Utility Earnings Calls Further Shows the Conflict of Nuclear and Coal Versus Natural Gas

Trump administration officials have been attempting to position renewable energy as the driver of coal and nuclear retirements by saying there is now a reliability issue with the electric grid. Rick Perry asked the Department of Energy to review the “regulatory burdens placed by the previous administration on baseload generators” and Scott Pruitt said coal losses make the grid vulnerable. A long list of studies shows that renewables do not pose a reliability problem at all (see here for list), and a leaked draft of the DOE study found that as well.

The real culprit that has made some coal and nuclear plants uneconomical is the price of natural gas, which can be clearly seen by diving into utility earnings calls (the leaked DOE draft study concluded this point as well).

FirstEnergy CEO Charles Jones responded to a question about the DOE study on a call with investors and if the final study could influence FERC to further help coal and nuclear generation stay afloat. Jones said:

“I’ve been telling everybody, I think our country is heading for a disaster, okay? The disaster could take a number of different forms. One disaster could be a national security type of issue…

None of that matters if the gas quits flowing, and we are reducing the amount of fuel-secure base load generation we have to keep the lights on in the event of that type of an event.

Second, I think we could be heading for an economic disaster. We are getting to where we are relying too much on one fuel source for the generation of electricity, and I think fuel diversity is critical to keeping economic stability.”

Jones then brought up how public officials in Illinois and New York worked in their respective states to create policies to subsidize Exelon ($235 million a year from Illinois ratepayers and $500 million a year from New York ratepayers). But Jones said that it is the federal government’s responsibility to fix the issue for the other coal and nuclear power plants that are no longer economical. Yet, FirstEnergy has been trying to get Ohio lawmakers to subsidize its plants. In a Q1 earnings call, Jones also said, if “nothing happens out of the DOE study” to financially help their coal and nuclear plants and Ohio lawmakers don’t act, then its subsidiary, FirstEnergy Solutions could be forced to file for bankruptcy.

On Exelon’s earnings call, Joseph Dominguez, executive vice president for governmental and regulatory affairs, said company lobbyists have talked with DOE and are confident the final study will recognize the importance of nuclear power plants. Exelon also expects FERC not to interfere with the credits it is receiving from Illinois and New York ratepayers to benefit their plants. Additionally, Dominguez brought up resiliency and gas:

“We hope the Department of Energy puts a spotlight on the issue of resiliency. Let me spend a moment talking about that. We have talked about reliability in the form of being able to run the system even in the event that we have major electrical components that fail. But as increasingly the system depends on both intermittent generation and natural gas-fired generation that don’t have the ability to secure fuel for long-term operations, we need to make sure that our customers get electricity even in the event of a long-term disruption of the natural gas pipeline system. That’s something that currently is not being modeled and needs to be modeled.”

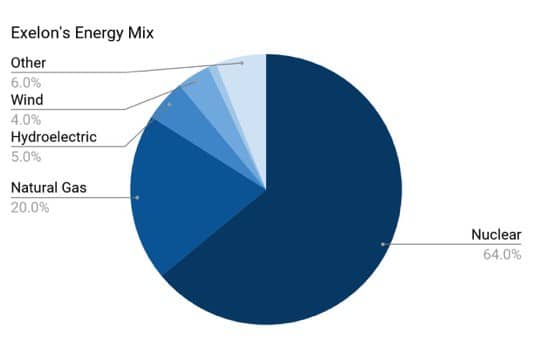

Exelon’s energy mix is predominantly nuclear:

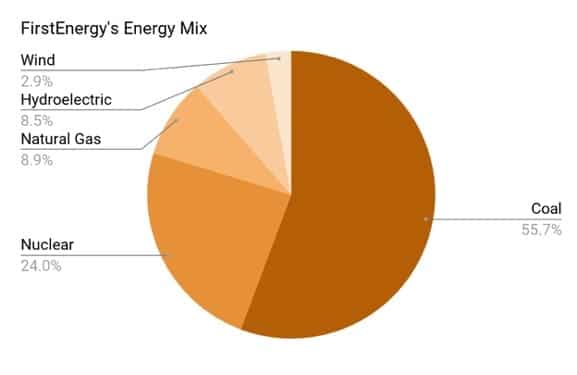

FirstEnergy’s energy mix is mostly coal and nuclear:

Not only did the executives criticize gas plants but they also picked-up the Trump administration vulnerability talking point and claimed to investors that an increase use of gas can lead to disasters. This is despite the draft DOE study saying the grid is as reliable than ever, and renewables can continue to be connected to the grid without harming reliability.

But it makes sense that these two utility companies are telling analysts and government officials that the surge in natural gas power generation threatens the grid; they are hoping that the DOE releases some type of recommendation that will lead to financial support that benefits their coal and nuclear assets, and have little to lose by scapegoating natural gas. However, not all utilities agree.

During NextEra Energy’s earnings call, the utility was asked what expectations it has for the DOE study. CEO Jim Robo said:

“I think it’s honestly too soon to speculate on what’s going to be in there. I think the – and Joe Kelliher actually testified in front of Congress last week around this whole issue of are there reliability issues as a result of the changes that have happened in terms of low natural gas prices and more renewables on the grid. And I think the data is pretty clear. There’s no reliability issues on the grid. And, there is plenty of capacity there, and the grid is very resilient.

I think you saw, actually last week Andy Ott from PJM saying renewables were very helpful during the polar vortex and that they’re a part of the reliability solution, not only part of the problem.

And so I feel very confident that the facts are that the grid is extraordinarily reliable as it is right now in America, and that renewables and storage are only going to make it – particularly combined with storage as storage prices come down, are only going to make it more reliable going forward.”

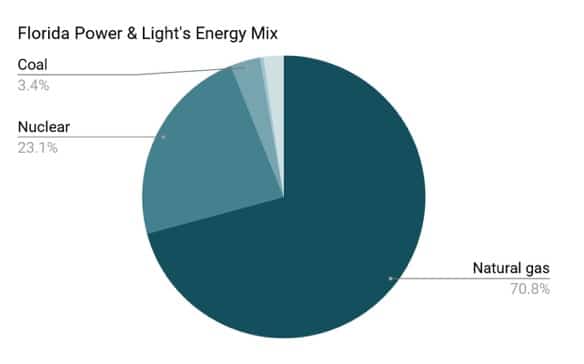

NextEra Energy’s energy mix is significantly different from FirstEnergy’s and Exelon’s portfolios. Its subsidiary NextEra Energy Resources is the largest generator of renewables from the wind and the sun in the world, and its other subsidiary, Florida Power & Light’s mix is mostly natural gas:

The positioning of gas against nuclear and coal has also been playing out with the trade associations.

In July, Bloomberg reporters Jennifer Dlouhy and Ari Natter reported how several industry groups have been advocating for their interests while the DOE studies the grid.

Paul Bailey, the president of the American Coalition for Clean Coal Electricity (ACCCE), told Bloomberg, “Coal is more resilient than natural gas. We think coal-fired power plants are necessary to have a resilient electricity grid.” Companies in ACCCE include Peabody Energy, Murray Energy, Southern Company, and American Electric Power.

A National Mining Association (NMA) spokesperson, referring to the polar vortex, said, “Had it not been for coal power plants, the gas-supported generation would not have satisfied the demand that peaked that winter.” Companies in NMA include Peabody Energy, Murray Energy, and Cloud Peak.

Meanwhile, Marty Durbin, executive vice president at the American Petroleum Institute, which released a report that advocated their position that natural gas make the grid reliable, said to Bloomberg, “We’re not taking shots at coal and nuclear,” but it’s important to “tell the whole story.” “We want to make sure if they go down this road, they understand” that reliability is about more than the fuel itself. Durbin also told Axios, “We certainly want to make sure there isn’t some inadvertent message coming out of this study that maybe we should be worried about having too much natural gas.” API members include oil and gas producers and suppliers such as ExxonMobil and Enbridge.

The DOE study still has yet to be released, so time will tell whether the Trump administration sides with the nuclear, coal or gas generators or somehow manages to avoid the question.

Earnings call transcripts are from Seeking Alpha. Photo from Wikimedia Commons