Wall Street and Regulators Choose Solar Over Fossil Fuels

Wall Street Favors Solar As Utilities Face Financial Threat

For the past few decades the electricity sector in the U.S. has faced almost no competition and enjoyed access to cheap credit. This is because utility companies are able use rates charged to customers to recoup capital costs associated with having enough generation, transmission, and distribution capacity. Utilities are also able to increase rates when they experience shortfalls in revenue. Therefore, power providing companies have very low borrowing costs and are considered a very secure investment option, but this view is beginning to diminish.

In May, Barclays, a multinational investment banking and wealth management service company, downgraded the entire electric sector of the U.S. high-grade corporate bond market.

The Barclays credit strategy team states:

Electric utilities… are seen by many investors as a sturdy and defensive subset of the investment grade universe. Over the next few years, however, we believe that a confluence of declining cost trends in distributed solar photovoltaic (PV) power generation and residential-scale power storage is likely to disrupt the status quo…

In the 100+ history of the electric utility industry, there has never before been a truly cost-competitive substitute available for grid power. We believe solar + storage could reconfigure the organization and regulation of the electric power business over the coming decade.

Barclays downgraded the electric sector due to projections that solar energy and storage capacity will become even better investments, and consequently, the business model utility companies have been using for over 100 years is no longer an investment as safe as it once was. The Barclays credit team further states, “We see near-term risks to credit from regulators and utilities falling behind the solar + storage adoption curve and long-term risks from comprehensive re-imagining of the role utilities play in providing electric power.” In other words, the falling price of solar power generation combined with utility companies failure to incorporate the technology into their power-generating portfolio has resulted in Barclays calling for change.

Then in July, Morgan Stanley released a report stating, “Energy storage, when combined with solar power, could disrupt utilities in the U.S. and Europe to the extent customers move to an off-grid approach.” The report was the third released this year emphasizing that the increase in consumer solar paired with battery technology could disrupt the utility industry. What is also significant about the July report by Morgan Stanley is that the firm says it believes in Tesla’s energy storage system being economically viable in parts of the U.S. and Europe.

Morgan Stanley also forecasts that between 2014 and 2020, 57.2 GW of solar will be installed in the U.S. driven by the “highly supportive net metering rules in 43 states.” Deutsche Bank predicted in September 2013 that the solar capacity in the U.S. would total 50 GW by the end of 2016. At the beginning of 2014, there was a total of 12 GW of installed solar in the US. Whether it’s in 2017 or in 2020, an increase to over 50 GW will surely cause disruption for utility companies that do not act.

Minnesota Regulators Choose Solar Over New Natural Gas Plant

In December of 2013, Administrative Law Judge Eric Lipman reviewed a solar project’s bid against natural gas projects to meet a projected shortfall of electricity generation. Taking into account cost savings, fuel consumption, pollutants emitted, market fluctuations for the energy sources, and both short- and long-term demand projections, Lipman said, “the greatest value to Minnesota Xcel’s ratepayers is drawn from selecting Geronimo’s solar energy proposal.”

Three months later, the Minnesota Public Utilities Commission upheld Lipman’s conclusion and determined that solar PV does have economic value and is in the best interest of ratepayers. The Commission ordered Xcel Energy, the state’s largest utility with 1.2 million customers, to purchase $250 million worth of distributed solar with some natural gas back up rather than invest solely in natural gas. Additionally, the regulators concluded that solar PV’s modularity added value, especially when future demand for power is uncertain. Natural gas peakers run so infrequently (4-8% of the hours in a year) that the cost per kWh is relatively high. Solar is predictably available on hot summer days when power is most needed. In addition, the Commission took into account the state’s solar market price, which includes eight separate factors. The largest four factors account for the most value: 25 years of avoided natural gas purchases (the fuel costs); avoided new power plant construction costs; avoided transmission capacity costs; and avoided environmental costs. When the 30% federal Investment Tax Credit is applied along with the social cost of carbon, the Commission found solar not only beat natural gas on life-cycle costs, but will save customers about $3,000 over 25 years.

Minnesota Regulators Determine Solar’s Value

During the same period of time, the Minnesota Department of Commerce submitted the Minnesota Value of Solar Methodology to the Public Utilities Commission. The market-based “value of solar” is a statewide formula for calculating customer-generated power’s value. In March, the Commission voted to approve the methodology, which now allows utility companies the choice to implement the tariff in lieu of the “existing compensation method,” known as net metering. The state became the first in the nation to adopt the federal government’s social cost of carbon figure into the value formula, along with other costs and benefits to all parties involved including avoided infrastructure and fuel costs. The figure created by the Institute For Local Self-Reliance (ILSR) illustrates the calculation solar’s value:

John Farrell at ILSR writes,

The value of solar delivers a transparent, market-based price for solar. It solves problems for utilities and for utility customers around compensation for distributed renewable energy generation. But its ultimate success lies in whether electric utilities can be convinced that accommodation of customer-owned power generation is in their best interest, or whether any concession of their market share is a deadly threat to their economic livelihood.

Georgia Regulators Demand More Solar

In July of 2013, the Georgia Public Service Commission recognized the benefits of solar energy and issued a requirement for the state’s largest electric utility to add 525 MW of new solar in 2015 and 2016. Of that amount, 425 MW would come from utility-scale projects and the remaining 100 MW would come from residential or commercial property owners. The Commission stated that the best strategy to meet future energy needs was to “approach this in a businesslike fashion,” and dismissed arguments that adding solar energy would increase customer bills and reduces reliability.

The recent determinations by commissioners in Minnesota and Georgia are additional signals that solar energy has a tremendous economic value, can be competitive with fossil fuels, and has changed the electricity market.

Solar as a Threat to the Status Quo

Utility companies are resisting this change and are even attacking solar energy despite its proven economic value. In the utility industry’s crosshairs are net metering policies, currently found in 43 states.

Net metering allows customers who have installed solar panels to be credited for any electricity produced that goes back into the power grid and sold to other electricity customers by the utility. Utilities argue that net metering provides an unfair advantage to solar consumers who do not pay to maintain the grid although they still require access to the grid for backup on cloudy days. The industry says that the more people who produce their own electricity through solar, the fewer ratepayers are left to be billed for fixed costs, then the retail rates increases for customers who do not have solar. Therefore, the customers with higher rates will have a greater incentive to generate their own power.

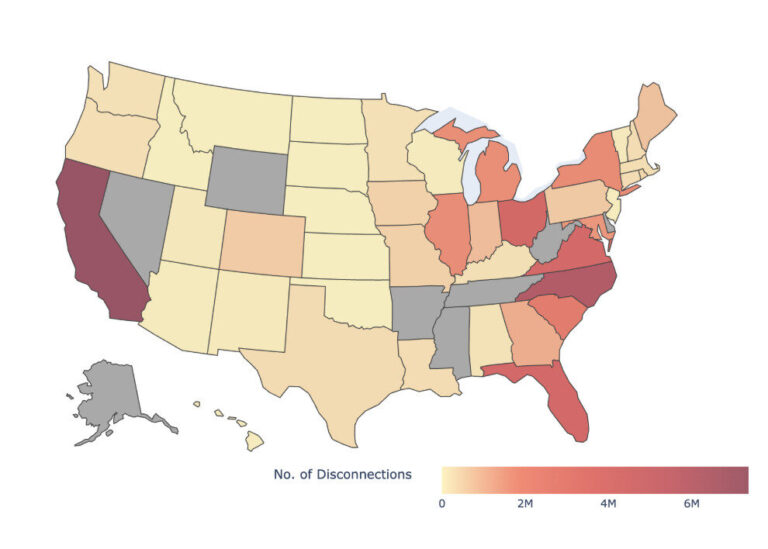

Shayle Kann, Senior Vice President of Research at GTM Research, says that even though distributed generation is concentrated in a few states, the portion of electricity sales distributed generation in California, New Jersey, Massachusetts, New York, Arizona, and Colorado is “hardly disruptive.” Kann explains utilities have historically made their profits from load growth and distributed solar is cutting into load growth, which is why utilities are battling against net metering.

The Edison Electric Institute (EEI), an association that represents investor-owned utility companies, was spending hundreds of thousands of dollars on advertisements and campaigns against net metering. In Arizona, for example, EEI spent $510,000 on a 10-day television advertising campaign against net metering. Their goal was to support Arizona Public Service (APS), the state’s utility, proposed fee of $50-100 a month on rooftop solar owners. APS also spent millions in the endeavor, and both joined with the Koch brother’s American Legislative Exchange Council in the pursuit of the fee. The Arizona Corporation Commission ultimately voted to impose a monthly fee of $5.

Elisabeth Graffy and Steven Kihm in a May 2014 Energy Law Journal article write, “The suggestion that utilities should rely mainly on legal remedies to stave off competition or on regulators to redesign rates or make other tariff changes to avoid stranded costs constitutes a doubling down on convention cost-recovery tactics… Neither regulators nor courts have an absolute obligation to preserve the solvency of utilities.”

Clearly, the economic value of solar is beneficial to customers. Public utility commissions across the country must develop policies that assist in the development and use of clean energy, specifically solar power. And as for the business model utility companies have been using for over 100 years, the time is running out to adapt and embrace the economic value of solar; or, as Graffy and Kihm write, “utilities may be headed in the same direction as streetcar companies.”

Read Part Two: The External Costs of Fossil Fuels; Environmental and Health Value of Solar

Read Part Three: How to Secure the Grid and Save Ratepayers Money

This page is part of EPI’s series, “Value of Solar Versus Fossil Fuels” published in August 2014.