Do major investors support American Electric Power’s lobbying against President Biden’s clean energy plan?

American Electric Power is lobbying to weaken the Clean Electricity Performance Program, a key component of President Biden’s goal of decarbonizing the electric grid. The three largest investors in AEP – BlackRock, Vanguard Group, and State Street Advisors – have pledged to engage with companies they own in order to do more to reduce emissions and align lobbying efforts with the Paris Agreement goals. But the three asset managers each won’t say if they agree or disagree with AEP lobbying against the climate legislation.

An AEP executive last year acknowledged the potential influence of BlackRock’s climate commitments on the company, explaining that as a major investor in utilities, “What they say matters because we all use their money to be successful.”

EPI asked BlackRock, Vanguard Group, and State Street Advisors this week if they support or oppose AEP’s lobbying efforts to weaken the Clean Electricity Performance Program and whether the investors had engaged with AEP over its lobbying efforts. Spokespeople for all three major investors said they would not comment.

AEP is also seeking to charge West Virginia ratepayers hundreds of millions of dollars for additional investments in three coal plants, even as regulators in Kentucky and Virginia have rejected the utility’s efforts to charge ratepayers in those states.

AEP’s lobbying efforts and continued investments in coal raise questions about the effectiveness of the major investors’ engagement strategies to align the business plans and lobbying efforts of the companies they own with the Paris climate agreement goals.

AEP is lobbying to weaken the Clean Electricity Performance Program

The Clean Electricity Performance Program (CEPP) is a key component of President Biden’s plan to clean up the electric utility sector; on Wednesday, White House National Climate Advisor Gina McCarthy called it “a top priority for President Biden’s Build Back Better Agenda.”

Our proposed Energy Efficiency and Clean Electricity Standard – being advanced in Congress as the Clean Electricity Performance Program – is a top priority for President Biden's Build Back Better Agenda. (1/2)

— Gina McCarthy (@ginamccarthy46) September 29, 2021

AEP is lobbying to weaken the CEPP and has been the most vocal opponent of the plan of any major investor-owned utility. Other utilities like Exelon and Public Service Enterprise Group have expressed support for the Clean Electricity Performance Program.

E&E News first reported AEP’s lobbying efforts, and the New York Times reported last week:

Among the industry executives to whom Mr. Manchin is listening closely is Nick Akins, the head of American Electric Power, an Ohio-based electric utility that serves 11 states, including West Virginia, and relies on West Virginia coal for many of its power plants.

The two men have a long working relationship and spoke earlier this month — each man has the other’s cellphone number.

Mr. Akins said he would like Mr. Manchin to slow the pace at which electric utilities are required to migrate from dirty to clean fuels, and eliminate fines against power companies that fail to switch to clean electricity sources.

“He is supportive of a clean energy future, like we all are,” Mr. Akins said. “But these transitions take time. We can’t cram all that into eight years,” he said, referring to Mr. Biden’s goal of 80 percent clean power by 2030.

“And I don’t like the penalty — we already have all the impetus in the world to continue to this clean energy transition,” Mr. Akins added.

AEP executive on BlackRock’s climate commitments: “What they say matters”

The three largest owners of American Electric Power are BlackRock, Vanguard, and State Street Advisors; all three major investors have made explicit climate commitments. AEP has explicitly acknowledged that these commitments are particularly influential. Lisa Barton, executive vice president of utilities at AEP, said in February 2020 at the Ohio Energy Management Conference in Columbus:

And so you know regulators want to make sure that you as a company are appropriately managing your risks and, you know, ESG is coming up is as one of those risks, and now that we’ve seen so many folks like BlackRock, who is a major investor in utilities and a major investor in quite frankly probably most industries. What they say matters because we all use their money to be successful. We can’t provide the solutions that we provide if we don’t have investors behind it. And so if they say they don’t want to invest in companies that have 25% of their revenues coming from, you know, carbon emission facilities such as coal, that’s something that needs to be taken to heart. And like all of you, you have to worry about your parent financing as well as your individual company financing so for for [sic] us as a company, we need to be sitting there and looking long term as we are, and what are we doing to lower our carbon footprint. Most importantly, how are we making sure that we’re managing that in a level that’s consistent with how our states want us to be managing those assets and what’s in the best interests of our customers. [Emphasis added]

BlackRock, Vanguard, and State Street Advisors have made climate commitments

BlackRock, Vanguard Group, and State Street Advisors are all members of the Net Zero Asset Managers Initiative, which means they have committed “to support the goal of net zero greenhouse gas (‘GHG’) emissions by 2050, in line with global efforts to limit warming to 1.5°C.” They have also committed explicitly to “implement a stewardship and engagement strategy, with a clear escalation and voting policy, that is consistent with our ambition for all assets under management to achieve net zero emissions by 2050 or sooner.”

BlackRock and State Street Advisors are also members of Climate Action 100+, “an investor-led initiative to ensure the world’s largest corporate greenhouse gas emitters take necessary action on climate change.” Climate Action 100+ includes hundreds of major investors with more than $55 trillion in assets under management; BlackRock joined in January 2020, and State Street Advisors joined in November 2020.

Climate Action 100+ published its first Net-Zero Company Benchmark in March 2020, which assessed the climate plans and performance of 159 large companies in several sectors, including major U.S. electric utilities. The Climate Action 100+ assessment of AEP found that the utility is not meeting any of the nine criteria the investor group uses to assess companies, including “Climate Policy Engagement,” which is focused on whether the company has aligned its lobbying efforts (and those of its trade associations) with the Paris climate agreement goals.

All three investors recently showed their willingness to go beyond their public rhetoric and hold ExxonMobil accountable for its failure to respond to requests to report on how it plans to adjust its business model to reflect climate risks. BlackRock, Vanguard, and State Street Advisors joined with Engine Number 1, an activist shareholder, in the successful May 2021 shareholder vote to replace several ExxonMobil board directors:

The vote to replace members of Exxon’s board, also flagged, won support from many Climate Action 100+ signatories, including the California Public Employees Retirement System (CalPERS), the California State Teachers Retirement System (CalSTRS), Legal and General Investment Management (LGIM), and the New York State Common Retirement Fund, as well as big asset managers BlackRock, SSGA, and Vanguard, which each voted for at least two directors from the slate.

AEP’s continued fossil fuel investments

While BlackRock, Vanguard, and State Street Advisors appear to be turning a blind eye to AEP’s current lobbying tactics, they also seem to be ignoring AEP’s fossil fuel-centered business model.

Earlier this year, AEP released a new Climate Scenario Analysis in which the utility took issue with President Biden’s goal for the U.S. to reach 100% carbon pollution-free electricity by 2035. The CEPP now before Congress would represent a big step in that direction.

AEP’s analysis said:

AEP urges President Biden and his team to carefully evaluate what might be required for moving from an economy that is powered by greater than 60% fossil-based electricity to one that is 100% clean energy — and for doing so in only 15 years. We are concerned that the costs would be extremely high and that the new sources of power that would be needed simply cannot be developed and integrated in such a short period of time.

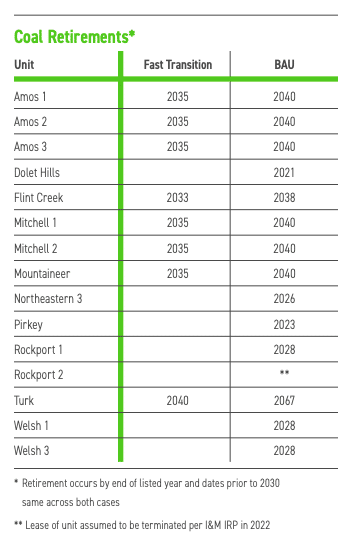

The analysis (see page 30) makes clear that AEP intends to keep much of its remaining coal generation online until 2040 or later under a “Business As Usual” scenario.

AEP also owns a 43 percent stake in the Ohio Valley Electric Corporation (OVEC), which operates two more coal-fired power plants in Ohio and Indiana. The utility’s Climate Scenario report fails to include both coal plants in the analysis. AEP and the other utilities that own stakes in OVEC are parties to an Inter-Company Power Agreement that will remain in effect in 2040. There are no plans to retire the OVEC plants before or after that date.Fossil fuels will still account for 39 percent of AEP’s generation fleet by 2030, and the utility also plans to invest in 2,226 MW of new gas by 2030.

Additionally, AEP is now proposing that its customers in West Virginia pay $448.3 million to keep the company’s John Amos, Mountaineer, and Mitchell coal-fired power plants operating until 2040. The proposed costs of keeping these outdated and uneconomic coal plants running increased for West Virginians after utility regulators in Kentucky and Virginia rejected AEP’s to pass some of the costs onto ratepayers in those states. The CEPP, however, could benefit AEP customers. “Most assessments of the Clean Electricity Payment Program conclude it will drive down consumer prices,” according to the MIT Technology Review. “That’s because it’s funded by the federal government, and utilities would be required to use the payments to benefit customers.”

Under the CEPP, AEP would be eligible to receive federal grant funding if the company increases the amount of clean electricity it provides to customers by 4 percent in a given year, between 2023 and 2030. Alternatively, if AEP fails to achieve the 4 percent annual target, it will be required to pay a fine, the cost of which would be borne by company shareholders, not ratepayers. AEP still burns a lot of coal and natural gas, but currently says it plans to increase renewables share of its generation fleet to 52 percent by 2030, or about 3.7 percent per year, just shy of the CEPP’s 4 percent target.The CEPP would also provide a tax credit to support existing nuclear plants, like AEP’s Donald C. Cook Plant.