Southern Company’s Kemper Scandal and Why Carbon Capture and Storage (CCS) Will Never Work

Southern Company officials misled state regulators and the Federal government to obtain financial incentives for the Kemper plant, according to an in-depth investigation by Ian Urbina in The New York Times last week.

Documents and recordings reviewed by the NYT from a whistleblower detail mismanagement of the project by Southern Company and its subsidiary, Mississippi Power. Those records and interviews with “more than 30 current or former regulators, contractors, consultants or engineers who worked on the project, show that the plant’s owners drastically understated the project’s cost and timetable, and repeatedly tried to conceal problems as they emerged.”

The plant was originally slated to cost $2.4 billion for the 582 MW of power production from gasified coal. The gasification process enables the plant to separate the carbon dioxide, which can then be buried underground. Now two years behind schedule, the carbon capture part of the plant is still not online and the price tag is currently over $6.7 billion. The question remains who will pick up the tab for more than $4 billion in cost overruns for construction of the plant.

This scandal illustrates that investments in CCS technology and “clean coal” have wasted billions of dollars, remain too expensive, and are not viable options to decarbonize our electricity sector.

Engineering False Timelines and Kemper Target of SEC Investigation

Urbina uncovered that “[Southern Company] and regulators were eager to qualify for hundreds of millions of dollars in federal subsidies for the plant, which was also aggressively promoted by Haley Barbour, who was Southern’s chief lobbyist before becoming the governor of Mississippi. Once in office, Mr. Barbour signed a law in 2008 that allowed much of the cost of building any new power plants to be passed on to ratepayers before they are built.”(For more on how the Southern Company used “Construction Work In Progress”, a legislative initiative backed by Southern-Company-lobbyist-turned-Governor Haley Barbour, read Matt Kasper’s post at Energy and Policy Institute’s site)

Compounding Southern Company’s issues, the Securities and Exchange Commission announced in May that the agency was launching an investigation into Southern Company and the Kemper plant “… concerning the estimated costs and expected in-service date of the Kemper IGCC.”

The SEC investigation should worry investors in Southern Company because the company could be responsible for millions in subsidies from the Federal government and cost overruns from building the plant. An editorial in The Clarion-Ledger reiterates that management at the company was warned about the lagging timeline:

In February 2014, with the plant already way behind schedule, engineers at the plant told upper-level managers that the company should not promise to government regulators and private investors that the project would be done before the end of that year. The company did so anyway, publishing a schedule it knew to be false.

Urbina’s investigation revealed additional details about the company’s engineering timeline and warnings from Greg Zoll, the state’s independent monitor for the project:

While engineering expenses and purchases went up, reported construction costs went down and scheduling timelines were shortened.

‘These trends are illogical,’ he wrote in of one of a series of highly critical reports that he filed with regulators from 2012 to 2014. Documents show that in a rush to qualify for federal subsidies, Mississippi Power started construction with less than 15 percent of the plant designed, Mr. Zoll told regulators.

Beyond Kemper: Why CCS Will Never Work

The coal industry, with help from major coal-burning utility companies, has misled politicians, regulators, and the public for years asserting that CCS is the only significant technological “solution” to curbing emissions from the power sector.

Despite billions of dollars that have been spent to advance the technology, at least 33 power plant CCS projects have been scrapped or mothballed in the past five years. Unfortunately, these failures have not stopped coal and utility corporations from working to access more handouts from the government, as seen in the scandal surrounding Kemper.

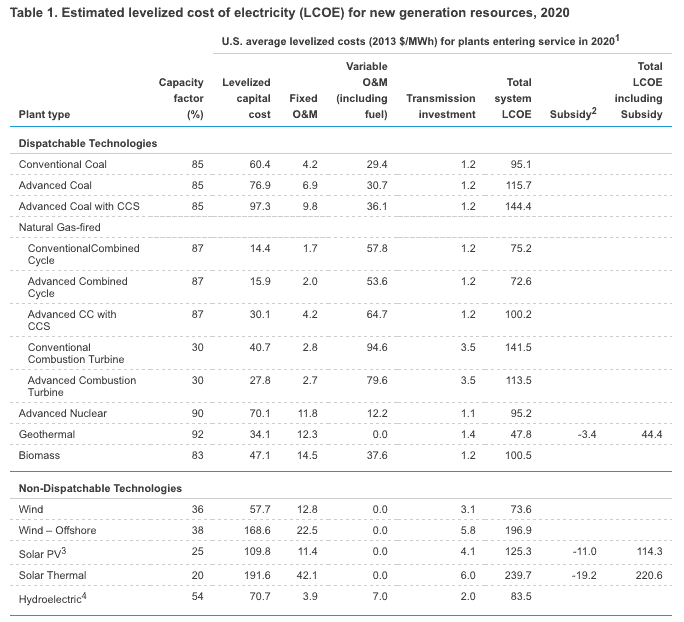

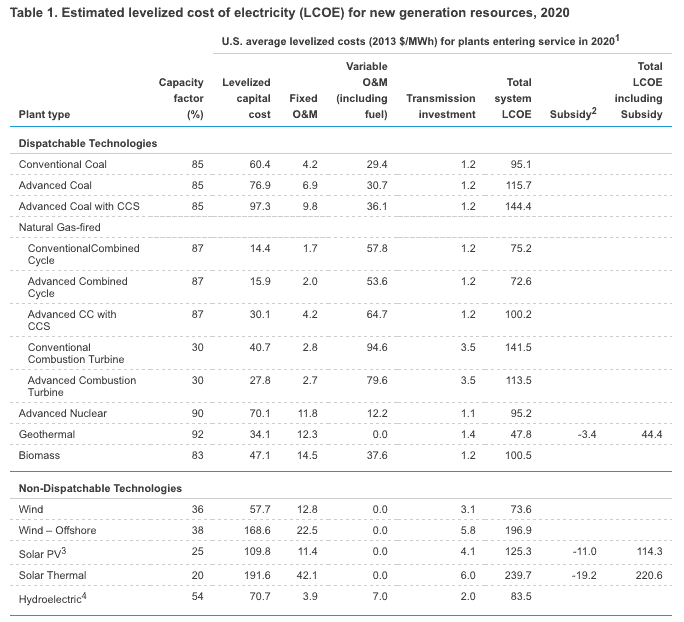

In reality, wind and solar are more effective investments to produce carbon-free electricity in the 21st century. The United States Energy Information Administration (EIA) released an estimated levelized cost of electricity for new power plants entering service in 2020. The EIA concluded that the total system levelized cost of electricity for a coal power plant with CCS will be $144.40 per megawatt hour. Onshore wind and solar photovoltaic, on the other hand, are estimated at $73.60 and $125.30 per megawatt hour, respectively. And, a report from Greenpeace USA compared the cost of avoiding a kilogram of CO2 emissions per unit of electricity (kilowatt hour) and concluded that CCS would cost almost 40% more per kilogram of avoided CO2 than solar photovoltaic, 125% more than wind, and 260% more than geothermal. Compounding this price issue is the cost of thousands of miles of pipelines that would be needed to transport CO2 to viable storage locations.

In reality, wind and solar are more effective investments to produce carbon-free electricity in the 21st century. The United States Energy Information Administration (EIA) released an estimated levelized cost of electricity for new power plants entering service in 2020. The EIA concluded that the total system levelized cost of electricity for a coal power plant with CCS will be $144.40 per megawatt hour. Onshore wind and solar photovoltaic, on the other hand, are estimated at $73.60 and $125.30 per megawatt hour, respectively. And, a report from Greenpeace USA compared the cost of avoiding a kilogram of CO2 emissions per unit of electricity (kilowatt hour) and concluded that CCS would cost almost 40% more per kilogram of avoided CO2 than solar photovoltaic, 125% more than wind, and 260% more than geothermal. Compounding this price issue is the cost of thousands of miles of pipelines that would be needed to transport CO2 to viable storage locations.

Plus, the amount of CO2 that would need to be captured and then stored is gigantic, and the energy it takes to compress, transport, and ultimately store CO2 makes these power plants uncompetitive. At least 20% and perhaps more than 80% of the power generated by the CCS plant will need to be used to capture and store the CO2. A December 2015 study by the University of Michigan found that both costs and the “energy penalty” are underestimated for CCS plants due to feedback loops not accounted for other CCS studies. When feedback loops for CCS are included, a CCS plant’s overall thermal efficiency (the total amount of heat from the coal that’s used to produce electricity) is reduced from 26% to 16%. In other words, for a “clean coal” plant, 84% of the energy produced is used to capture and store the carbon dioxide.

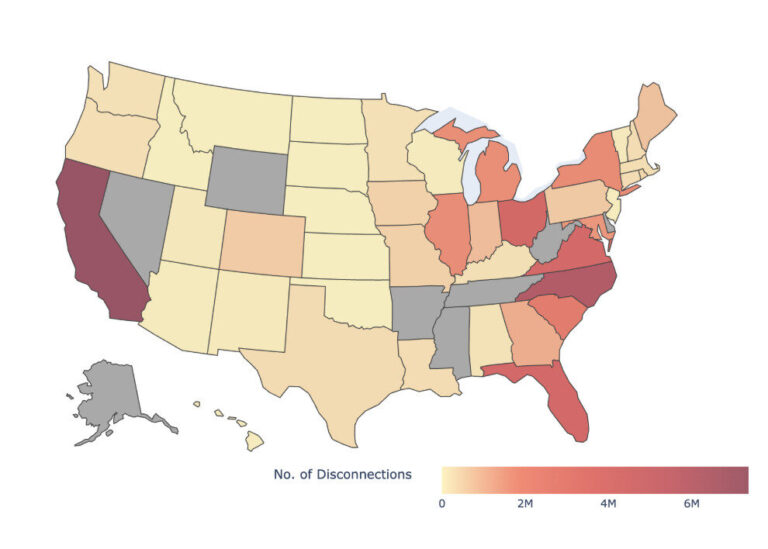

Finally, captured CO2 will need to be stored safely for decades and guaranteed that it will not leak. To date, there have been multiple CO2 blow-outs and leaks from storage areas and pipelines in Louisiana, Colorado, New Mexico, Wyoming, Idaho, Texas, and Mississippi. Several of these involved evacuations of oil workers, first responders, and residents. Residents had to be moved to safety after a 2007 blow-out in Amite County, Mississippi, which cost over $3 million to fix. A 37-day blow-out in 2011 at Tinsley Field in Mississippi sent one oil worker to the hospital after being overcome by the gas, and killed deer, armadillos, blue heron and other wildlife. Southern Company’s Kemper plant had a contract with Treetop Midstream Services, a company that planned to inject Kemper’s CO2 underground for enhanced oil recovery (the same process used at Tinsley Field). Treetop is now suing Southern Company for “…misrepresenting and concealing the start date for the facility and forcing Treetop to unnecessarily spend nearly $100 million on a pipeline and other equipment…” The Tinsley incident cost $53 million dollars and required an enormous number of personnel from several specialized companies. What company will be responsible for monitoring and guaranteeing no leakage of the CO2 for 100 years?

We’re in a new era, and it is time to put “clean coal” dreams to bed. Obama’s announcement that coal leases on public lands will end is one more blow to a coal industry reeling from drops of over 90% in stock values and multiple bankruptcies in the past few years.

We simply can’t change the laws of physics and those physical laws mean that CCS is too expensive and energy-intensive. We’ve already thrown away billions trying to make CCS work. Now that we have cost-competitive clean technology, we should stop investing in failed clean coal technologies and invest in 21st century energy technologies like wind, solar, energy efficiency, and battery storage.