Maine bill proposes cap on rate case charges to utility customers

A new Maine bill, LD 1949, would place limits on the costs utilities can charge their customers for the legal and consulting fees they pay to advocate for rate increases. The bill, introduced by Senator Anne Carney, recently advanced out of the Legislature’s Committee on Energy, Utilities, and Technology and now awaits a floor vote in the House and Senate.

Maine’s utilities, like those around the country, charged customers millions in legal and consulting fees in its last rate cases to argue for rate increases in proceedings before their regulator, the Maine Public Utilities Commission (MPUC). LD 1949 caps the amount utilities can recover in contested rate cases by tying it to a benchmark: no more than 150% of the monthly costs incurred by Maine’s Office of the Public Advocate (OPA) during the same proceeding. The OPA represents Maine utility customers and typically advocates for lower rates.

LD 1949 also prohibits recovery of board of directors and investor relations expenses. The legislation also adds protections to prevent utilities from disconnecting households with medically vulnerable individuals who are behind on their bills.

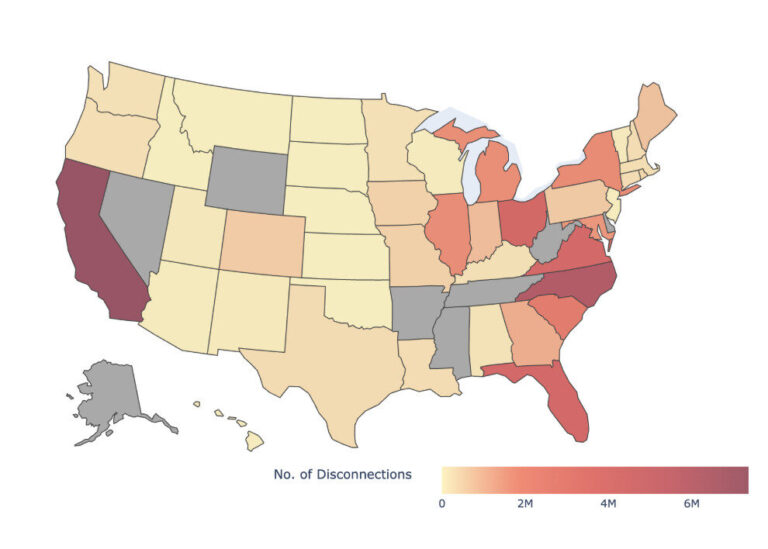

LD 1949 builds on legislation passed by the Maine legislature in 2023 which barred utilities from charging customers for lobbying, public relations, charitable contributions, and membership dues to trade and business associations. Colorado and Connecticut also passed similar legislation in 2023. Four other states introduced bills in 2025 – bringing the total to 18 states that have filed legislative proposals to prohibit utilities from ratepayer money for political e expenses, and other expenses that benefit shareholders rather than ratepayers, in recent years. Several of the bills include provisions to restrict the recovery of rate case expenses, which often include consultants and expert witnesses hired by the utility specifically to support rate increases that benefit investors. Connecticut’s legislation prohibits the recovery of all rate case expenses and recently proposed legislation in Massachusetts would be just as expansive. Other states have sought to limit utilities’ rate case expenses: New Jersey’s Board of Public Utilities has a longstanding regulatory precedent to split rate case expenses 50-50 between utility investors and ratepayers.

In its last two rate cases, Central Maine Power reported $2.4 million and $2.2 million, respectively, for rate case expenses. Versant, which distributes power in northern Maine, reported $1.5 million on outside consultants and attorneys in its most recent case.

Consultants charge steep hourly rates

Consultants hired in rate cases often bill at high hourly rates. In its most recent case, Versant disclosed a fee of nearly $700 per hour for an expert from Concentric Advisors, who testified in support of a return on equity (ROE) between 10.3% and 10.8%—well above the 9.35% ultimately approved by the MPUC. Concentric’s fees exceeded $385,000 for Versant and $240,000 for CMP. Brattle Group charged CMP $37,000 for services in its latest case, which included $625 an hour for testimony supporting a 10.2% ROE, also higher than the final 9.35% approved by regulators.

A growing number of studies have raised concerns that authorized utility ROEs may exceed what is necessary to attract investment, leading to unnecessary costs for ratepayers. Lawmakers in several states have responded by introducing legislation to restrict excessive ROE.

Brattle and Concentric Advisors are frequently hired by investor-owned utilities to provide expert analysis and testimony in support of rate proposals and policies aligned with shareholder interests. In 2021, Concentric Advisors authored a report funded by Mainers for Affordable Energy, a campaign committee backed by CMP’s parent company Avangrid, opposing a statewide ballot initiative to create a publicly-owned statewide utility. In April 2025, Concentric prepared a similar report paid for Duke Energy Florida challenging the City of Clearwater’s exploration of municipalization.

High outside counsel expenses

Versant reported over $1 million in legal fees paid to the Portland-based law firm Bernstein Shur, with several attorneys charging more than $500 per hour. CMP also retained outside counsel, reporting just under $175,000 in legal fees paid to another Portland firm, Pierce Atwood. CMP did not disclose hourly rates for its attorneys.

Connecticut ratepayers are seeing savings

Since Connecticut’s utility cost-recovery law took effect in 2023, investor-owned utilities have reported over $9.7 million of spending in categories that are no longer recoverable from ratepayers. Utilities in Connecticut owned by Avangrid, the parent company of Central Maine Power, disclosed more than $923,000 of board and investor relations expenses—including travel and meals—and over $1.5 million in rate case expenses.