While NV Energy decries rooftop solar “cost shift”, it is over-profiting from its customers by tens of millions

Nevada’s monopoly electric utility, NV Energy, has been embroiled in a bruising campaign for over two years to make it more expensive for its customers to install solar power. The latest skirmish is over a contentious proposal by the monopoly to raise charges on all of its customers in ways that would disadvantage rooftop solar power, a plan which state regulators rejected today.

Throughout the long-simmering conflict between NV Energy and rooftop solar advocates, the utility has relied on one core argument: that rooftop solar customers are not paying their fair share for the electric grid, and thus are making electricity more expensive for their peers who don’t have the solar panels.

NV Energy’s claims are dubious on their own merits: multiple studies have shown that solar customers actually provide more benefits than costs to all electric customers.

But the utility has another big problem in choosing that argument: NV Energy’s own documents reveal that it has been profiting from its customers by tens of millions of dollars per year more than regulators allowed since 2012.

In total, the utility has “overearned” in Nevada by $180 million from 2012 to 2016 beyond the profit it was supposed to be allowed to earn: that comes out to about $144 that each NV Energy customer has overpaid to the utility over that period.

Before getting into NV Energy’s history of overearning, here’s some context on its efforts to slow down solar in the Silver State:

NV Energy won a victory in late 2015, when it petitioned the Public Utilities Commission of Nevada (PUCN) to reduce the payments that NV Energy had to make to customers when buying the excess solar power they produced, part of a program known as net metering.

But public sentiment turned dramatically against NV Energy for its hostility toward solar, and Nevada politicians saw the writing on the wall. In 2016, Republican Gov. Brian Sandoval appointed commissioners who disagreed with the 2015 decision once in office. And then in June of this year, the monopoly lost the biggest battle yet, when Sandoval signed bipartisan legislation which mostly restored net metering.

NV Energy continues to falsely argue that rooftop solar rips off customers

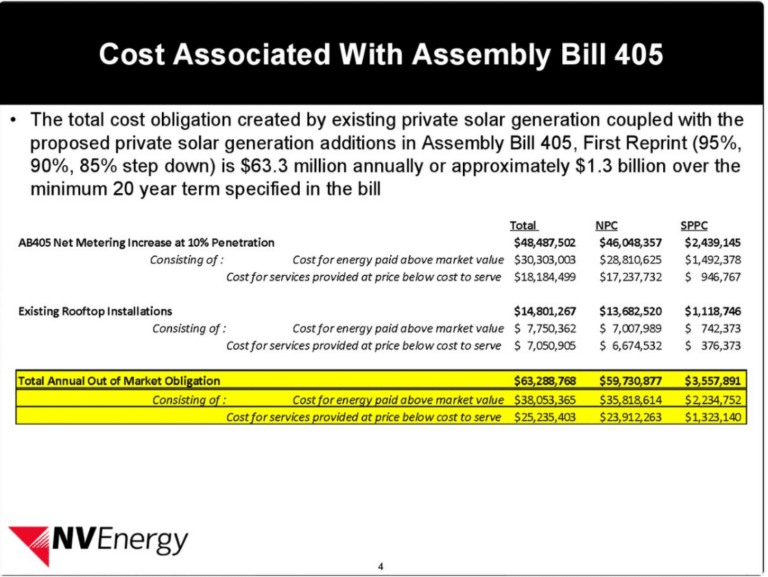

During the net metering debate in the legislature this past June, NV Energy’s lobbyists showed legislators a chart which claimed that AB 405, the legislation to restore net metering, would raise rates by a total of $63 million a year. (The company later downgraded that number to $42.3 million after some changes to the bill, but it continues to make the same basic argument to the PUCN.)

The utility’s claims are not supported by countless studies which have looked at the issue. NV Energy rests its math on the notorious argument, peddled by many investor-owned utilities, that solar customers are “shifting costs” to non-solar customers. But the Nevada Public Utilities Commission found that there no unreasonable cost shift is occurring. When the PUC restored net metering rates to Northern Nevada customers, the commissioners found that “the average Nevada ratepayer will see a decrease of $0.01 per month on monthly utility bills.”

NV Energy has over-earned by millions of dollars

Like all regulated monopoly utilities, NV Energy’s business model revolves around a basic deal that it has with the stat: NV Energy gets a monopoly; in exchange, to prevent the utility from using that monopoly to gouge customers, the state gets to determine how much the utility is allowed to profit every year via a number called the “authorized rate of return.”

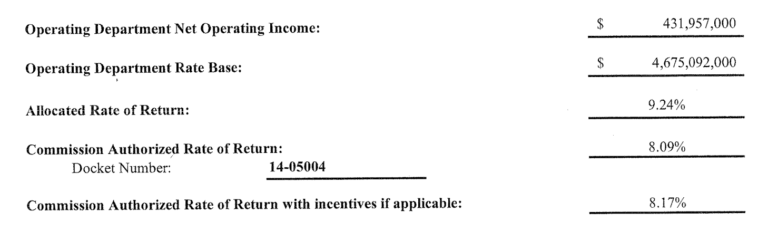

In 2015, the authorized rate of return was 8.09% – which meant that for every dollar NV Energy invested into Nevada’s grid, the PUC allowed it to take about 8 cents of profit.

But a document that NV Energy filed with the PUC on May 12 of 2017 reveals that in 2016, it actually took a 9.24% return – or over 9 cents on the dollar. That penny might not sound like much of a difference, but in aggregate it means that NV Energy over-earned by $50 million last year.

That’s more than the $42 million that the utility (inaccurately) claims the net metering law will cost ratepayers.

To be clear, it’s not illegal or even necessarily rare for utilities to over-earn; ratemaking is forward-looking and involves estimates about how much money the utility will invest. If the utility can cut costs or make other adjustments that saves money, it does not have to pay back those savings to consumers on an annual basis.

But NV Energy’s 2015 over-earning wasn’t an isolated event. A look through similar disclosures shows that the utility over-earned in every year since 2013. If a utility consistently is over-earning, it’s a sign it may be overestimating its costs in rate cases as a way to take more money from captive customers. Some customers, such as MGM Resorts, have taken issue with the habit.

| 2012 | 2013 | 2014 | 2015 | 2016 | |

| Adjusted Income | $451,096,000 | $438,194,000 | $450,458,000 | $431,145,000 | $431,957,000 |

| Net Rate Base | $5,178,601,000 | $5,163,622,000 | $5,023,503,000 | $4,718,335,000 | $4,675,092,000 |

| Allowed Return | 8.17% | 8.17% | 8.17% | 8.17% | 8.17% |

| Actual Return | 8.71% | 8.49% | 8.97% | 9.14% | 9.24% |

| Excess Return | 0.54% | 0.32% | 0.80% | 0.97% | 1.07% |

| Excess Earnings | $27,964,445.40 | $16,523,590.40 | $40,188,024.00 | $45,767,849.50 | $50,023,484.40 |

Above data from NV Energy’s own filings from 2016, 2015, 2014 and 2013.

NV Energy’s total over-earnings sums to $180 million over the five-year period, or an average of $144 for each of the utility’s 1.25 million customers.

NV Energy’s latest effort would raise fixed charges, hurting low-income customers

In August, NV Energy petitioned the PUCN to change its rate structure in ways that would make solar more expensive by increasing fixed charges on all of its customers’ monthly bills. Those fixed fee increases would make solar more expensive, but also have the knock-on effect of harming low-income customers who tend to buy less electricity than wealthier ones.

As the AARP has said, fixed charge increases “disproportionately burden those who are living on low or fixed incomes and struggling to pay for food, rent, medicine and utility bills.”

The NAACP called efforts to increase fixed charges “part of an insidious trend in shifting the economic and health burden of the fossil fuel economy onto vulnerable populations.”

NV Energy’s push for the regressive charges is ironic, given the utility has justified its attack on net metering as a defense of the poor. A spokesperson for an NV Energy-backed front group said last August that “If the big rooftop solar companies get what they want, it would really hurt low-income families and punish those Nevadans who do not have solar panels.

The PUCN issued a draft decision last night, which it is expected to finalize today, batting away NV Energy’s latest effort for these charges, saying it must apply for them in an upcoming general rate case. There’s no indication that NV Energy won’t try to do that.

Between NV Energy’s habit of over-earning on its profits, and its new efforts to raise fixed charges, the utility hardly has a leg to stand on when it makes dubious that rooftop solar is driving people’s bills up. NV Energy seems to be doing that all on its own.