Dominion Energy’s new carbon reduction goal will mean slowdown in emissions reduction pace

A new carbon reduction goal from Dominion Energy shows that the utility is planning on slowing down its rate of decarbonization significantly between now and 2030, compared to its recent track record.

The Virginia-based energy company told investors that it would reduce its carbon footprint by 80% by 2050, and 55% by 2030 compared to its 2005 emissions during a special session for “ESG,” or “Environment, Social, Governance” investors on March 25.

The announcement is part of a growing trend from utilities who want to prove to investors that they are adequately decarbonizing their electricity generation in response to climate change.

Institutional investors representing $1.8 trillion in assets, including the New York City and State Comptrollers and the California Public Employees’ Retirement System, announced in February that they expect to see U.S. utilities decarbonize completely by 2050, in accordance with the goals of the Paris Agreement. The investors called decarbonization a “financial necessity.”

If those investors hold Dominion shares, they may be disappointed to learn that the company’s new goal will result in a slower pace of decarbonization between 2017 and 2030 than the previous period from 2005 to 2017.

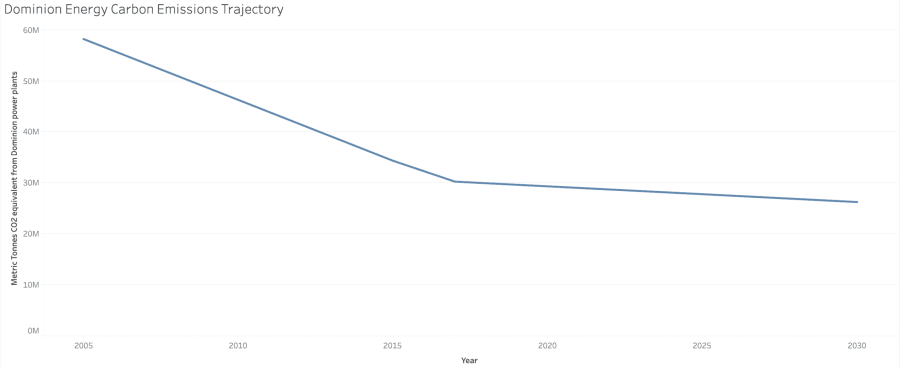

The 2005 baseline makes it difficult to discern the slowdown at first blush, but Dominion’s own emissions data reveals the trend. The slowdown is visible in the flattening of the line in the below graph that happens starting in 2017, the most recent year for which Dominion reported emissions data.

According to Dominion’s data, the company reduced its carbon emissions at an average rate of 4% per year from 2005 to 2017, mostly by retiring coal plants in the later years of that period. That reduction rate plummets to 1% per year between now and 2030 under Dominion’s new goal.

The company’s reduction pace would increase again between 2030 and 2050 in order to meet its later goal, though only to about 2.8%, still lower than its pace from 2005 to 2017.

Dominion was not explicit about whether its goal applies to only its owned power plants, or also to emissions derived from the power that it purchases and then sells to its customers, but the data included in the investor presentation indicates that it applies to owned power plants. The slowdown would be only slightly less pronounced if Dominion were to apply its new goal to emissions associated with its power purchases as well.

Gas investments likely at the root of Dominion’s decarbonization slowdown

Dominion’s slowdown is counterintuitive: renewable energy and energy efficiency technologies are far cheaper now than they were in the 2005 – 2017 period, with solar energy highly competitive with fossil fuels in Dominion’s service territory. The last ten years of climate science have shown that rapid emissions reductions are now more urgent than ever.

Any explanation for the slowdown is likely to revolve around Dominion’s current building spree of gas-fired power plants. Other utilities like NIPSCO in Indiana and Consumers Energy in Michigan have announced that as they retire their aging coal plants, they intend to skip gas completely, instead opting for lower-cost renewable energy and battery storage.

In its presentation to ESG investors, Dominion said it was “Transitioning to a clean energy future with new emissions reduction targets,” but unlike NIPSCO or Consumers Energy, the company is still investing heavily in gas.

Dominion proposed to its Virginia regulators that it build between eight and 13 new gas combustion turbines in its long-term energy plan in 2018. The regulators, in an unprecedented move, rejected that plan on the basis that Dominion was inflating how much new generation it would need to build to meet demand and did not sufficiently account for energy efficiency. The company came back with a new, more modest plan last month, though it still proposed building between four and seven gas plants.

The company has a deeply vested interest in building new gas plants: the logic it has used to justify its Atlantic Coast Pipeline, a massive interstate gas pipeline on which Dominion expects to spend over $7 billion, is that the pipeline is needed to provide gas to those new power plants.

Dominion did not mention the ACP anywhere in its presentation to the ESG investors.