Despite record solar+storage deal, TEP still plans more gas, underwhelming solar growth

Although Tucson Electric Power (TEP) pushes a pro-solar image, TEP’s energy mix is very heavy on fossil fuels. Tucson is awash in sunshine, but TEP’s future plans indicate that it will continue running very old coal plants, and increasing its use of natural gas far more than solar. TEP’s nearly 2,700 MW of owned generation at the end of 2016 included ~1,400 MW of coal, ~1,200 MW of natural gas or oil power plants, and only 46 MW of owned solar.

In May 2017, TEP signed a 20-year power purchase agreement for solar-plus-storage at all-in costs less than 4.5 cents/kWh. While the exact price is confidential, the solar portion (100 MW) is pegged at below 3 cents/kWh. The 30 MW, 120 MWh energy storage and solar array will be developed by an affiliate of NextEra Energy, which will use the 30% Investment Tax Credit.

Although the solar-plus-storage would help shave peak energy usage, TEP’s long-term plans indicate that it still sees gas as a more important part of its resource mix than solar and storage.

In 2017, TEP Generated 80% of Its Electricity from Coal and Gas, and Only ~11% from Solar

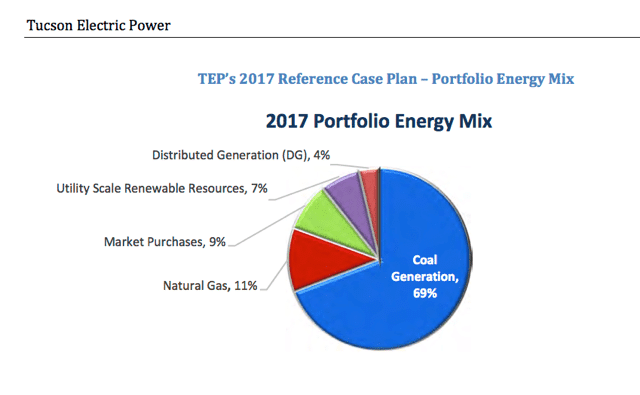

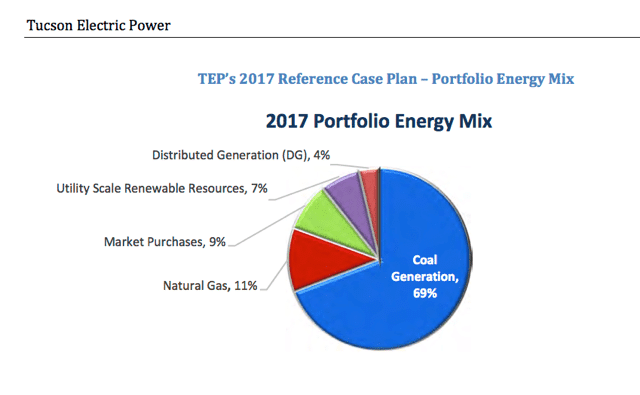

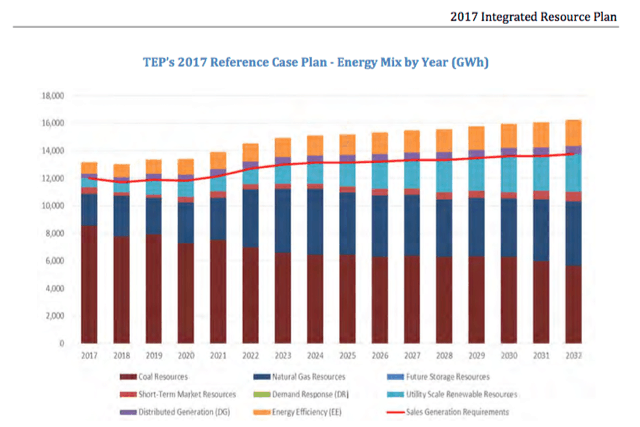

TEP’s 2017 Integrated Resource Plan (IRP) filed with the Arizona Corporation Commission in April, describes its current energy mix, and projects future needs over the next fifteen years. While not binding, the IRP describes when and what types of new generation TEP expects to add between 2017 and 2032.

Surprisingly, TEP’s 2017 energy mix is 69% coal and 11% gas, with utility-scale solar power at 7%, and distributed solar at only 4%. (While purchased power is 9% of TEP’s total energy mix in 2017, it’s unclear how much is clean energy versus coal or natural gas.)

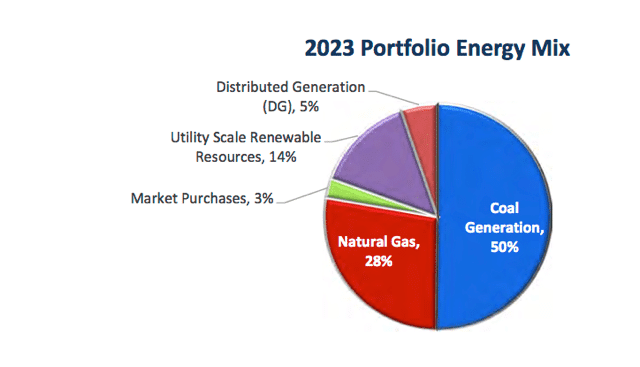

TEP’s Energy Mix in 2023: 78% Fossil, and 19% Renewables

TEP’s planned energy mix in 2023 — six years from now — isn’t much better, with coal at 50% of total generation, and natural gas leaping from its current 11% to 28%, so that TEP’s overall coal-plus-natural-gas mix remains at 78%.

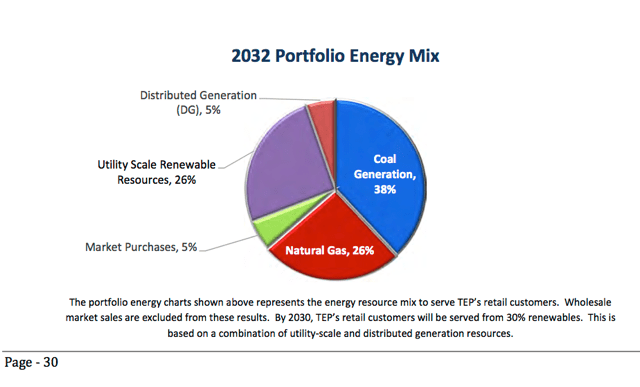

TEP’s Energy Mix in 2032: 64% Fossil, 31% Renewables

TEP’s energy mix in 2032 has renewables at 31%, and fossil generation at 64%. However, this is too little, too late, considering that the current cost of solar PV in the sunny southwest is 4-5 cents/kWh. Both New York and California have goals of 50% clean energy by 2030, and neighboring Nevada is currently over 20% clean energy, with a bill working its way through in the Nevada legislature to increase its target to 50% renewable energy by 2030, with a further goal of 80% by 2040.

TEP’s 2017 IRP reports that the Levelized Cost of Electricity (LCOE) for single-axis-tracking solar PV is 4.4 cents/kWh, with fixed tilt solar PV at 5.1 cents/kWh. Natural gas combined cycle (NGCC) power is more expensive than both, ranging from 6.5 to 7.7 cents/kWh, and natural gas combustion turbines (NGCT) ranges from 15.7 to 19.2 cents/kWh.

And while the current cost of natural gas is very low, future cost and availability are estimates. Future LCOEs for natural gas power plants are highly dependent on the cost of natural gas, and TEP’s natural gas costs have ranged from $3.14/MMBtu (million British thermal units) in 2016 to $5.17/MMBtu (million British thermal units) in 2014. Despite this price volatility, and the fact that Arizona imports all its natural gas, TEP is betting the farm that natural gas prices will remain stable for the next 15 to 30 years.

TEP’s Latest Plan To Quash Distributed Solar Approved by the Arizona Corporation Commission

TEP is even worse when it comes to its plans around distributed solar energy that it does not own. TEP’s most recent plan to quash distributed solar PV was recently approved by the Arizona Corporation Commission (ACC), making it more likely that even the small amount of solar TEP plans to add will be utility-scale, rather than distributed.

The recently-approved rate plan includes monthly fees for solar customers of $2.05/month for a second meter to measure solar output, with commercial customers paying an additional $0.35/month. (Existing customers are exempt.) While this fee is modest, when coupled with more drastic changes such as ending retail-rate net metering, the effect on customer-sited solar could be severe.

In December last year, Arizona regulators voted to eliminate retail-rate net metering after a three-year value-of-solar proceeding. Regulators also voted to eliminate the netting or ‘banking’ of solar credits, so that excess solar generation cannot be ‘rolled over’ from month to month, like cell phone minutes. TEP has proposed that the amount paid for customer-sited solar generation fed back into the grid — called the ‘solar export’ rate — should be less than the retail rate, at 9.7 cents/kWh, which is nearly 2 cents/kWh lower than the current 11.5 cents/kWh paid for net metered solar.

Solar advocates believe this will cut the value of rooftop solar by 30%, even though regulators said they didn’t want solar compensation rates to fall any more than 10% in a given year. TEP’s proposed new charges for new solar customers could also add $25 to $30 per month, adding $3.50 per installed kW. The average customer in TEP territory has ~7 kW of solar, which would add $24.50/month. The final determination will be made by the ACC in a rate case.

It’s hard to understand why TEP plans to triple its gas burn by 2032, only minimally increase solar, and push policies that hammer rooftop solar. TEP refuses to recognize that methane contributes greatly to climate change, since its warming effect is 86 times that of CO2 over 20 years. Natural gas, rather than being a “bridge to renewables,” is actually preventing TEP from reaching its solar potential.

TEP should be a leader in innovation and local, distributed generation, rather than changing the rules to slow down rooftop solar.