FirstEnergy Shareholders Vote Against Proposal for Disclosure of Lobbying Activities and Membership Payments

Yesterday, shareholders at FirstEnergy’s annual meeting in Akron, Ohio, rejected a proposed resolution asking for the company to disclose both direct and indirect lobbying and grassroots lobbying communications, as well as disclosure of FirstEnergy’s membership in and payments to tax-exempt organizations. Although rejected, the proposal received 28 percent of the votes cast – an increase from 19 percent last year.

New York City-based Nathan Cummings Foundation submitted the proposal. In a May 6 letter to shareowners, the foundation provided reasoning for why investors should approve their proposal:

We believe that inadequate disclosure by FirstEnergy, combined with its active lobbying against the Clean Power Plan, present significant risks to investors. Instead of diversifying away from coal, FirstEnergy appears to be investing resources to subvert public policies that address climate change and pursuing business strategies that are subject to reversals by regulators.

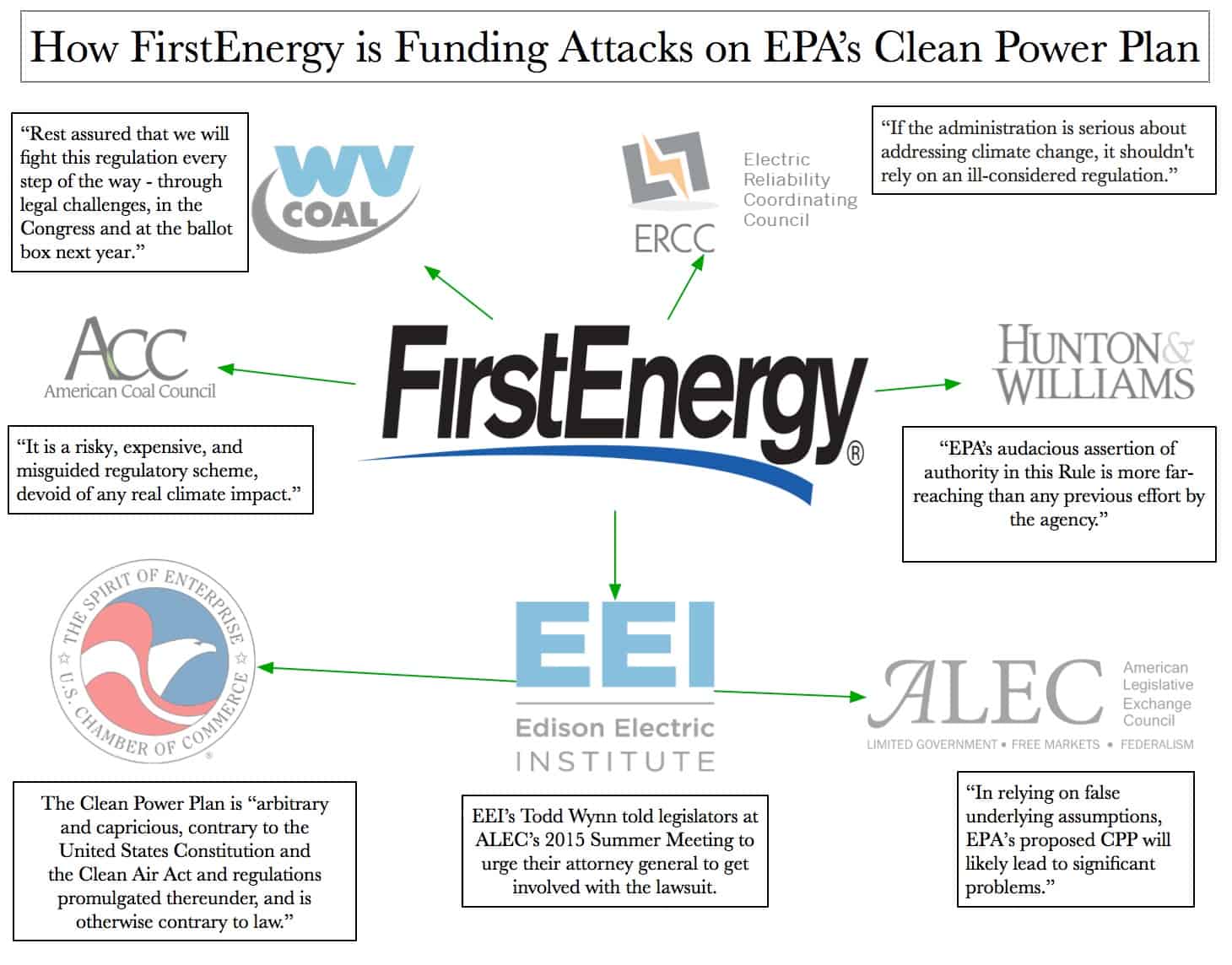

Indeed. The infographic below highlights how FirstEnergy is providing resources to many different entities involved in the attacks and lawsuits against the EPA’s Clean Power Plan.

The foundation specifically highlighted the fact that FirstEnergy is a member of the Utility Air Regulatory Group (UARG), which is litigating against the CPP, and that the utility has hired lobbyists at Hunton & Williams – the firm in turn is counsel to UARG.

FirstEnergy told shareholders to reject the proposal. The utility said data is available showing political contributions and lobbying expenses. Yet, as John Funk of The Plain Dealer noted earlier this week: “If such a rule were already part of its corporate bylaws, FirstEnergy would have to report what it has spent during the last couple of years lobbying Ohio lawmakers to amend or throw out state laws requiring power companies to sell renewable energy and rules requiring the companies to help customers use less electricity by installing more efficient technologies. And it would have to report the cost of its grass roots campaign, ‘The Switch is On’ in the last several months aimed at convincing the public it embraces green power generation while it convinced state regulators the importance of having customers subsidize two old power plants.”

Furthermore, the Nathan Cummings Foundation stated:

We are concerned about the impact of this strategy on the Company’s business because of the risk that regulation will decrease demand for uncompetitive power plants, as evidenced by last week’s federal ruling on FirstEnergy generation plants in Ohio. FirstEnergy shares dropped ten percent the following day.”

The foundation is referring to the Federal Energy Regulatory Commission (FERC) recent order that blocked FirstEnergy and American Electric Power’s approved Power Purchase Agreements. FERC agreed with the complainants that the affected customers are essentially captive. However, FirstEnergy has since submitted a new plan to Ohio regulators that would eliminate the power purchase agreements between FirstEnergy’s regulated local power delivery companies and its unregulated FirstEnergy Solutions, which owns the power plants, while still keeping the new charges the purchase agreements would have forced customers to pay.

Earlier this month, Duke Energy shareholders rejected a similar proposal asking for disclosure of contributions and expenditures. That proposal specifically noted the American Legislative Exchange Council (ALEC) and Duke Energy’s role within the organization. When the EPA was preparing to release its proposed rule regulating carbon dioxide emissions, ALEC hosted Peter Glaser, an attorney for Troutman Sanders, to speak at its winter conference. At the ALEC conference, Glaser called for “guerrilla warfare” against the Clean Power Plan.

The rejections of these proposals come shortly after a network of more than 270 institutional investors with over $23 trillion in assets said they are concerned that electric utility companies are not preparing for the risks associated with climate change. According to the group of investors, the failure to prepare for climate change will negatively impact utilities’ holdings, portfolios, and assets.