Alabama Commission President Misleads Legislative Review Committee about Alabama Power’s High Rate of Profit

Alabama’s top utility regulator, Twinkle Cavanaugh, falsely implied to a state legislative review committee late last month that the Alabama Public Service Commission had more than halved the amount of profit Alabama Power is allowed to collect from customers under her leadership. An Energy and Policy Institute (EPI) analysis shows Alabama Power’s profits have remained largely steady, at levels far higher than the rest of the utility industry in recent years, despite spiking utility prices leaving many customers unable to afford their monthly electricity bills.

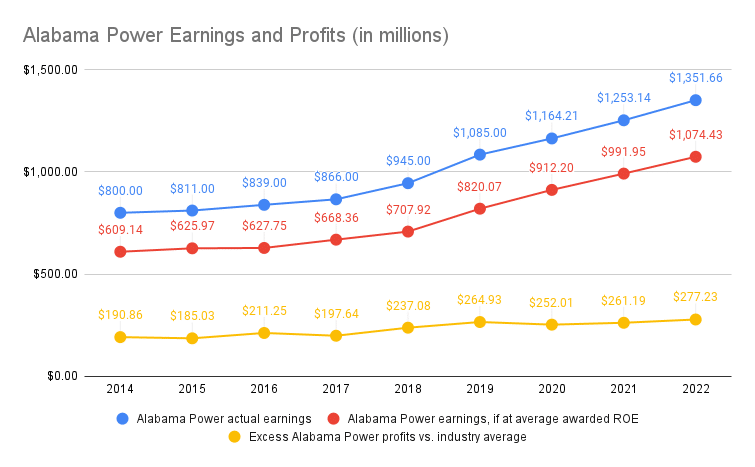

EPI’s analysis found that Alabama Power customers are paying more than $250 million per year in extra profits than they would be paying if Alabama Power earned a profit margin at allowed industry average rates, according to data published by the Edison Electric Institute, the trade association for investor-owned utilities.

Cavanaugh did not respond to a request for comment.

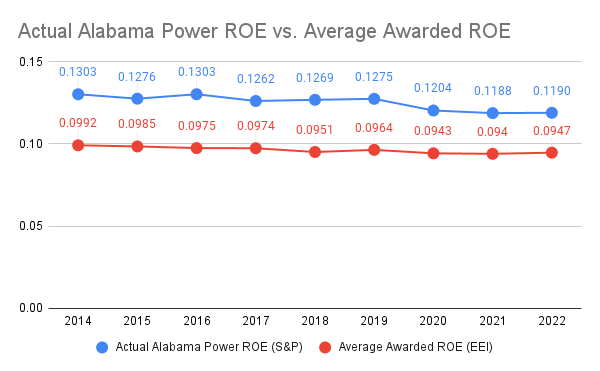

S&P Global, a financial analytics firm which tracks utility return on equity, found that Alabama Power’s ROE has remained stable during Cavanaugh’s tenure, hovering between 13% in 2014 and 11.9% in 2022.

Cavanaugh is President of the Alabama Public Service Commission (PSC), the state agency charged with regulating Alabama Power and ensuring that the company delivers adequate electric service at fair prices. In 2022, the Alabama Public Service Commission granted four rate increases to Alabama Power, adding almost $23 per month to the average residential bill, according to an investigation by the Opelika-Auburn News and the Dothan Eagle. Dominion Energy, a peer investor-owned utility based in Virginia, told its regulators that Alabama Power’s 2018-2022 average return on equity of 12.76%, a measure of a utility’s profitability, was a “high-end” outlier and 38% higher than its neighbor and sister company Georgia Power.

Figure 1. Testimony by Dominion Energy to Virginia regulators on average return on common equity 2018-2022

Cavanaugh’s profit margin claims fraught with error

Cavanaugh told a meeting of the Alabama Joint Interim Sunset Committee that Alabama Power’s return on equity (ROE) “went from 13 to 14 and a half percent allowable return when I got here. Today it is 5.65 to 6.05%, a very big difference.”

But Alabama Power’s ROE has remained between 12-13 percent from 2013-2022, despite Cavanaugh’s claims. Under Cavanaugh’s leadership in 2013, the PSC changed how it calculated the company’s return – but that change did nothing to actually reduce the return Alabama Power could collect from customers.

The modified calculation, known as the “Weighted Retail Return on Common Equity” or WRRCE, has never been used by any other Commission in the country, despite Cavanaugh’s prediction at the time that other states would adopt Alabama’s approach. The WRRCE allowed the PSC to dismiss concerns of Alabama Power’s excess profit by citing a much lower number, while not changing the underlying issue of excessive earnings.

In June 2020, the PSC released a review of WRRCE and claimed that the new metric was “fair and reasonable” and “no revisions” were needed, despite also finding that Alabama Power’s “return on invested capital has remained relatively flat since 2013″ and that the utility’s return was “in the first quartile” of similar utilities. The filing in docket 18117 was made more than eight months after a review meeting between the PSC staff, the Alabama Attorney General’s office and Alabama Power occurred.

Former Republican Commissioner Terry Dunn, who served on the Commission from 2011 – 2015, called the initial WRRCE informal hearings “just a dog and pony show. It was all staged. The people that you saw get up, they were reading off the same script.” Dunn later lost his re-election bid after being attacked by media outlets, such as Yellowhammer News and Alabama Political Reporter, that were paid by Matrix LLC, a consulting firm that contracted with Alabama Power. Dunn told NPR and Floodlight in 2022 that a top Alabama Power lobbyist had told him after he won his 2010 election that if he would be a “team player,” he could keep his $100,000 per year job on the Commission for many years.

| Year | Alabama Power ROE (S&P) | Earnings (in millions) | Average Awarded ROE per EEI | Earnings at Average Awarded ROE (in millions) | Excess Profit (in millions) |

| 2014 | 13.03% | $800.00 | 9.92% | $609.14 | $190.86 |

| 2015 | 12.76% | $811.00 | 9.85% | $625.97 | $185.03 |

| 2016 | 13.03% | $839.00 | 9.75% | $627.75 | $211.25 |

| 2017 | 12.62% | $866.00 | 9.74% | $668.36 | $197.64 |

| 2018 | 12.69% | $945.00 | 9.51% | $707.92 | $237.08 |

| 2019 | 12.75% | $1,085.00 | 9.64% | $820.07 | $264.93 |

| 2020 | 12.04% | $1,164.21 | 9.43% | $912.20 | $252.01 |

| 2021 | 11.88% | $1,253.14 | 9.4% | $991.95 | $261.19 |

| 2022 | 11.9% | $1,351.66 | 9.47% | $1,074.43 | $277.23 |

| Totals | $9,115.01 | $7,037.80 | $2,077.21 |

Table 1. Return on Equity, Earnings, and Excess Profit Above Average by Alabama Power 2014-2022.

Figure 2.

Figure 3.

Table 1, Figures 2 and 3 data notes: Alabama Power ROE data from S&P Global, average awarded ROE data from the Edison Electric Institute, values may not match exactly due to rounding

Cavanaugh, Commission shirk responsibility for fuel costs

Cavanaugh misleadingly told the Sunset Committee that the Commission was not responsible for high fuel costs, and she did not discuss what the Commission could do to combat volatile gas prices that have driven up the cost of Alabama Power’s electricity.

“They [Alabama Power] by law are allowed to recover the cost they pay on fuel” and that recent utility bill spikes are “totally due to fuel cost.” But Cavanaugh and the Alabama Public Service Commission are responsible for making the decisions about which power plants and fuels Alabama Power can build and use. The Commission has applauded what it called Alabama Power’s “ongoing reliance […] on natural gas” in 2020.

Commissions around the country have tools to help keep volatile gas prices from burdening consumers, according to a 2023 report from RMI, a nonprofit clean energy research and analysis firm. Under current practice, utility companies like Alabama Power are not affected if fuel prices are high or low because all burdens are passed to customers. But risk-sharing proposals could reward utilities for keeping fuel prices manageable and penalize them when fuel prices spike. Other states have adopted measures to limit fuel cost risk to customers, including Wyoming and Missouri.

Cavanaugh also told the legislative review committee that the Commission believed in and had “approved” an “all of the above approach” to energy production, but the Commission voted unanimously to deny 400 megawatts of solar and battery storage projects in 2020, despite being the least costly options proposed by Alabama Power to meet electricity demand. The Commission cited in their denial Alabama Power’s “lack of operational experience.”