Duke Energy seeks higher rates, profits in NC despite soaring disconnections

Duke Energy has asked North Carolina regulators to approve major rate hikes for both of its North Carolina utilities while also increasing the “return on equity” that the utilities may earn. Return on equity (ROE) is the profit that the utilities are allowed to earn on the equity-financed share of their capital investments; it drives utility profitability.

In November, the Charlotte-based company, which earned $4.4 billion in net profits last year, filed a request with the state Utilities Commission to take an additional $1.7 billion in revenue over two years: $1 billion from its Duke Energy Carolinas customers, a 15% increase over current levels, and $729 million from its Duke Energy Progress customers, a 15.1% jump. The new rates would take effect in 2027.

For residential customers, the increases would be substantial. If the North Carolina Utilities Commission approves the request, monthly electric bills for typical Duke Energy Carolinas residential customers using 1,000 kilowatt-hours would climb by $17.22, from $144.98 to $162.20, followed by another $6.34 increase the following year to $168.54. Monthly bills for typical Duke Energy Progress residential customers using that same amount of electricity would increase $23.11, from $163.84 to $186.95, and an additional $6.59 jump a year later to $193.54. Commercial and industrial customers would see smaller increases, ranging from 3.4 to 9.2%.

The proposed rate hikes for Duke’s North Carolina customers come amid a growing national affordability crisis driven in part by high utility bills. Between January 2025 and August 2025, residential electricity prices jumped by 10.5% – one of the fastest increases in a decade, according to government data analyzed by the National Energy Assistance Directors Association (NEADA). Between August 2024 and August 2025, average residential electricity prices rose 6.1%, more than double the rate of inflation.

NEADA attributes this rapid rise in electricity prices to high interest rates driving up the cost of financing new power plants and transmission projects, reduced federal clean energy incentives under the Trump-Vance administration, aging grid infrastructure requiring investments, and rising gas prices driving up generation costs. Duke Energy has been investing heavily in gas-burning generation facilities in North Carolina, and under the state’s current regulatory system the cost of fuel is passed directly to customers.

Some state leaders are pushing back. Attorney General Jeff Jackson, a Democrat, announced that his office will intervene to fight the proposed rate hikes. Democratic Gov. Josh Stein is also opposing them. The matter will ultimately be decided by the state’s five-member utilities commission, three of whom were appointed by Republican state officials.

“Duke Energy’s proposed rate hike is simply too high and comes as the company is also retreating on more affordable clean energy,” Stein said in a statement. “At a time when families are struggling to make ends meet, we should be doing everything we can to make life more affordable, not less.”

Industrial customers have raised procedural objections as well. After Duke Energy announced its North Carolina rate hike request, a group of industries asked the utilities commission to deem the application incomplete because it covers only two years rather than the three specified under the state law authorizing multi-year ratemaking. The company told NC Newsline that it’s seeking rate hikes for only two years to accommodate its ongoing plan to merge its utilities in the Carolinas.

Duke seeks to raise investor profits

Duke Energy is also seeking to boost profits for its investors. The company is asking the state Utilities Commission to allow a 10.95% return on equity (ROE) for both utilities, while retaining their current capital structure of 53% equity. The utilities finance the remainder with debt, which charges interest but at much lower rates than for equity.

ROE is one of the most consequential numbers in utility regulation. It determines how much profit a company is allowed to earn on capital investments financed with shareholder equity. Higher approved returns translate directly into higher customer bills and higher investor profits.

Duke’s current approved ROE is 10.1% for DEC-NC and 9.8% for DEP-NC per the last rate case, decided in 2023, both above the national average of 9.75% for the 12 months preceding March 2025. The new request would push those returns even higher, increasing the flow of customer dollars to investors.

There’s intensifying concern among consumer advocates that approved ROEs for the industry are already unreasonably high. This came up during recent proceedings for DEP rate hikes in South Carolina and was the focus of testimony delivered to that state’s Public Service Commission in September by Albert Lin, an economic and financial consultant for the OG Finance Lab.

Lin argued that Duke Energy Progress’s ROE should be reduced, not increased, to reflect long-term trends in capital markets. He noted that higher approved ROEs result in higher bills for customers and should be granted only if a utility’s risk has increased or market conditions have changed, leading to a higher cost of capital. But that’s not why ROEs are rising across the industry, he testified. Instead, they’re rising because utilities draw on a small subset of financial firms that provide ROE expert analysis in rate cases, and they invariably make the case for higher returns — even though heavily regulated investor-owned utilities are a relatively low-risk investment since they operate as monopolies with no competition.

These few ROE expert firms “consistently recommend substantially higher ROEs for their clients than dozens of other financial institutions analyzing utilities’ cost of capital,” Lin testified. He pointed out that the three biggest shareholders in Duke Energy — Vanguard Fiduciary Trust, BlackRock Advisors, and State Street Global Advisors — have market return expectations for far riskier equities at rates well below DEP-SC’s current approved ROE.

“In short, when utility expert witness firms regularly present recommendations in which the proposed ROE is higher than the highest rates estimated by objective, reputable firms working in the broader financial markets, the utility-sponsored results should be examined carefully with a heavy dose of skepticism,” Lin said.

Earlier this year, the anti-monopoly American Economic Liberties Project reported that the stock market values the excess profits utilities make due to excessively high ROE at approximately $1 trillion. This represents a massive transfer of wealth from the captive customers of monopoly utilities to their investors.

“The solution is simple: IOU rates of return should equal their true, market-based cost of capital, in accordance with the century-old legal standard for setting utility rates,” said report author Mark Ellis, a former executive with the San Diego-based gas utility company Sempra. “This is not just about lowering utility bills — it’s about restoring trust and accountability to a system that hundreds of millions of Americans rely on.”

Other researchers have similarly found that utility commissions are approving ROEs that are systematically higher than necessary to attract capital.

Profit burden hidden in customer bills

The ROE levels approved by regulators have a direct impact on customers’ bills and a utility’s profits.

However, ROE isn’t synonymous with how much total profit a utility company earns in a given year; ROE is the lever that sets profits in regulated utility rates. Regulators decide how much equity the utility can invest in its rate base (the portion of assets like power plants that customers are paying for), then apply the allowed ROE to that equity portion.

The profit is not a one-time charge; it keeps accruing after the utility has finished investing in the asset. As long as the asset stays in rate base, customers keep paying a return on the remaining undepreciated balance every year. Depreciation gradually reduces what’s left in rate base, but utilities often add new projects faster than old ones roll off, so the “base” being charged keeps growing. Even with the same ROE percentage, profit dollars can keep stacking up year after year because the utility is continuously earning ROE on a large, constantly refreshed pool of assets.

Duke’s utilities have extracted high overall profits from its North Carolina customers in recent years.

A simple way to measure the profit that investors take out of a customer’s electric bill is to add together the net income that the utility earned from retail operations to its income taxes, which are a function of profit, and then divide by retail revenues. By that formula, corporate profit (plus taxes on profit) accounted for 28.5% of a DEC-NC’s customer bill last year and 26.4% of a DEP-NC customer’s bill. Here are the bill profit percentages going back to 2020:

Rate hike proposal drops as disconnections soar

Duke Energy’s request for higher rates and profits comes as more North Carolina households are struggling to afford their utility bills. DEC and DEP’s disconnection rates – shutoffs per 1,000 customers – have risen sharply over past year.

Unlike many states, North Carolina does not completely prohibit disconnections in the winter or summer. However, it disallows utilities from cutting service between Nov. 1 and March 31 to households that include someone who’s disabled, age 65 or older, or unable to pay under an installment plan, and certified by a local social services agency as eligible for help from an energy assistance program, according to the state Department of Justice.

The data show that Duke Energy’s disconnection rates plunged in the wake of Hurricane Helene in September 2024 as affected residents lost income and became eligible for winter protections. But as soon as the winter protection period ended, the disconnection rate soared past what it had been before the disaster.

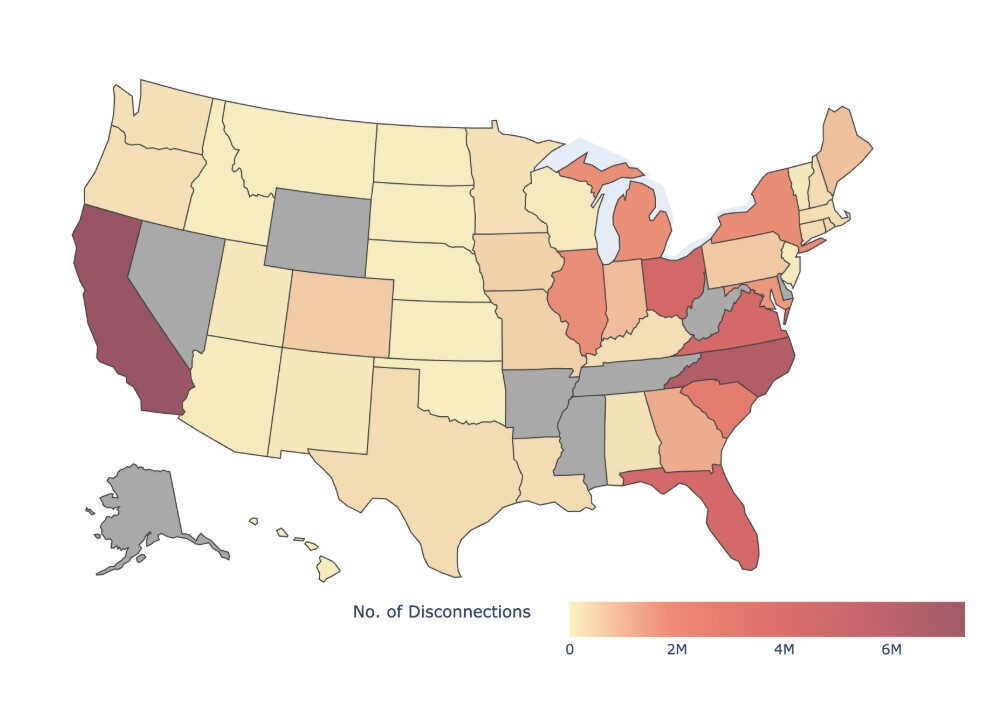

Between 2019 and 2024, North Carolina had the second-highest number of utility disconnections among the 42 states that report this data, surpassed only by California, according to the Energy Justice Lab’s Utilities Disconnection Dashboard, compiled by Sanya Carley and David Konisky. In that period, North Carolina utilities made a total of 6,756,140 disconnections. Duke Energy Carolinas made the most, followed by Duke Energy Progress.

Multiple studies have tied electricity shutoffs and energy insecurity more broadly to respiratory illness, cardiovascular disease, mental health problems such as depression and anxiety, and greater difficulty managing chronic conditions like diabetes.

Rate hike request coincides with costly generation plan

Duke’s rate hike request coincides with its push for an expensive new integrated resource plan, the long-term blueprint for meeting electricity demand and carbon reduction goals. The plan is subject to approval by the state Utilities Commission, with hearings to begin next year.

The company’s proposed plan would increase its reliance on methane gas, which has shown significant price volatility in recent years. The plan also aims to build a costly nuclear reactor in each of the Carolinas, even though the most recently completed U.S. reactor construction project, at Georgia Power’s Plant Vogtle, took twice the initially estimated time and money to complete.

In addition, Duke Energy wants to extend for at least 15 years its burning of coal, the cost of which increased by 20% from 2018 to 2024, according to data from the U.S. Energy Information Administration. To that end, the company has been lobbying to lift federal limits on greenhouse gas pollution.