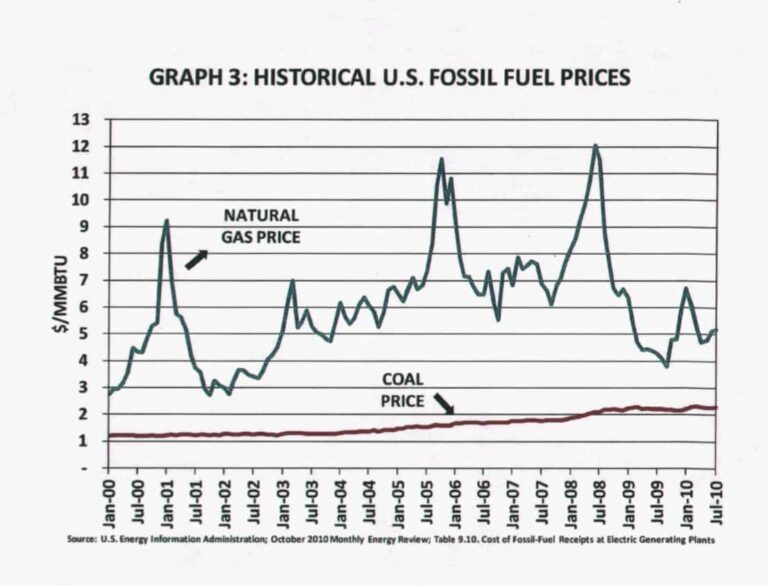

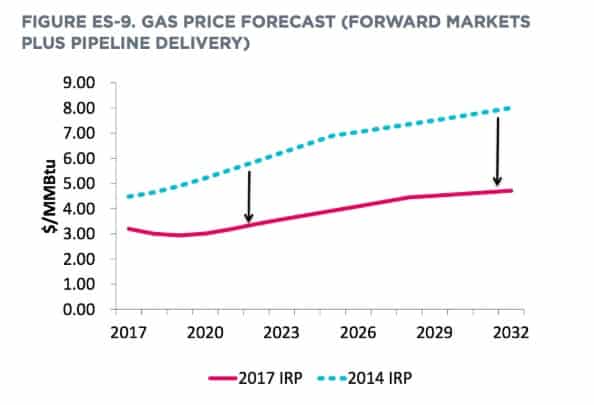

Part of APS’s pitch to regulators and stakeholders to increase its ownership in units 4 and 5 was a proposal to close the older coal units at the plant, 1-3. APS wholly owned these units. Additionally, APS needed to convince regulators that the economic benefits to ratepayers were too good to pass up, so they told the ACC that while the price of natural gas was at a low point, its price was too volatile and would ultimately increase. An overreliance on the fuel would put customers at risk, APS said to justify the investment in coal. APS’s expert witness told the regulators, “our analysis indicates gas prices are at a historic low, and this is a buy low, sell high opportunity that the Commission is being asked to make a decision on.”

The utility was wrong. The price of natural gas decreased further, and the purported savings of buying more coal has likely been wiped out. Yet despite the awful prediction, APS’s shareholders still got to profit.

Graph source: Arizona Public Service’s November 22, 2010 application to the Arizona Corporation Commission to purchase Southern California Edison’s ownership in Units 4 and 5 at the coal power plant Four Corners. Docket No. E-01345A-10-0474.

The first warning: no other utility is investing in coal

In May 2011, Sierra Club witness David Schlissel filed testimony against the utility’s plan. He argued that APS’s modeling was biased in favor of the proposal to purchase Southern California Edison’s share, as the company failed to adequately consider converting one of the coal units to natural gas, purchasing gas-fired electricity, or renewable energy sources as alternatives to coal.

He further said that APS significantly overstated the potential risk posed by natural gas price volatility and noted how other large investor-owned utilities across the country, including Xcel Energy in Minnesota and Duke Energy in North Carolina, were replacing coal-fired units with natural gas. Indeed, he cited Xcel Energy’s 2010 Resource Plan filed with the Minnesota Public Utility Commission, which took a different tone regarding natural gas compared to APS:

“Economically recoverable shale gas has been a major contributor to increasing reserves and declining natural gas prices … A long-term price for natural gas will produce significant benefits to our customers. It will reduce the production cost at both current and new resources … Today’s natural gas forecasts also predict reduced price volatility.”

Schlissel recommended that the ACC order APS to begin planning to retire Four Corners Units 1-3 in 2012 or 2014, and that it reject the acquisition of Southern California Edison’s share of units 4-5.

In post-hearing briefs, Sierra Club and the Arizona Competitive Power Alliance, an organization that was run by the former director of the state’s consumer advocate office, continued to warn regulators about why the decision wouldn’t be prudent.

Travis Ritchie, of the Sierra Club Environmental Law Program, filed a post hearing brief in October 2011 that warned regulators about the financial risk for future environmental compliance costs:

“If APS purchases [Edison’s] share of Units 4-5, it will be committing itself and its customers to a course of action that will require substantial future capital investments … it is not reasonable to put customers at risk of having to fund multiple modifications or retrofits to meet compliance obligations if, taken as a whole, those compliance activities are less economical than alternatives.”

The Arizona Competitive Power Alliance argued that the ACC should shift more risk from APS’s customers to the utility’s shareholders:

“The Commission should consider requiring that any environmental cost over and above which have been disclosed in its application should be borne by APS shareholders, not ratepayers … If natural gas prices are lower – or even less volatile – than those presented in APS testimony, and absent an RFP, then the Commissioners could deem the excess price paid for the Four Corners plant to be imprudent.”

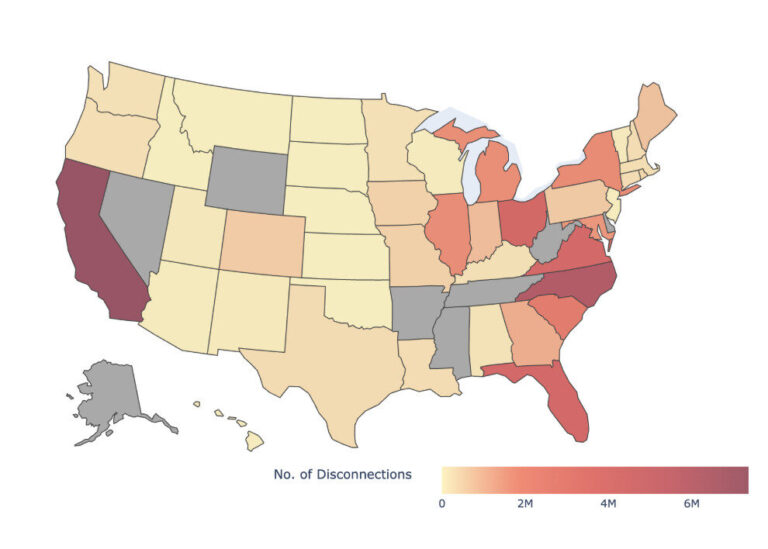

Nevertheless, in April 2012, the ACC ruled in favor of APS and granted the utility the ability to pursue the purchase of Southern California Edison’s interest in units 4 and 5. The regulators did say they would review the acquisition cost once APS filed an application to raise rates to collect the final purchase cost. APS opened a docket to have their customers pay for that cost in December 2013. This new docket allowed intervenors a second opportunity to warn regulators and the utility about the investment in coal. By that time, APS’s peers in the electric utility industry were moving at full steam away from coal and towards cheaper natural gas and, in some parts of the country, cleaner renewables.

The second warning: the change in natural gas forecasts had erased APS’ promised customer benefits

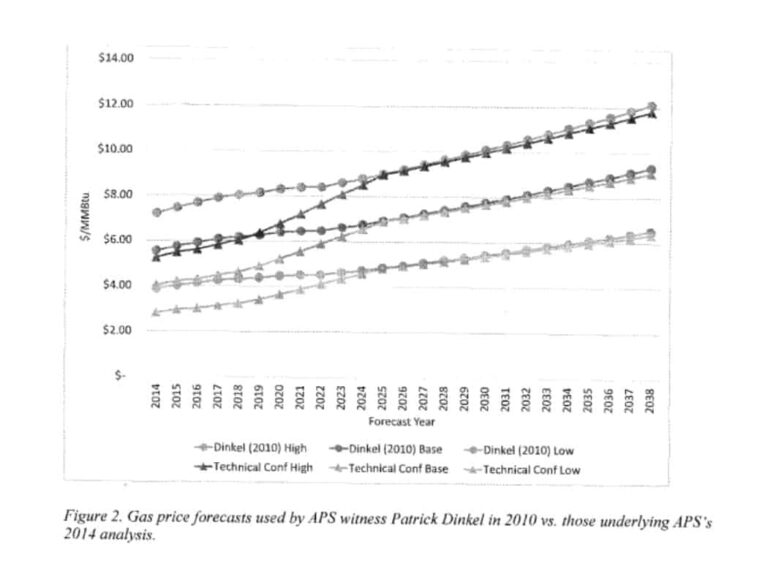

Sierra Club once again tried to persuade the ACC. It sponsored testimony of Dr. Ezra Hausman, an independent consultant with a background in economic analysis and price forecasting. Hausman pointed out that replacing the coal plant with a natural gas plant was the more prudent option based on gas price forecasts given to Sierra Club in response to their data requests in the docket, and based on what APS modeled in 2010 and 2014.

Hausman concluded that the changes in fuel price forecasts from 2010 to 2014 would lead to a change of almost $500 million, which “negates the entire benefit claimed by APS either in 2010 or in the present proceeding.”

Figure source: Testimony of Ezra D. Hausman, Arizona Corporation Commission. Docket No. E-01345A-11-0024

He stated:

“The result of these changes [natural gas price forecasts] is a significant reduction in the economic benefits to ratepayers. In fact, I conclude that had APS used the company’s later, updated fuel price projections at the time of the initial filing, all else being unchanged, the company would have found that the alternative plan of retiring Four Corners entirely and replacing it with new gas plants was the preferable option …”

Hausman further noted that since the 2010 application, the price of coal had increased and APS had increased its projection of costs of maintaining the plant.

Additionally, the Sierra Club’s witness reminded the ACC that APS’s analysis to save ratepayers money was entirely dependent on the plant operating at a very high number of hours per year all the way through 2039, when the units would be 70 years old:

“I do not know how the units will operate into their seventh decade of service, and neither does APS. It is certainly reasonable to assume that, like all capital equipment, they will require increasing infusions of capital as they age if they are to continue running at such a high level – but APS has actually assumed that capital costs will be close to constant in nominal dollars, meaning that they would decrease precipitously in real terms.”

He argued that the ACC should deny APS’s petition and order the utility to refile with a revised analysis. “Continued investment in Four Corners on behalf of ratepayers risks becoming a game of throwing good money after bad, as each ‘investment’ becomes a sunk cost that justifies the next.”

Nevertheless, before the Christmas holiday, on Thursday, December 23, 2014, the ACC sided with APS again, approving APS’s plan to recover the $182 million in purchase costs of Southern California Edison’s share of the coal units from ratepayers.

“APS has had the home field advantage with the ACC, and their ratepayers are the visiting team,” Schlissel told EPI.

APS set to repeat its mistake, now by building gas plants when solar and storage is the cheaper option

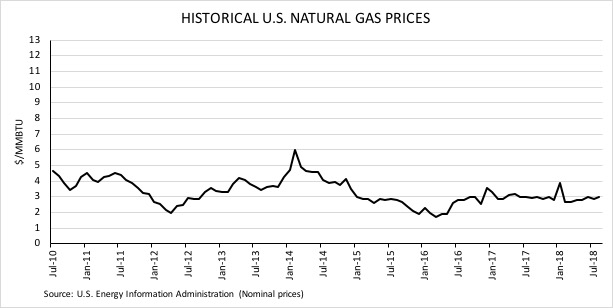

In the years since APS first opened a docket with the ACC to invest in more coal, the price of natural gas has stabilized and decreased at a level far lower than what the utility forecasted.

Ironically, in APS’s most recent integrated resource plan, which is the company’s roadmap for how it plans to meet forecasted energy demand using different sources of electricity, APS no longer predicts high natural gas prices at the $12/MMBTU range. APS has instead forecasted natural gas prices to be between $4/MMBTU and $5/MMBTU in the latter half of the 2020s and through the early years of the 2030s. As a result of their new forecast, the utility wants to significantly invest in natural gas power plants while it conveniently ignores its previous argument about an over-reliance on the fuel.

The latest integrated resource plan features scenarios where APS builds 5,000 megawatts of natural gas capacity and significantly increases the fuel’s share in the utility’s generation portfolio over the next 15 years. If APS gets its way, then customers would be on the hook to pay for these massive capital investment projects. Investors, meanwhile, will be able to make a larger profit faster than if APS instead invests in cheaper, more incremental renewable energy investments.

Figure source: APS 2017 Integrated Resource Plan filed with the Arizona Corporation Commission. (Nominal dollars)

While Schlissel agrees that the price of natural gas will remain relatively cheap compared to the last decade, he cautions regulators and utility companies against investing millions in natural gas infrastructure, as APS has proposed to do. Instead, he points to renewable energy. Hausman does too. “Lots of utilities now want to add gas, but I do think many of them are being short-sighted,” said Hausman in an interview with EPI. “The low prices of gas many not last while the the low price of energy from the sun and wind are forever.”

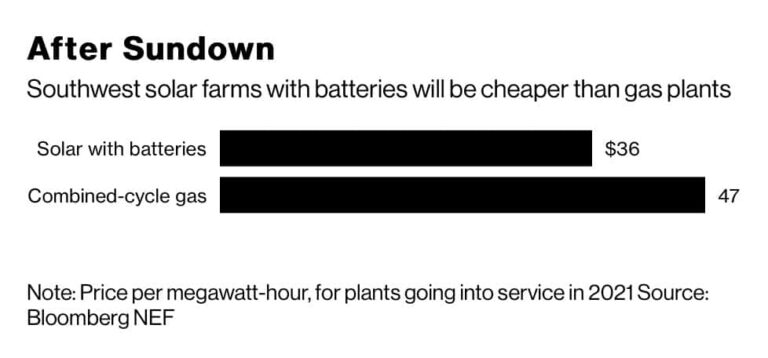

Indeed, according to a new report from Bloomberg New Energy Finance (BNEF), in the Southwest, solar energy plants built with batteries that will enter into service in just a few years will be cheaper than gas.

The BNEF report finds that “a 100-megawatt solar farm that goes into service in Arizona in 2021, coupled with a 25-megawatt storage system with four hours of capacity, will be able to provide power for $36 a megawatt-hour. That’s well below the $47 price from a new combined-cycle gas plant.”

Hugh Bromley, a BNEF analyst, said, “In the long-term, this is a threat to gas suppliers whose demand from utilities will be in decline.”

Colorado regulators recently approved of Xcel Energy’s plan of retiring coal units and adding about 1,100 megawatts of new wind, 700 megawatts of solar, 275 megawatts of battery storage, and 380 megawatts from existing natural gas sources. Xcel Energy credits the declining cost of renewable energy as the justification for this energy plan.

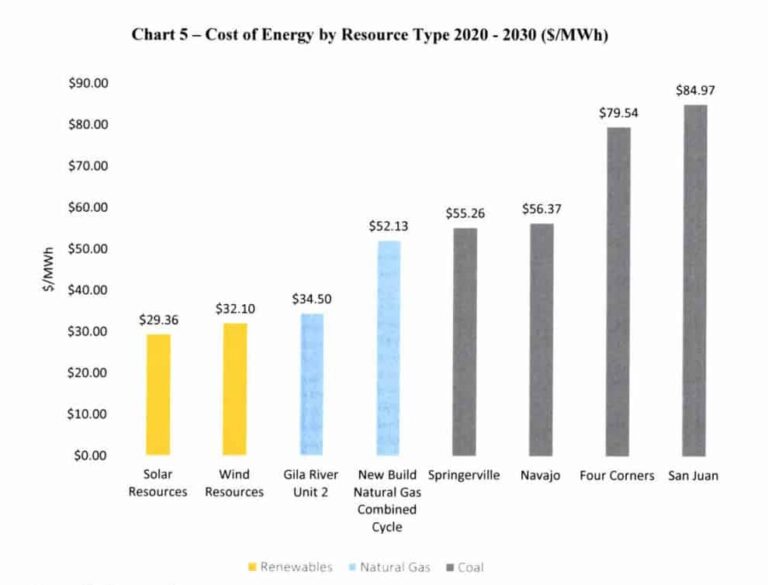

Furthermore, Tucson Electric Power, which is another Arizona electric utility regulated by the ACC that owns a share of the Four Corners power plant, submitted data to the ACC earlier this year to show that it projects the cost of renewables to be cheaper than its current fossil fuel plants – but also new natural gas plants for the foreseeable future.

Figure source: Tucson Electric Power and UNS Electric, Inc response to the Notice of Inquiry from the Arizona Corporation Commission. Docket No. E-00000Q-16-0289

As a result of the falling prices of solar and battery storage, in March, Arizona regulators refused to acknowledge APS’s integrated resource plan. Months later, however, APS’s executives reassured its investors that the ACC’s refusal was mostly symbolic and “there is no requirement that a utility modify its resource plan.” In other words, APS will likely continue its push for natural gas infrastructure despite the fact that renewable energy is cheaper.

The future of the Four Corners Power Plant and what it means for local communities

Today, the Arizona Corporation Commission is not interested in listening to arguments over whether or not the pollution control equipment installed at the Four Corners plant was a prudent investment. An ACC administrative law judge sided with APS in July over Sierra Club to limit the scope of arguments in the docket. Weeks later, Sierra Club withdrew from the case since it could not use the proceeding as an opportunity to prove that the “ill-advised” decision was imprudent. The group stated that the order, “gives APS a free pass to ignore red flags that would have prompted a rational investor to carefully scrutinize the prudency of spending approximately $400 million on an increasingly financially challenged power plant.”

“Ratepayers are paying double for the power from the Four Corners plant than it would cost to get the same power from new renewable power purchase agreements. And now they’ve put in hundreds of millions of dollars more into it,” Schlissel told EPI. “It’s simply unfair to consumers. The plant is expensive. There are cheaper alternatives, including renewables or gas. There are increasingly amounts of low cost solar in the Southwest and California, cheap wind coming out of the Southwest Power Pool, and for certain months, cheap hydroelectricity coming from the Northwest. I don’t see how these coal plants in the West are going to survive, unless they keep getting bailouts from regulators.”

It appears that the regulators will – as Dr. Hausman put it four years ago – continue to throw money at the Four Corners plant as each “investment becomes a sunk cost that justifies the next.” He told EPI, “This is exactly what happens. Utilities file for piecemeal investments, but these become creeping capital investments that make no economic sense when taken together. The good news is that many commissions are catching on, but it can still be a hurdle to recognize previous decisions that have gone sour.”

In neighboring New Mexico, utility regulators appeared to have shown signs that they were becoming more skeptical about passing PNM’s share of the cost upgrades at the Four Corners plant on to customers. Utility regulators initially adopted a December 2017 order that found PNM Resources’ share of the pollution control equipment costs and other upgrades at the Four Corners plant, which total $150 million, to be imprudent. PNM is New Mexico’s largest power provider. But weeks later, the regulators adopted a different order that postponed a prudency determination about the costs to a future date. The new order had no new evidence to support the change. The environmental nonprofit New Energy Economy sued the regulators over their new ruling, and its filing reveals that PNM lobbied the utility regulators to change the order. The suit is currently pending at the New Mexico Supreme Court.

Meanwhile, the arguments in the current docket in Arizona mainly focus on the profit APS is allowed to earn for the capital investment of equipment at the plant. But Nicole Horseherder and Mike Eisenfeld, on behalf of the several non-profit organizations and indigenous communities near the Four Corners plant, filed briefs with the ACC that have sparked a discussion about the future of the coal plant. Their testimony, sponsored by the San Juan Citizens Alliance, TO NizhOni Ani, and Diné CARE, made five recommendations to the ACC, including the establishment of a “transition fund” of at least $10 million of seed funding with at least half that amount funded by APS shareholders. A transition fund would help the local communities in their transition to new modes of economic development.

Horseherder and Eisenfeld told the ACC that since there is talk about the Four Corners plant retiring in 2031, which is earlier than APS projects, stakeholders needs to be talking about a transition today:

“Uncertainty begs the need for robust just transition planning that begins now … APS and its customers have benefited from these communities for decades. As such, they have an obligation to ensure that proactive steps are taken now to help these communities transition to new economic bases once the power plant closes at some point in the future.”

The groups also requested that APS support Tribal communities by providing transmission capabilities and renewable energy development opportunities on Tribal Lands to continue a revenue stream for the Navajo.

APS, whose lobbyists have touted the Navajo Nation’s opposition to a renewable energy ballot initiative, filed testimony to oppose the requests for transition funding and stated that the current proceeding “provides neither the correct time nor place to have these discussions.” Eisenfeld responded to APS in subsequent testimony to tell the regulators, “important decisions will need to be made about the Plant well before 2031, and those decisions will have significant consequences for the economies of the Navajo Nation and the Four Corners region.”

Meanwhile, the utility has spent has already spent over $11 million in shareholder dollars fighting the ballot initiative, which would require APS to increase the amount of electricity generated from renewable sources to 50% by 2030.

It appears even more disingenuous for the utility to oppose the requests from the local community members to begin planning for a transition to a new economic model, since APS was eager to remind the regulators about the jobs the plant and nearby coal mine provides to the Navajo in its testimony years ago.

Image source courtesy of EcoFlight.