FirstEnergy dark money payments included over $550,000 for ‘consumers’ group’s campaign against Cleveland Public Power

This post is part one of a two-part blog series. Part one reveals FirstEnergy’s secret role in funding Consumers Against Deceptive Fees, based on subpoenaed bank records. Part two looks at how the group used FirstEnergy’s money to pay a network of lawyers and lobbyists who campaigned against Cleveland Public Power.

FirstEnergy secretly paid over $550,000 to fund a front group called “Consumers Against Deceptive Fees” and its campaign against Cleveland Public Power, according to previously unreported bank records subpoenaed by the Cleveland City Council.

In mailings sent to Cleveland residents in 2019, Consumers Against Deceptive Fees (CADF) purported to be a statewide Ohio organization that “works tirelessly to make sure utility bills are consistent, reasonable and fair to utility customers.” Behind the scenes, CADF received all but less than $10,000 of its funding from FirstEnergy, an investor-owned utility that was later caught paying bribes for legislation that secured ratepayer-funded bailouts for the company in a criminal scheme that played out between 2017 and 2020.

FirstEnergy owns the Cleveland Electric Illuminating Company (CEI), which competes for customers with Cleveland Public Power (CPP), a publicly owned not-for-profit utility. CPP customers traditionally benefited from lower electricity bills than those paid by CEI customers, but in recent years that advantage disappeared as CPP’s bills rose.

FirstEnergy seized the opportunity to attack its competitor. CADF used FirstEnergy’s money to campaign against CPP’s rates and billing practices. City officials acknowledged CPP had serious problems, but suspected CADF was part of a long-running campaign by FirstEnergy and CEI to undermine CPP and expand FirstEnergy’s monopoly control over utility customers.

CADF, which was formed in 2018 and dissolved in 2020, registered with the IRS as a tax-exempt 501(c)(4) social welfare organization. The group was not legally required to publicly disclose its donors.

In August 2020, the Cleveland City Council launched an investigation into FirstEnergy’s secret use of dark money groups to influence energy policy in Cleveland and Ohio. The move came shortly after the arrest of then-Ohio House Speaker Larry Householder. Householder was convicted earlier this year in a racketeering case involving $60 million in bribes paid by FirstEnergy in exchange for ratepayer-funded bailouts included in Ohio’s House Bill 6. A network of 501(c)(4) groups with names like Generation Now and Partners for Progress helped to conceal the money from FirstEnergy that enabled the scheme.

H.B. 6 included a now-repealed $1.3 billion ratepayer bailout for nuclear and coal plants then owned by a bankrupt FirstEnergy subsidiary. The 2019 Ohio law also included another now-repealed provision that guaranteed FirstEnergy’s Ohio utilities hundreds of millions of dollars in unearned revenue at ratepayers’ expense. Other parts of the bribery-tainted 2019 Ohio law still remain in effect today, including a rollback of state renewable energy and energy efficiency standards for electric utilities that was long sought by FirstEnergy, and a coal plant bailout benefiting other utilities like AEP, AES and Duke Energy.

The Energy and Policy Institute filed a public records request and obtained copies of CADF’s subpoenaed bank records and other documents from the City Council’s investigation. Records from the City Council’s CADF investigation are now available for the public to view for the first time on DocumentCloud. Included in the DocumentCloud collection are copies of emails between members of the City Council and CADF’s political consultants, also obtained through a public records request.

The emails include copies of draft legislation that CADF distributed to some City Council members which included “poison pills” that threatened CPP’s revenue at a time when the public utility’s financial situation was already tenuous, the City Council’s investigation determined.

In early 2021, Cleveland’s Mayor Frank Jackson said the city was considering a lawsuit against FirstEnergy over the utility company’s attacks on CPP. The lawsuit never materialized and Jackson soon announced he would not seek re-election. The Cleveland investigation fizzled out after City Council President Kevin Kelley, who led the probe, ran for mayor that year and lost.

The subpoenaed records from CADF have sat in the city’s files since then, unseen by the public until now.

A spokesperson for FirstEnergy did not respond to a request for comment on the company’s funding of CADF, and whether FirstEnergy’s utilities charged ratepayers for any payments to the group and its consultants.

FirstEnergy was the secret source of all the revenue that Consumers Against Deceptive Fees reported to the IRS

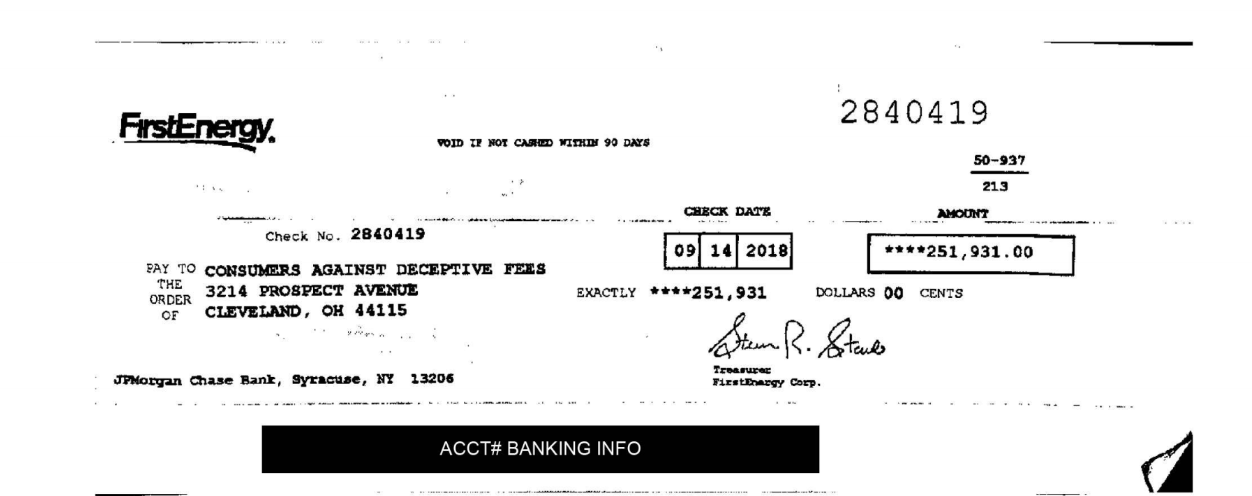

FirstEnergy paid a total of $551,931 to CADF in 2018 and 2019, according to bank records the City Council obtained via subpoena.

CADF deposited two checks from FirstEnergy for $100,000 and $251,931 in May and September of 2018. CADF later reported $351,931 in total revenue on its annual Form 990 report to the IRS for 2018.

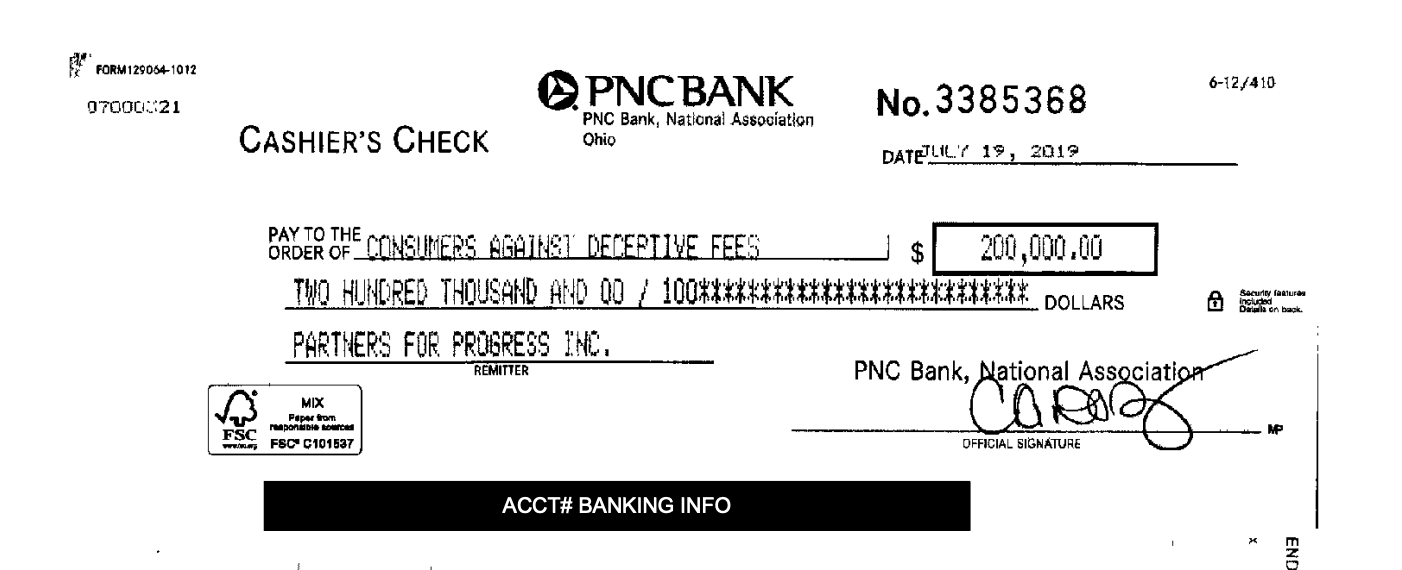

In 2019, CADF received a cashier’s check for $200,000 from Partners for Progress, a 501(c)(4) that FirstEnergy admitted to having funded and controlled as part of an agreement with federal prosecutors. CADF reported exactly $200,000 in total revenue to the IRS for 2019.

Partners for Progress disclosed its $200,000 payment to CADF on its own IRS Form 990 for 2019, as Cincinnati.com first reported in 2020. The over $350,000 FirstEnergy paid to CADF through corporate checks in 2018 remained secret until now.

FirstEnergy also admitted that it used Partners for Progress to help conceal approximately $15 million in payments to Householder’s 501(c)(4) Generation Now, which itself pleaded guilty to racketeering in 2021. FirstEnergy agreed to pay a $230 million legal penalty and cooperate with the federal investigation to avoid prosecution on a federal criminal charge.

All told, Partners for Progress received approximately $25 million from FirstEnergy and also paid hundreds of thousands of dollars to other 501(c)(4)s that have not been charged in the federal criminal investigation, including CADF.

The City Council obtained records related to the $200,000 payment to CADF from Partners for Progress’ bank, PNC Bank. The PNC Bank records show that Michael VanBuren, Partners for Progress’ treasurer and an attorney at the law firm Calfee Halter & Griswold, withdrew $200,000 from the PNC Bank on July 19, 2019. The Partners for Progress cashier’s check to CADF was dated on the same day and signed by a bank official, so VanBuren’s name did not appear on the payment deposited by CADF.

FirstEnergy lobbyists Michael Dowling and Joel Bailey received emails from VanBuren with “legal advice” about a “potential” Partners for Progress donation to CADF a few days before the cashier’s check was written, according to a privilege log Partners for Progress filed earlier this year in a class action shareholders lawsuit against FirstEnergy.

Dowling and Bailey were later terminated by FirstEnergy amidst the fallout from the federal criminal investigation. Both lobbyists were named in an exhibit listing “people involved in the investigation” that prosecutors displayed at Householder’s trial during testimony by the lead FBI agent on the case. Dowling and Bailey have not been charged, but lawyers for Dowling say their client faces a potential indictment.

VanBuren and an attorney for Dowling did not respond to requests for comment; EPI could not reach Bailey.

The only other money raised by Consumers Against Deceptive Fees was used to pay the political consultant who filed the group’s articles of incorporation

CADF deposited two smaller checks totaling $9,177.83 from the law firm Roetzel & Andress and Vandercar Holdings on March 10, 2018, prior to receiving its first check from FirstEnergy that May.

CADF wrote a check to Jamie Kincaid, a political consultant based in Cincinnati, that same day for exactly $9,177.83. Kincaid had filed CADF’s articles of incorporation with the Ohio Secretary of State earlier in 2018.

CADF reported $351,931 in total revenue to the IRS in 2018, but the group’s actual revenue was over $360,000 when those two smaller checks are added to the $351,931 it received from FirstEnergy that year.

Vandercar Holdings, also known as Life Notes, LLC, is incorporated in Kentucky, and its principal office is located in Cincinnati. The LLC’s articles of incorporation listed Joseph Robert Smyjunas, a Cincinnati-area developer, as its organizer. Mary Ruth Smyjunas is currently listed as the company’s manager. The signature of “M. Smyjunas” appeared on Vandercar Holdings’ check to CADF.

Roetzel & Andress and its lobbying arm Roetzel Consulting Services would go on to play a central role in CADF’s management and operations and were paid $245,000 of the money CADF received from FirstEnergy.

Roetzel was also paid by FirstEnergy to help secure the ratepayer-funded nuclear plant bailout included in H.B. 6. Roetzel lobbyist Matthew Borges, a former chairman of the Ohio Republican Party, was convicted alongside Householder for his role in the H.B. 6 scheme, as detailed in part two of this blog series.

Top photo from Flickr by Eric Dost captures the recent removal of FirstEnergy’s bribery-tainted name from the Cleveland Browns stadium. Attribution 2.0 Generic (CC BY 2.0)