Dominion Energy says data centers are “key industries” to the company but its South Carolina subsidiary may soon refuse them service

Dominion Energy South Carolina CEO Keller Kissam recently told lawmakers that he would be “fine” if the company did not pursue data centers as potential customers. But elsewhere within the company, Dominion sees data centers as one the largest growth areas for the utility.

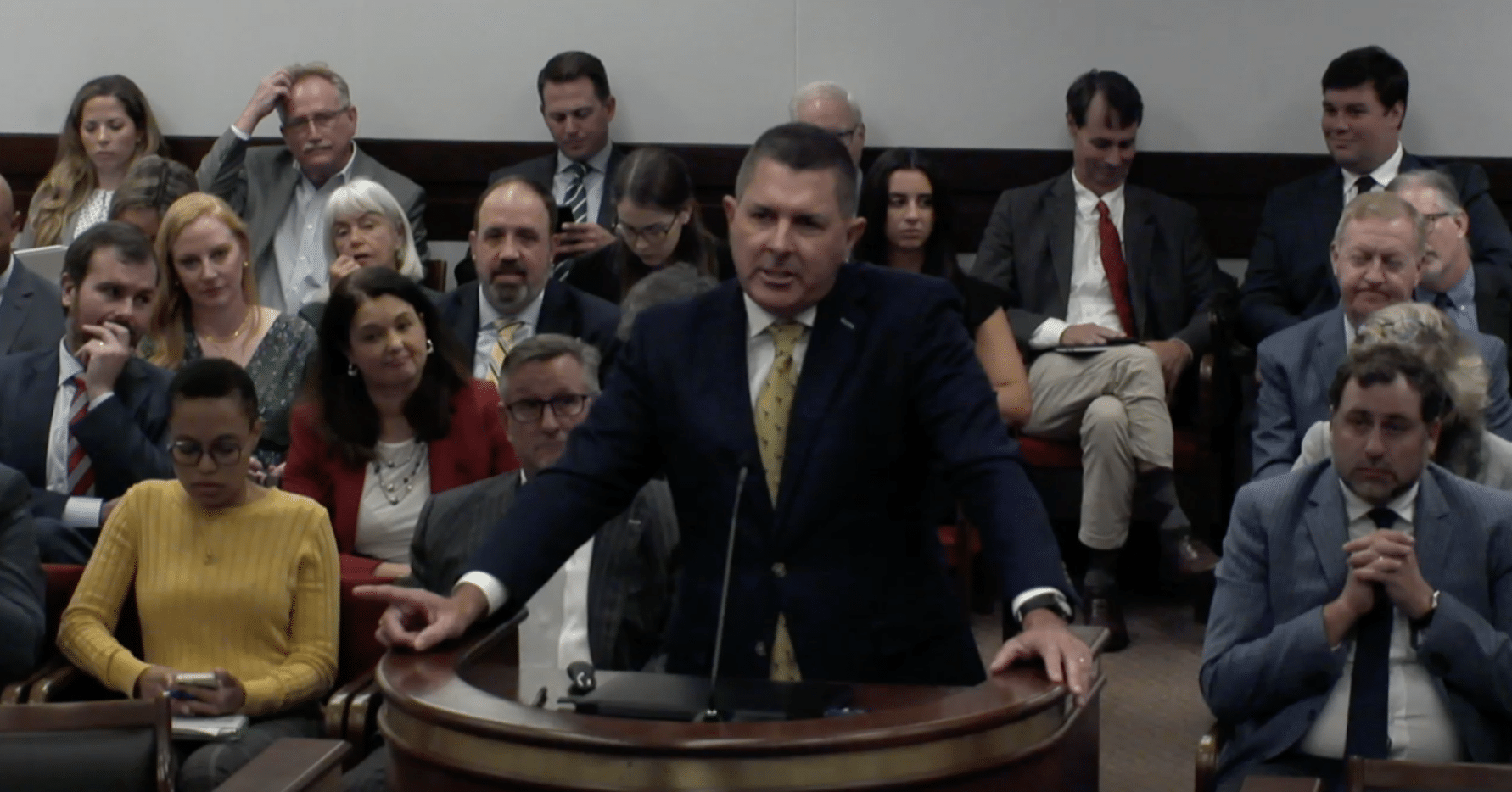

At an October 18 hearing with South Carolina lawmakers of the the Economic and Utility Modernization Ad Hoc Committee, Kissam said, “we’re no longer going to serve [a municipal customer] coming up” and that it would be “fine with me if we didn’t serve any of [data centers].” Kissam’s comments come as Dominion and other utilities face a new and growing demand for electricity from the effects of electrification, onshoring of manufacturing, and other U.S. federal policy.

Kissam’s statements contradict Dominion’s plans in Virginia, where the utility is projecting a 376% increase in energy demand from data centers by 2038, according to the 2023 Dominion Virginia IRP. Despite Kissam’s statements, utilities often have legal obligations to serve customers willing to pay reasonable terms for electricity as a condition of the state granting them a monopoly over their monopoly service territory. A public utility is generally prohibited from selecting which customers to serve.

At the same October hearing, Kissam said that data centers were a reason Dominion could no longer serve the municipal utility for the City of Orangeburg, which Dominion had supplied for 70 years, resulting in the city entering into a new contract with Duke Energy. Kissam blamed a “lack of capacity.” Federal filings show that Dominion lost almost 200 megawatts worth of business to Duke Energy.

Large data centers use massive quantities of electricity, and utilities, including Dominion, typically recruit them to their service territory; their presence can justify the construction of new power plants and infrastructure, increasing profits for shareholders.

Tensions have emerged, however, between some utilities and the technology companies building the largest data centers, because some tech companies have pressured utilities to provide them with clean energy. Google, for example, has a goal to “run on 24/7 carbon-free energy (CFE) on every grid where we operate by 2030.” Amazon and Microsoft have their own commitments to powering with renewable energy. In North Carolina, a Duke Energy-funded front group attacked Microsoft, Amazon, Google, and Twitter for promoting the formation of a wholesale electricity market, which they believed would speed up the transition to clean energy. Tech companies have routinely complained to state regulators that utilities are transitioning to clean energy too slowly.

If a utility is unable or unwilling to serve new large customers, or effectively plan for them through existing planning processes, economic development prospects in the state could be at risk. A spate of federal legislation has led to a surge of new manufacturing and resulting electricity load growth across the U.S. Large electric customers in the Carolinas, including technology companies, have called for the creation of a regional transmission organization (RTO), which could allow for many suppliers to compete for the business of new large customers. Power for Tomorrow, a utility-front group funded by Dominion, has attacked the concept of RTOs, despite Dominion’s Virginia subsidiary being a member of PJM, the RTO covering parts of the Mid-Atlantic and Midwest regions. One potential benefit of an RTO is to broaden the geographic region from which power can be supplied to customers.

Dominion’s varied stance on data centers, opposition to clean energy

Dominion’s business plan for serving data centers differs in Virginia, where Dominion is the largest electric provider. Virginia’s data center boom has reportedly led to a surge in investment, jobs, and tax revenue. “Data centers invested $6.8 billion in Virginia in 2021, supporting 45,460 jobs and paying out $3.6 billion in salaries, as well as $1 billion in tax revenues for local governments,” according to an article in Data Center Frontier.

Kissam’s comments in South Carolina could be representative of a conflicting stance within Dominion on serving data centers due, in part, to the clean energy goals of data center operators, and the different political landscapes of South Carolina and Virginia

On November 6, the South Carolina Public Service Commission approved Dominion’s new Integrated Resource Plan (IRP), which includes at least 150 MW of new gas plants, some in conjunction with Santee Cooper. In Virginia, Dominion has come under fire for its plans to build more gas plants, despite the Virginia Clean Economy Act, which calls for Dominion to use 100% clean sources to generate its electricity by 2045.

Dominion South Carolina struggled to keep the lights on

Last Winter, Dominion South Carolina experienced extreme winter conditions during Winter Storm Elliott, which led to rolling blackouts, raising further concerns over the utility’s management under Kissam’s leadership. Kissam admitted in the hearing that his utility, and the others in the state, failed. Kissam acknowledged in his remarks that many of the fossil fuel generation assets in Dominion South Carolina’s fleet went offline overnight due to the cold temperatures, surging demand, and gas shortages and a blackout ensued. While solar is a small portion of Dominion’s overall energy mix, the utility’s solar assets proved helpful during Elliot, coming back online in the morning and functioning in cold conditions while some fossil fuel assets were still offline. The generation mix of Dominion South Carolina remains similar, with thousands of customers remaining at risk for extreme weather outages again this winter.

Header image credit: Screen capture of Kissam presenting at the South Carolina Legislature’s October 18 meeting of the Economic and Utility Modernization Ad Hoc Committee