Southern Company’s Big Bets Lead to Loss of Gulf Power

On May 21st, Southern Company decided to part ways with its almost 100- year-old subsidiary, Gulf Power, due in large part to failed bets the company made on its scuttled Kemper coal plant and budget-busting Vogtle nuclear plant.

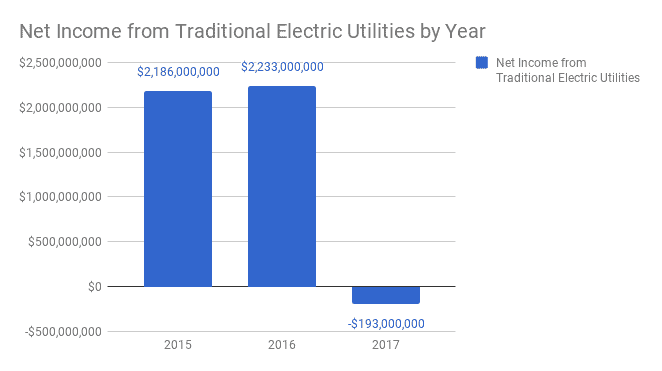

The loss of Gulf Power comes on the heels of Southern Company’s meek 2017 financial performance. Southern’s “traditional electric operating companies” lost $193 million last year. And the possibility of further adverse financial news continues to hover over Southern amidst continued uncertainty over Vogtle’s financial viability.

Southern’s sacrifice of Gulf almost certainly was not done lightly. Dating to the era when Southern was forced to cede territory to the federally-created and owned Tennessee Valley Authority in the 1930s, the company has always fought bitterly against any perceived encroachment. Southern has never willingly given up a crown jewel, and Gulf Power has been a reliable anchor asset in an important corner of the Florida market for almost 100 years.

So, while Southern Company publicly claims NextEra’s $6.5 billion purchase of Gulf is the best deal for customers and investors – an awkward admission, given its tacit acknowledgement that Gulf Power’s customers are better off without Southern – Southern’s financials tell a very different, troubling story.

Big Bets and High Debts

Southern Company was built on “Big Bets” – a phrase that its CEO, Thomas Fanning, enjoys using, and the title of a book that serves as the company’s autobiography. Most of those bets paid off, helped in no small part by the sophisticated political machine that Southern built to guarantee pliant regulators – and legislators – throughout four states. Southern’s luck though, may be running out.

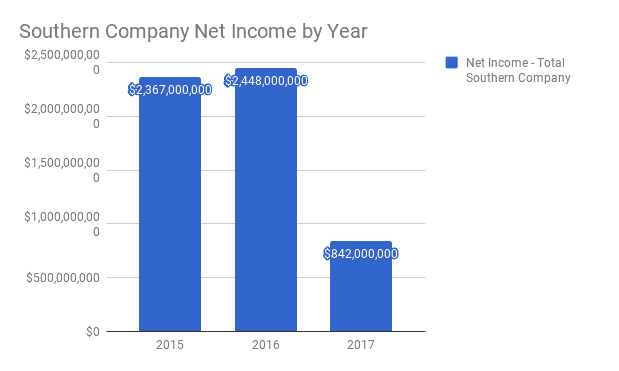

In its 2017 annual 10-K filing with the Securities and Exchange Commission (SEC), Southern Company claimed a net income of $842 million, down from more than $2 billion in each of the previous two years.

The company’s poor 2017 financial performance boils down to two factors that have to unnerve investors: troubled investments and grid defection.

Southern Company’s attempt to build an Integrated Gas Combined Cycle power station in Kemper County, Mississippi turned into a budget buster. Southern originally estimated that Kemper would cost $2.3 billion, but the price tag rose to $7.5 billion. Mississippi Power has already written off $6.4 billion in losses, according to Mississippi Public Service Commissioner Cecil Brown.

In Georgia, Southern now estimates that Plant Vogtle’s expansion will cost $25 billion at a time when the survival of nuclear power plants across the country is threatened by the poor economics of using nuclear reactors to generate electricity.

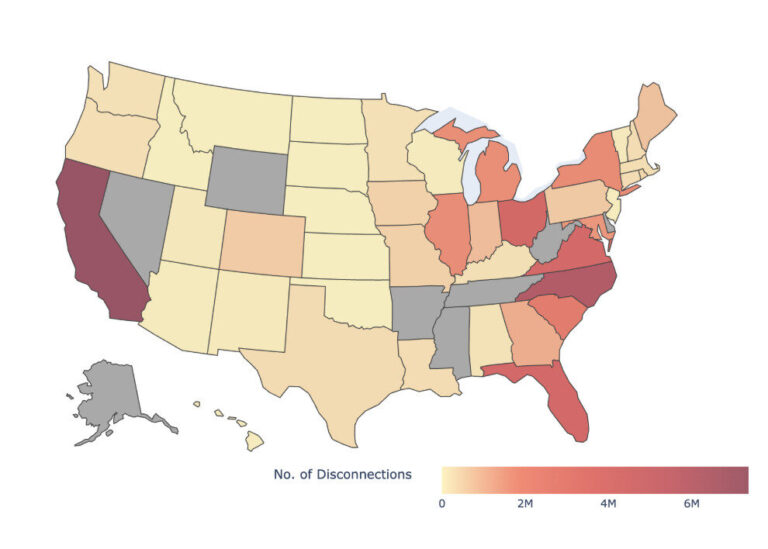

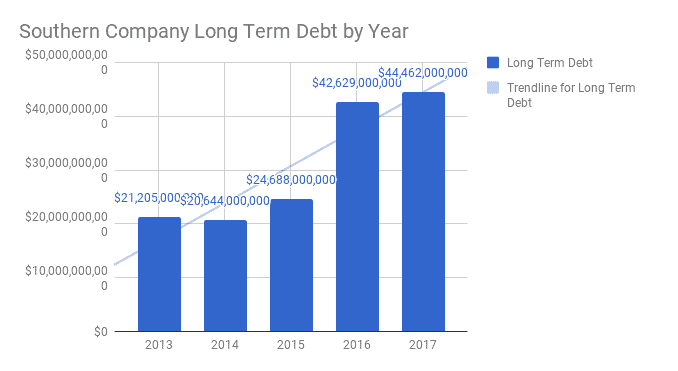

As a result of multi-billion-dollar bad bets on Kemper and Vogtle, Southern’s traditional electric operating companies (Mississippi Power, Alabama Power, Georgia Power, Gulf Power) have been fighting for their lives. In 2017, their net income crashed. Meanwhile, Southern Company’s long-term debt has doubled to $44.462 billion in less than 3 years.

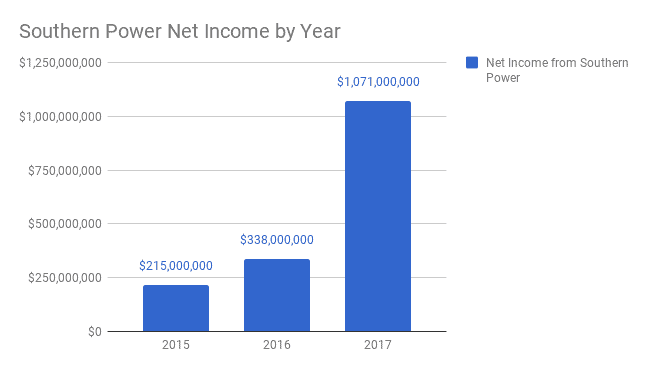

However, Southern Power, the unregulated subsidiary largely responsible for wind and solar development, earned Southern Company $1.071 billion in net income in 2017. Southern Company would have posted a loss of $229 million without Southern Power’s renewable energy portfolio. Irony abounds, as Southern’s regulated assets continue to fight off renewable growth: Gulf Power spent more than $2 million supporting a deceptive ballot initiative designed to hinder solar growth in Florida in 2016. The next year, Southern Company relied on renewable energy to avoid losing money.

Southern Company’s financial bind has forced it to sell one-third of its solar assets, one of the company’s few profit centers, for $1.2 billion.

Larger Systemic Problems

Southern Company’s long-term health is threatened by more than short-sighted big bets on coal and nuclear power. Customers are using less electricity, creating real doubt as to how much more cash can be extracted from Southern’s traditional electric operating companies.

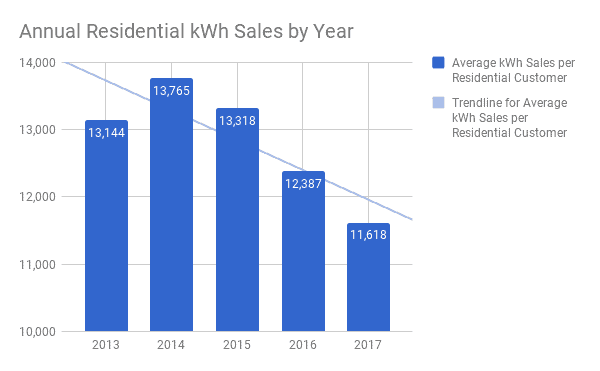

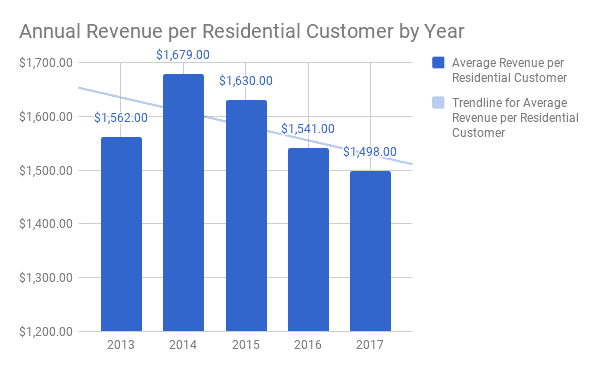

In 2017, residential customers bought 11.6% less electricity from Southern Company than they did in 2013. Annual residential revenue declined per customer 5% from $1,562 in 2013 to $1,498 in 2017. Southern’s political capture of regulators may help to blunt those losses in the short-term; revenue decline per residential customer dropped less than consumption as Southern subsidiaries like Alabama Power pilot complicated rate structures that charge customers fixed fees as high as $60 per month, regardless of how much energy they use. In 2017, Gulf Power tried to jam through a monthly fixed fee increase from $18.60 to $47.40, ultimately settling for a modest $1 per month increase.

Still, utilities are likely unable to stem the tide of customer preference for energy efficiency and renewable energy forever. Businesses are buying renewable energy at a record rate through initiatives like Rocky Mountain Institute’s Business Renewable Center. And companies are reaping both reputational and economic benefits by publicizing their use of renewable energy and conservation in their corporate fleets, manufacturing plants, offices and residential developments. All of which involve smaller, cheaper, and wiser bets than Southern’s mammoth infrastructure projects Kemper and Vogtle. No matter the spin, Southern’s fire sale of two critical assets – all in one week – tells a story of a company aware that if Vogtle goes the way of the cancelled Kemper, the consequences for the entire Southern family of companies could be dire.

And that’s a story that makes Southern Company’s big bets on coal and nuclear power look very bad indeed.